Kemper Corp (KMPR) Returns to Profitability in Q4 2023 with Improved Underlying Combined Ratio

Net Income: Reported $51.4 million in Q4 2023, a significant turnaround from a net loss of $53.3 million in Q4 2022.

Adjusted Consolidated Net Operating Income: Reached $50.5 million in Q4 2023 compared to a net operating loss of $23.5 million in Q4 2022.

Specialty P&C Underlying Combined Ratio: Improved by 2.3% sequentially to 98.2%.

Expense Savings: Achieved a multi-year target of $150 million in the first year of the program.

Parent Liquidity: Increased to $1.1 billion, up $325 million from the prior quarter.

Dividends: Declared a quarterly dividend of $0.31 per share, paid on November 30, 2023.

Book Value Per Share: Decreased by 6% year-over-year to $39.08.

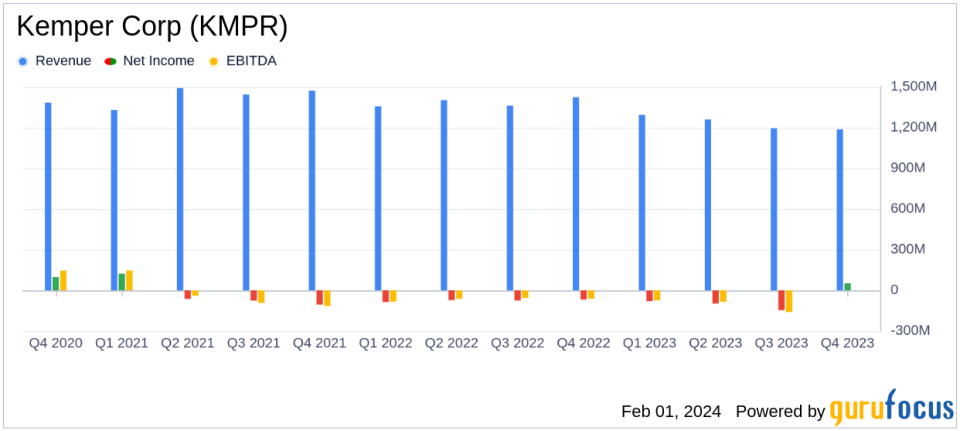

On February 1, 2024, Kemper Corp (NYSE:KMPR) released its 8-K filing, announcing a return to profitability in the fourth quarter of 2023. The diversified insurance company, which provides property and casualty insurance, life and health insurance, and operates through three segments, reported a net income of $51.4 million, or $0.80 per diluted share. This marks a stark contrast to the net loss of $53.3 million, or $(0.84) per share, in the same quarter of the previous year.

The company's Specialty Property & Casualty Insurance segment showed a notable improvement with an underlying combined ratio of 98.2%, a sequential improvement of 2.3%. The Life Insurance segment continued to produce stable earnings, despite a decrease in net operating income from $23.0 million in Q4 2022 to $15.0 million in Q4 2023, primarily due to lower Net Investment Income.

Joseph P. Lacher, Jr., President, CEO, and Chairman of Kemper Corp, expressed satisfaction with the company's performance, stating,

Im pleased we closed 2023 with a return to profitability and we are clearly on the path to return to target margins in 2024."

He highlighted the consecutive quarterly improvements in the Specialty P&C underlying combined ratio and the strategic initiatives that significantly increased liquidity and strengthened the company's low-cost operating platform.

The company's financial achievements, including reaching a multi-year target of $150 million in expense savings in the first year of the program and optimizing operations in Bermuda to generate approximately $330 million of dividends to the parent, are critical for maintaining competitiveness in the insurance industry. These measures not only improve profitability but also enhance the company's ability to invest in growth opportunities and return value to shareholders.

Despite a decrease in total revenues by 13.6% to $1,187.2 million in Q4 2023, primarily due to reduced Specialty P&C earned premiums and the disposition of Kemper Health, the company's strategic actions have positioned it for a stronger performance in the upcoming year. The increase in parent liquidity to $1.1 billion provides a robust financial cushion and reflects the company's solid financial management.

As Kemper Corp (NYSE:KMPR) moves into 2024, the focus remains on balancing underwriting profitability and new business generation to optimize long-term profitable growth. The company's resilience in the face of challenges and its strategic initiatives to improve operational efficiency are key factors that value investors may find appealing.

For more detailed financial information and to access the full earnings report, please visit the investor section of kemper.com.

About Kemper Corp (NYSE:KMPR): Kemper is a diversified insurance company offering property and casualty insurance, along with life and health insurance. The company operates through three segments: Specialty Property & Casualty Insurance, Preferred Property & Casualty Insurance, and Life & Health Insurance. Kemper serves over 4.9 million policies and is represented by approximately 23,700 agents and brokers.

Explore the complete 8-K earnings release (here) from Kemper Corp for further details.

This article first appeared on GuruFocus.