KELLOGG W K FOUNDATION TRUST Reduces Stake in Kellanova Co

On October 30, 2023, KELLOGG W K FOUNDATION TRUST (Trades, Portfolio), a prominent investment firm, reduced its holdings in Kellanova Co (NYSE:K). This article provides an in-depth analysis of the transaction, the firm's investment philosophy, and the financial health of Kellanova Co. We will also compare KELLOGG W K FOUNDATION TRUST (Trades, Portfolio)'s position with other gurus who hold Kellanova Co stock.

Details of the Transaction

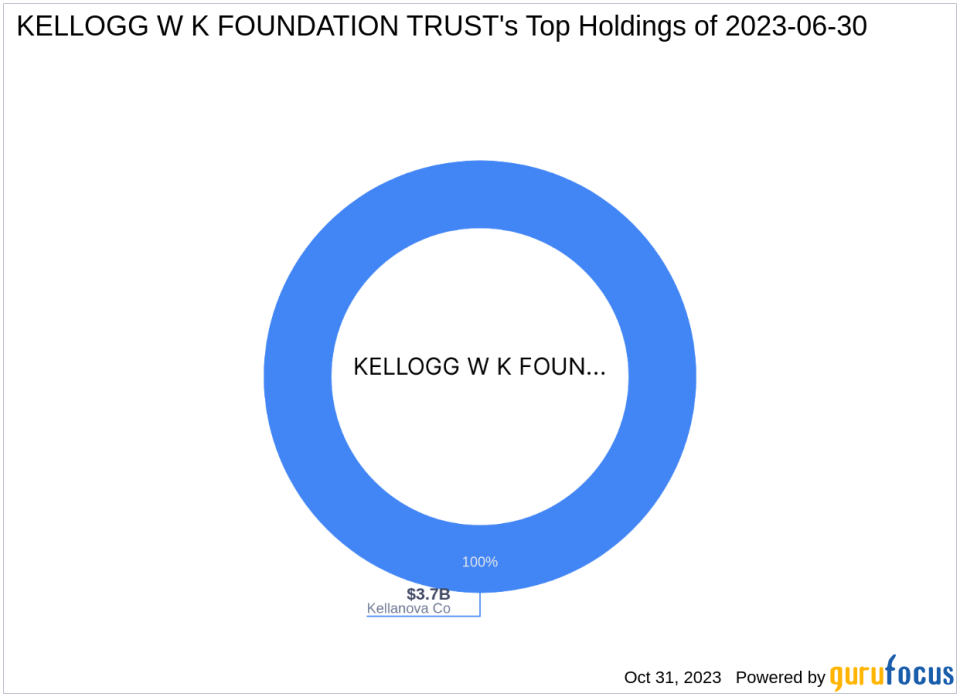

The firm reduced its stake in Kellanova Co by 77,800 shares, representing a -0.14% change in its holdings. The transaction, which took place at a trade price of $49.96 per share, had a -0.11% impact on the firm's portfolio. Following the transaction, KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) holds a total of 53,709,438 shares in Kellanova Co, accounting for 72.82% of its portfolio and 15.69% of Kellanova Co's total shares.

Profile of KELLOGG W K FOUNDATION TRUST (Trades, Portfolio)

KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) is a nonprofit charity organization based in Battle Creek. The foundation provides the majority of funding to the W. K. Kellogg Foundation, which was founded in 1930 by Will Keith Kellogg. The foundation's mission is to support children, families, and communities to create conditions that propel vulnerable children to achieve success. The trust invests almost exclusively in the consumer staples sector, with over 90% of its total asset allocations in this sector. The trust's primary investment is in the Kellogg Company, its original parent company, and it also allocates a small portion of its held assets in the iShares S&P 100 Index Fund. The firm's top holding is Kellanova Co(NYSE:K), and its total equity stands at $3.69 billion.

Overview of Kellanova Co

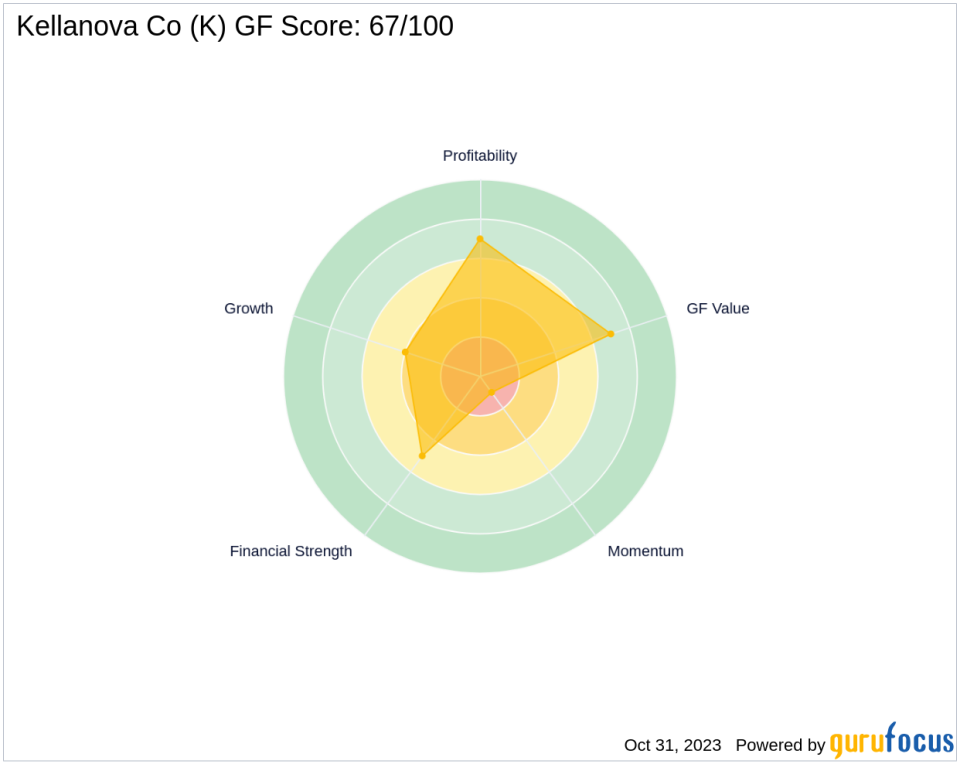

Kellanova Co, a leading global manufacturer and marketer of salty snacks, snack bars, frozen breakfast fare, meat alternatives, and other packaged foods, was split from the North American cereal business. The company's product mix includes well-known brands such as Pringles, Cheez-It, Rice Krispies Treats, Pop-Tarts, Eggo, Nutri-Grain, and Morningstar Farms. Kellanova Co has a market capitalization of $17.19 billion and its stock is currently priced at $50.2. The company's GF-Score is 67/100, indicating a poor future performance potential. Its Balance Sheet Rank is 5/10, Profitability Rank is 7/10, and Growth Rank is 4/10. The company's Piotroski F-Score is 5, and its Altman Z score is 2.46.

Comparison with Other Gurus

Other gurus who hold Kellanova Co stock include Mario Gabelli (Trades, Portfolio), Ken Fisher (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio). However, KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) holds the largest stake in Kellanova Co among these gurus, with a position of 15.69% in the company.

Conclusion

The recent transaction by KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) has slightly reduced its exposure to Kellanova Co, but the company still represents a significant portion of the firm's portfolio. Despite Kellanova Co's modest financial health and growth potential, the firm's continued investment in the company indicates its confidence in its long-term prospects. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.