KELLOGG W K FOUNDATION TRUST Reduces Stake in Kellanova Co

Recent Stock Transaction Overview

On November 14, 2023, KELLOGG W K FOUNDATION TRUST (Trades, Portfolio), a prominent investment firm, executed a reduction in its holdings of Kellanova Co (stock symbol: K). The firm sold 77,800 shares at a price of $52.62 each, resulting in a slight portfolio impact of -0.13%. Despite this reduction, KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) still holds a significant stake in Kellanova Co, with a total of 53,553,838 shares, representing 87.77% of its portfolio and 15.64% of the company's outstanding shares.

Profile of KELLOGG W K FOUNDATION TRUST (Trades, Portfolio)

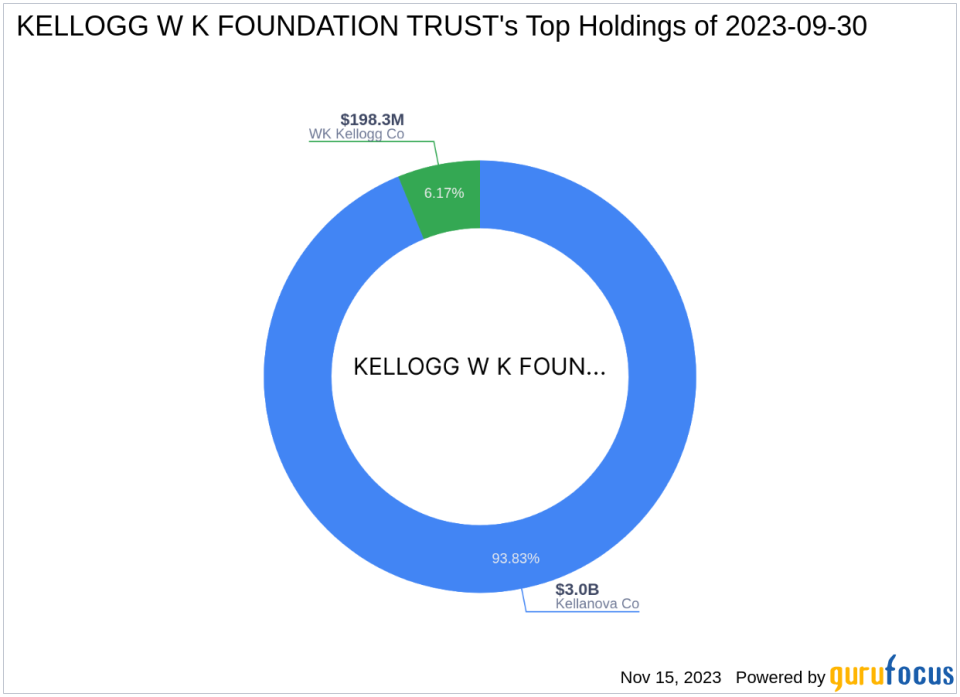

KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) is a nonprofit charity organization with a rich history dating back to its founding by Will Keith Kellogg in 1930. With a mission to support vulnerable children and communities, the trust has grown to become the seventh-largest philanthropic foundation in the United States. The trust's investment strategy is heavily focused on the consumer staples sector, with over 90% of its total asset allocations in this area. Its top holdings include Kellanova Co (NYSE:K) and WK Kellogg Co (NYSE:KLG), with an overall equity of $3.22 billion.

Introduction to Kellanova Co

Kellanova Co, based in the USA and having gone public on May 12, 1959, is a leading global manufacturer and marketer in the consumer packaged goods industry. The company's diverse product segments include salty snacks, snack bars, frozen breakfast items, meat alternatives, and other packaged foods, with well-known brands like Pringles and Cheez-It under its umbrella. Kellanova operates in approximately 20 countries and markets its products in over 180 countries, with nearly half of its sales coming from outside the United States.

