Keros Therapeutics Inc (KROS) Reports Increased R&D Spending and Net Loss in 2023

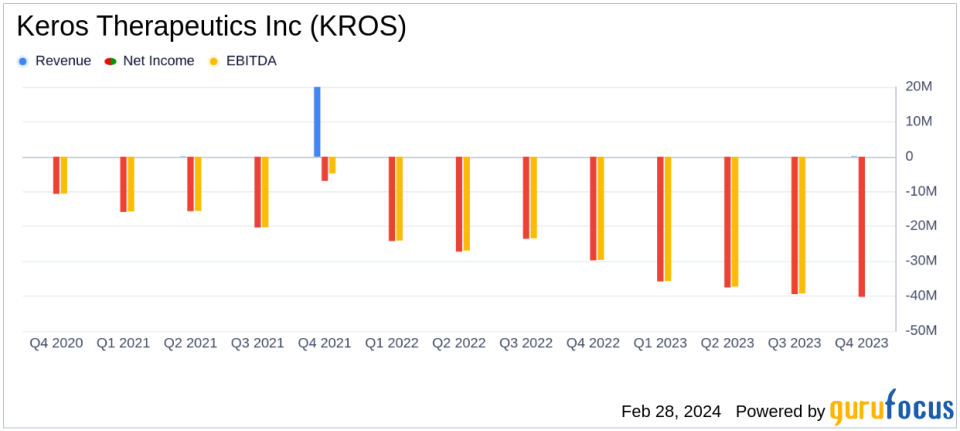

Net Loss: KROS reported a net loss of $40.2 million for Q4 and $153.0 million for the full year 2023.

Revenue: Generated $0.2 million in revenue for the full year 2023 from a manufacturing technology transfer agreement.

R&D Expenses: Research and development expenses increased to $37.5 million for Q4 and $135.3 million for the full year.

G&A Expenses: General and administrative expenses rose to $9.1 million for Q4 and $34.8 million for the full year.

Cash Position: Cash and cash equivalents stood at $331.1 million as of December 31, 2023.

Stock Offering: Completed a public offering of 4,025,000 shares, expecting to fund operations into 2027.

On February 28, 2024, Keros Therapeutics Inc (NASDAQ:KROS) released its 8-K filing, detailing the company's financial results for the fourth quarter and full year ended December 31, 2023. Keros Therapeutics, a clinical-stage biopharmaceutical company, is at the forefront of developing novel treatments for patients with hematological, pulmonary, and cardiovascular disorders through the modulation of the TGF- protein signaling pathways.

The company reported a net loss of $40.2 million for the fourth quarter, which is an increase from the $29.7 million loss in the same period of the previous year. The full year net loss also widened to $153.0 million from $104.7 million in 2022. This increase in net loss is primarily attributed to heightened research and development efforts and investments aimed at achieving Keros' clinical and corporate objectives.

Despite the increased losses, Keros Therapeutics generated $0.2 million in revenue for the full year 2023, a notable improvement from the previous year where no revenue was recorded. This revenue stems from a manufacturing technology transfer agreement with Hansoh (Shanghai) Healthtech Co., Ltd., showcasing the company's ability to monetize its technological expertise.

Financial Performance and Clinical Advancements

Research and development expenses for Keros saw a significant uptick, reaching $37.5 million for the fourth quarter and $135.3 million for the full year 2023. This reflects the company's commitment to advancing its clinical pipeline, including the progression of two Phase 2 clinical trials of KER-050 and the initiation of the TROPOS trial for KER-012.

General and administrative expenses also rose to $9.1 million for the fourth quarter and $34.8 million for the full year, driven by increased personnel expenses, facilities costs, and professional fees associated with the company's growth.

The company's cash and cash equivalents as of December 31, 2023, were reported at $331.1 million, compared to $279.0 million at the end of 2022. The strengthened cash position is partly due to a successful public offering of common stock, which is expected to fund Keros' operations and capital expenditures well into 2027.

Looking Ahead

Keros Therapeutics is poised to engage with regulators for the design of a planned Phase 3 clinical trial of KER-050 in patients with MDS and is preparing to report additional data from ongoing Phase 2 trials for KER-050 and KER-012. The company also anticipates initial data from the Phase 1 trial of KER-065 in the treatment of obesity and neuromuscular diseases.

While the increased net loss reflects the company's strategic investment in its clinical pipeline, the revenue generation and strengthened cash position demonstrate Keros' potential for long-term growth and sustainability. The company's focus on addressing unmet medical needs in hematological, pulmonary, and cardiovascular disorders positions it as a notable player in the biotechnology industry.

For investors and stakeholders, the financial results of Keros Therapeutics Inc (NASDAQ:KROS) underscore the company's commitment to advancing its clinical programs while maintaining a robust financial foundation to support its ambitious goals.

Explore the complete 8-K earnings release (here) from Keros Therapeutics Inc for further details.

This article first appeared on GuruFocus.