Kellogg's (K) Q2 Earnings & Sales Rise Y/Y, '23 View Moves Up

Kellogg Company K delivered second-quarter 2023 results, with the top and the bottom line increasing year over year. Earnings beat the Zacks Consensus Estimate, while sales missed the same.

Courtesy of solid first-half results and robust trends, management raised its 2023 sales and profit view. Management is on track with the separation of the North America cereal business.

Quarter in Detail

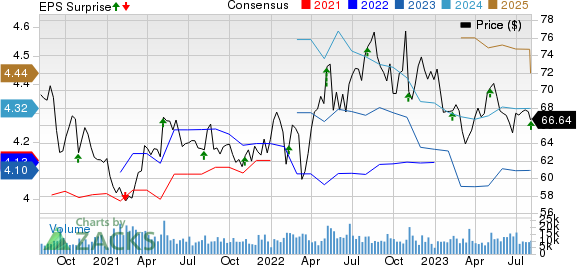

Kellogg reported adjusted earnings of $1.25 per share, which came ahead of the Zacks Consensus Estimate of $1.11. The bottom line increased by 6% compared with the year-ago quarter’s figure. On a constant currency or cc basis, adjusted earnings per share (EPS) increased 5% to $1.24.

The company recorded net sales of $4,041 million, missing the Zacks Consensus Estimate of $4,047.2 million. The top line advanced 4.6% year over year. Net sales growth was backed by favorable price/mix and continued snack momentum. These factors offset the impact of price elasticity and unfavorable currency rates. Organic net sales (excluding the currency impact) increased 7%.

Adjusted operating profit increased 14% on a reported and cc basis.

Kellogg Company Price, Consensus and EPS Surprise

Kellogg Company price-consensus-eps-surprise-chart | Kellogg Company Quote

Segment Discussion

Sales in the North American segment amounted to $2,325 million, increasing 3.4% year over year. The upside in sales can be attributed to favorable price/mix, which more than offset the impact of price elasticity and lapping of inventory replenishment from the year-ago quarter’s levels. Net sales increased 3.7% on an organic basis.

Revenues in the European segment totaled $669 million, up 11.9% year over year on favorable price/mix and momentum in snacks. These factors more than offset the impacts of price elasticity. Organic net sales increased 10.5%.

Revenues in Latin America totaled $336 million, up 16.8% year over year, backed by a solid price/mix and favorable foreign currency rates. Organic sales ascended 9.2%.

Revenues in the Asia Pacific and the Middle East & Africa segment totaled $712 million, declining 2.7% year over year. Unfavorable foreign currency rates caused the downside. Nevertheless, the favorable price/mix was a breather. Organic sales increased 13.9%.

Image Source: Zacks Investment Research

Other Financials

The Zacks Rank #3 (Hold) company ended the reported quarter with cash and cash equivalents of $308 million, long-term debt of $5,078 million and total equity of $4,221 million. The company generated cash from operating activities of $644 million for the year-to-date period ended Jul 1, 2023.

Net cash provided by operating activities is likely to be $1.7-$1.8 billion in 2023, while cash flow is estimated to be $1.0-$1.1 billion.

2023 Guidance

Management expects organic net sales growth to be up nearly 7% compared with the earlier guidance of 6-7% growth. The revised outlook reflects solid first-half results, price/mix growth and a gradual increase in price elasticities.

The adjusted operating profit is now expected to rise 9-10% at cc, up from its earlier guidance of 8-10% growth. The outlook reflects efforts toward profit-margin recovery. Management expects the adjusted EPS to decline 1-2% at cc. The company had earlier predicted the metric to drop 1-3% at cc.

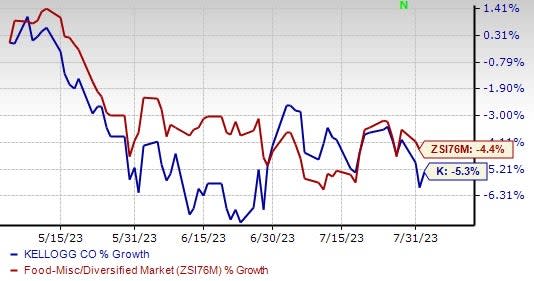

The company’s stock has lost 5.3% in the past three months compared with the industry’s 4.4% decline.

Some Better-Ranked Staple Bets

Here, we have highlighted three better-ranked stocks, namely TreeHouse Foods, Inc. THS, Post Holdings POST and McCormick & Company, Incorporated MKC.

TreeHouse Foods, a packaged food and beverage manufacturer, currently sports a Zacks Rank #1 (Strong Buy). THS has a trailing four-quarter earnings surprise of 49.3% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TreeHouse Foods’ current financial year’s sales suggests a decline of 12.4% from the year-ago reported numbers.

Post Holdings, a consumer-packaged goods holding company, currently has a Zacks Rank #2 (Buy). POST has a trailing four-quarter earnings surprise of 46.7% on average.

The Zacks Consensus Estimate for Post Holdings’ current fiscal year sales and earnings suggests growth of 13% and 141.1%, respectively, from the corresponding year-ago reported figures.

McCormick, a manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors, currently carries a Zacks Rank #2. MKC has a trailing four-quarter earnings surprise of 4.2%, on average.

The Zacks Consensus Estimate for McCormick’s current fiscal year sales and earnings suggests 6.4% and 5.1% growth, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kellogg Company (K) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report