Kellanova Co's Financial Snapshot

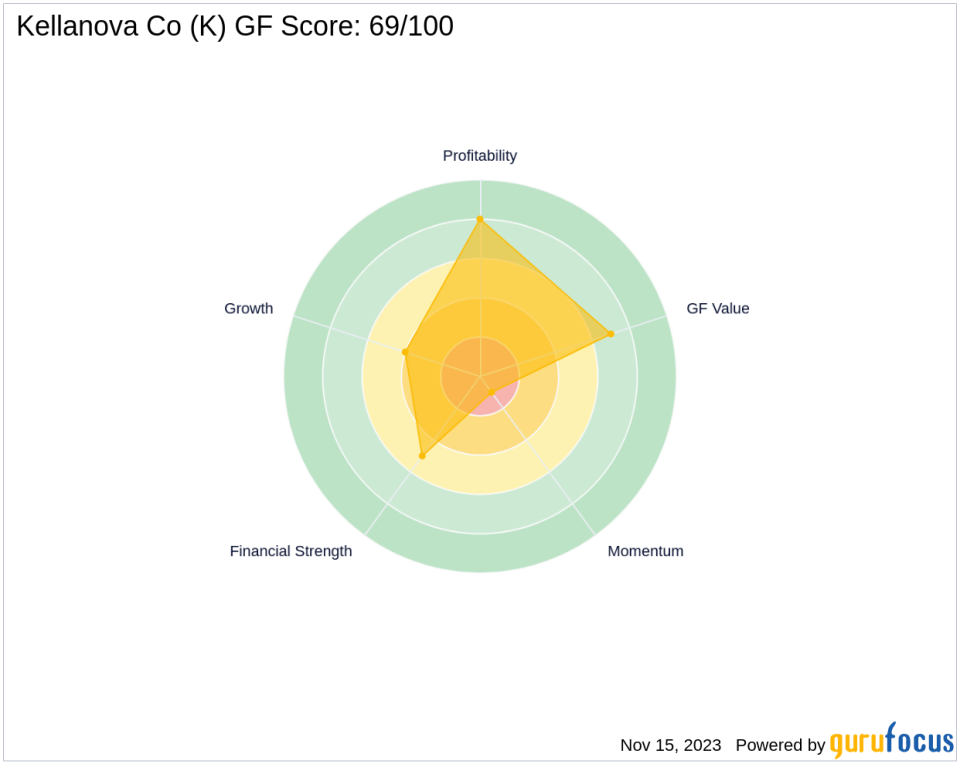

As of the latest data, Kellanova Co boasts a market capitalization of $18.01 billion and a current stock price of $52.58. The stock is considered modestly undervalued with a GF Value of $65.05 and a price to GF Value ratio of 0.81. The company's PE percentage stands at 22.09, indicating profitability, although the stock has experienced a year-to-date percentage change of -21.38%. Kellanova's financial strength is reflected in its GF Score of 69/100, suggesting a potential for future performance.

Market Position and Performance Metrics

Since its IPO, Kellanova Co's stock has seen a staggering increase of 3,249.04%. The company's GF Score indicates a moderate potential for future performance. Kellanova also holds a Profitability Rank of 8/10 and a Growth Rank of 4/10, with a GF Value Rank of 7/10. However, the company's Momentum Rank is low at 1/10, indicating a need for caution among investors.

Impact on KELLOGG W K FOUNDATION TRUST (Trades, Portfolio)'s Portfolio

The recent trade by KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) has slightly decreased its position in Kellanova Co but the stock remains a dominant part of the firm's portfolio. This move reflects a strategic adjustment rather than a significant shift in the trust's investment stance towards Kellanova Co.

Comparative Analysis with Other Investors

Kellanova Co is also held by other notable investors, including Mario Gabelli (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Ken Fisher (Trades, Portfolio). Southeastern Asset Management stands as the largest guru shareholder, although specific share percentage data is not available. This diversity of interest from various investment gurus underscores Kellanova's appeal in the market.

Recent Performance Indicators of Kellanova Co

Kellanova Co has shown mixed performance indicators recently. The company's balance sheet and profitability remain strong, with a Financial Strength rank of 5/10 and a Profitability Rank of 8/10. However, growth has been tepid, with a Growth Rank of 4/10. The stock's momentum indicators, such as the RSI and Momentum Index, suggest that the stock may not be in a strong upward trend at the moment.

Transaction Analysis

The reduction in Kellanova Co shares by KELLOGG W K FOUNDATION TRUST (Trades, Portfolio) is a tactical decision that marginally affects the trust's portfolio. Given the firm's significant remaining stake, it continues to show confidence in Kellanova's market position and future prospects. Investors should monitor the company's performance metrics and market trends for further insights into the potential impact of this transaction.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.