Kennedy Lewis Management LP Reduces Stake in Eastman Kodak Co

On July 21, 2023, Kennedy Lewis Management LP, a New York-based investment firm, significantly reduced its holdings in Eastman Kodak Co. This article provides an in-depth analysis of the transaction, the profiles of both the firm and the traded company, and the potential implications of this move on their respective portfolios.

Details of the Transaction

The transaction saw Kennedy Lewis Management LP reduce its stake in Eastman Kodak Co by 42.99%, selling off 2,794,862 shares. This move had a -38.68% impact on the firm's portfolio. The shares were traded at a price of $5.26 each, leaving the firm with a total of 3,706,318 shares in Eastman Kodak Co. Post-transaction, Eastman Kodak Co constituted 83.66% of the firm's portfolio, with the firm holding a 4.70% stake in the company.

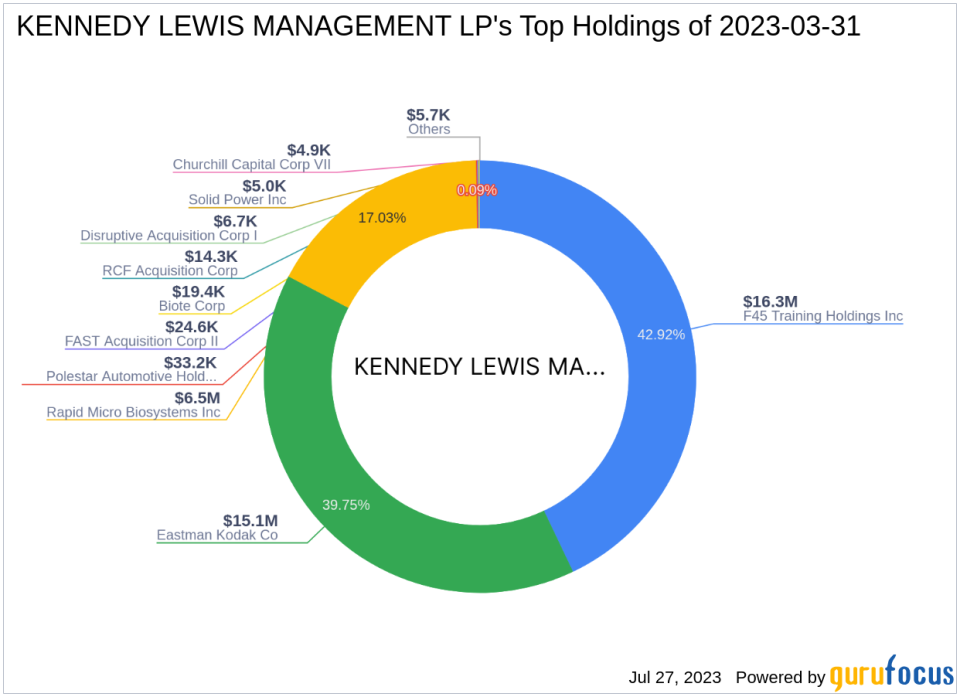

Profile of Kennedy Lewis Management LP

Kennedy Lewis Management LP is an investment firm located at 111 W. 33RD STREET, SUITE 1910, NEW YORK, NY 10120. The firm's portfolio consists of 12 stocks, with a total equity of $38 million. Its top holdings include Eastman Kodak Co(NYSE:KODK), FAST Acquisition Corp II(NYSE:FZTWS), F45 Training Holdings Inc(NYSE:FXLV), Rapid Micro Biosystems Inc(NASDAQ:RPID), and Polestar Automotive Holding UK PLC(NASDAQ:PSNY.WS). The firm's investments are primarily concentrated in the Consumer Cyclical and Industrials sectors.

Overview of Eastman Kodak Co

Eastman Kodak Co, a US-based company, operates in several business segments including Traditional Printing, Digital Printing, Brand, and Advanced Materials and Chemicals. The Traditional Printing segment, which contributes over half of the total revenue, offers digital and traditional products and services to various businesses such as commercial print and book publishing. The company has a global business presence, with overseas markets accounting for a majority of revenue. As of July 28, 2023, the company's market capitalization stood at $446.701 million, with a stock price of $5.63. The company's PE percentage is 9.91, indicating that it is currently profitable. However, according to GuruFocus valuation, the stock is modestly overvalued with a GF Value of $4.85 and a Price to GF Value ratio of 1.16.

