Ken Fisher's Q2 2023 Portfolio Update: Top Trades and Holdings

Ken Fisher (Trades, Portfolio), the CEO and CIO of Fisher Investments, is a renowned figure in the investment world. With a legacy of over two decades of writing for Forbes' prestigious "Portfolio Strategy" column, Fisher has made a name for himself with his accurate market predictions, often going against Wall Street's consensus forecast. Trained by his father, the legendary investor Philip A. Fisher, Ken has authored three major finance books and has been featured in numerous global finance and business periodicals. His firm, Fisher Investments, recently filed their 13F report for Q2 2023, providing insights into their investment strategy and portfolio changes.

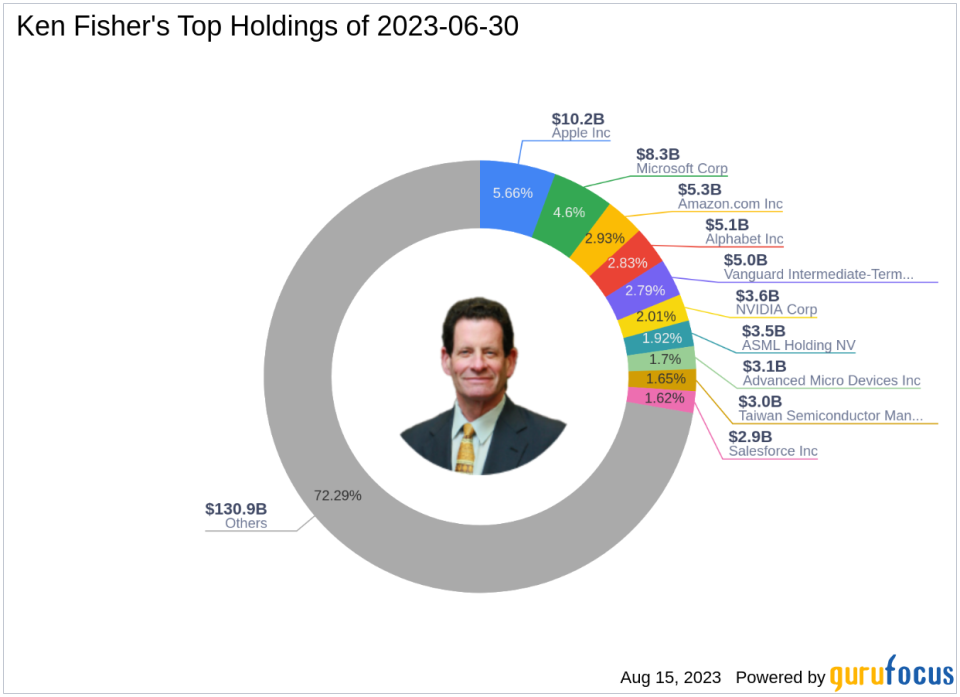

Overview of Fisher's Q2 2023 Portfolio

The firm's portfolio for the second quarter of 2023, ending on June 30, contained 1,161 stocks with a total value of $180.98 billion. The top holdings were Apple Inc. (AAPL) with 5.66%, Microsoft Corp. (MSFT) with 4.60%, and Amazon.com Inc. (AMZN) with 2.93%.

Top Three Trades of the Quarter

Among the notable trades of the quarter, Fisher Investments reduced their stake in Block Inc (NYSE:SQ) by 11,218,816 shares, impacting the equity portfolio by 0.46%. The stock traded at an average price of $62.58 during the quarter. As of August 15, 2023, Block Inc had a market cap of $35.89 billion and a stock price of $58.83, reflecting a -32.23% return over the past year. GuruFocus rates the company's financial strength and profitability at 6/10 and 5/10 respectively. The company's valuation ratios include a price-book ratio of 2.02, a EV-to-Ebitda ratio of 371.20, and a price-sales ratio of 1.81.

In a significant addition, Fisher Investments purchased 4,400,857 shares of PepsiCo Inc (NASDAQ:PEP), bringing their total holding to 4,452,316 shares. This trade had a 0.45% impact on the equity portfolio. The stock traded at an average price of $186.55 during the quarter. As of August 15, 2023, PepsiCo had a market cap of $250.32 billion and a stock price of $181.84, with a return of 4.23% over the past year. GuruFocus rates the company's financial strength and profitability at 5/10 and 9/10 respectively. The company's valuation ratios include a price-earnings ratio of 31.85, a price-book ratio of 14.15, a PEG ratio of 7.96, a EV-to-Ebitda ratio of 20.78, and a price-sales ratio of 2.82.

Another notable purchase was UnitedHealth Group Inc (NYSE:UNH), with Fisher Investments acquiring 1,548,224 shares, bringing their total holding to 1,561,174 shares. This trade had a 0.41% impact on the equity portfolio. The stock traded at an average price of $488.72 during the quarter. As of August 15, 2023, UnitedHealth Group had a market cap of $469.39 billion and a stock price of $506.73, with a return of -5.58% over the past year. GuruFocus rates the company's financial strength and profitability at 7/10 and 10/10 respectively. The company's valuation ratios include a price-earnings ratio of 22.67, a price-book ratio of 5.73, a PEG ratio of 1.72, a EV-to-Ebitda ratio of 14.36, and a price-sales ratio of 1.38.

In conclusion, Fisher Investments' Q2 2023 portfolio reflects a strategic balance of technology and consumer staples stocks, with significant trades in Block Inc, PepsiCo Inc, and UnitedHealth Group Inc. These trades provide valuable insights into the firm's investment strategy and market outlook.

This article first appeared on GuruFocus.