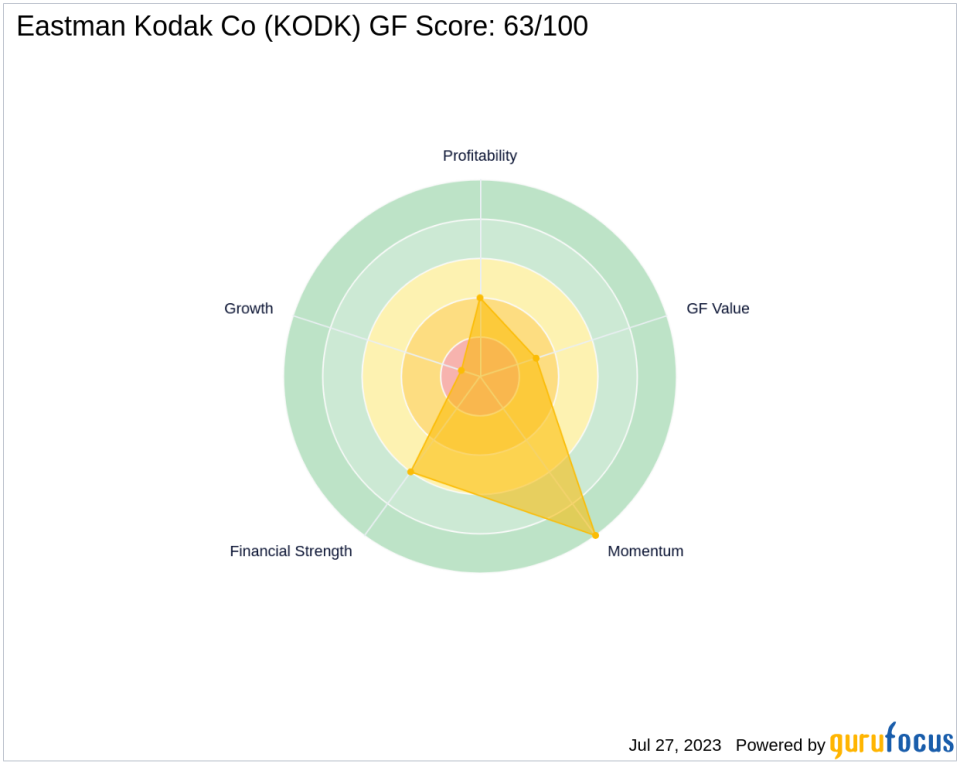

Analysis of Eastman Kodak Co's Performance

Eastman Kodak Co has a GF Score of 63/100, indicating a poor future performance potential. The company's balance sheet, profitability, growth, and GF value ranks are 6/10, 4/10, 1/10, and 3/10 respectively. The company's F Score is 4, and its Z Score is 0.81, indicating a low probability of bankruptcy. The company's cash to debt ratio is 0.62, ranking it 618th in the industry. Over the past three years, the company's gross margin growth was -1.00%, while its operating margin growth was 24.50%. The company's 3-year revenue and EBITDA growth were -19.70% and 69.20% respectively.

Eastman Kodak Co's Industry Position

In the Business Services industry, Eastman Kodak Co's interest coverage is 0.40, ranking it 776th. The company's ROE and ROA are 5.44% and 2.73% respectively, ranking it 618th and 596th in the industry. The company's RSI over 5, 9, and 14 days are 52.37, 54.31, and 56.50 respectively. The company's 6 - 1 month momentum index is 25.28, ranking it 155th in the industry.

Conclusion

In conclusion, Kennedy Lewis Management LP's decision to reduce its stake in Eastman Kodak Co is a significant move that will undoubtedly impact its portfolio. Despite Eastman Kodak Co's modest overvaluation and poor future performance potential, it remains a major part of Kennedy Lewis Management LP's portfolio. Investors should closely monitor the implications of this transaction on both entities.

This article first appeared on GuruFocus.