Keurig Dr Pepper Inc. Reports Growth Amidst Market Challenges, Eyes Steady 2024

Net Sales: $14.81 billion in FY 2023, a 5.4% increase over the previous year.

Diluted EPS: Adjusted diluted EPS grew by 6% to $1.79 for the full year.

U.S. Market Share: Gains in categories representing approximately 85% of the portfolio.

International Growth: Double-digit net sales growth, now accounting for 13% of total company sales.

Shareholder Returns: Over $1.8 billion returned through dividends and share repurchases.

2024 Outlook: Mid-single-digit range net sales growth and high-single-digit range Adjusted diluted EPS growth expected.

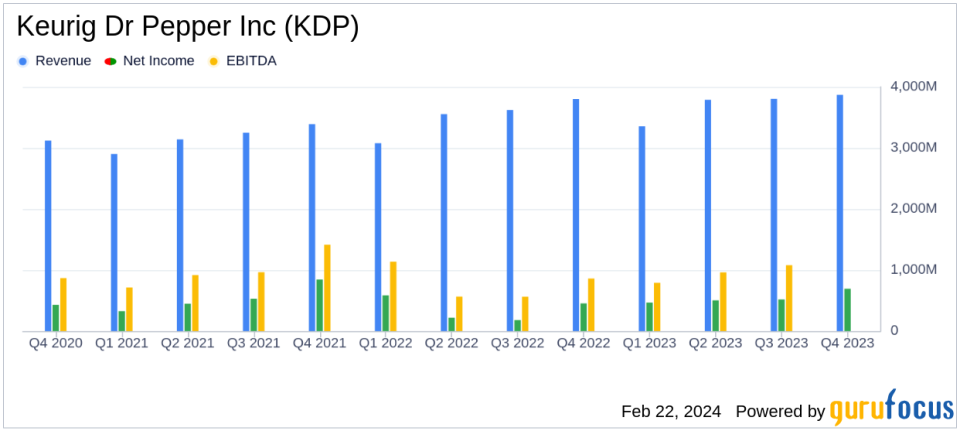

On February 22, 2024, Keurig Dr Pepper Inc (NASDAQ:KDP) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leader in the beverage industry, has shown resilience and strategic growth, particularly in its U.S. Refreshment Beverages and International segments.

Keurig Dr Pepper was established in 2018 following a merger between Keurig Green Mountain Coffee and Dr Pepper Snapple. The company manufactures and distributes coffee systems, including coffee brewers and single-serve coffee pods, as well as ready-to-drink beverages. With a strong presence in the U.S. and Canada, which make up 95% of revenues, KDP has also made significant strides in the Mexican market.

Despite facing inflationary pressures and a challenging volume/mix decline, KDP managed to increase its net sales by 5.4% to $14.81 billion for the full year of 2023. The company's adjusted diluted EPS growth of 6% aligns with its guidance, reflecting an enhanced composition of earnings. Market share gains in the U.S. Refreshment Beverages and a significant expansion of the Keurig brewing system to approximately 40 million U.S. households were among the key drivers of growth.

Internationally, KDP experienced double-digit net sales growth, with strategic partnerships in the ready-to-drink coffee and sports hydration categories contributing to this success. The company's commitment to shareholder returns was evident, with over $1.8 billion returned through dividends and share repurchases.

Chairman and CEO Bob Gamgort commented on the results, stating:

"2023 was a year of significant progress for KDP. Broad-based market share gains across our portfolio and entries into attractive white spaces supported our revenue momentum. Gross margin expansion resumed, as the relationship between inflation, pricing, and our redoubled productivity efforts improved throughout the year and helped fund investments in our brands and capabilities. We delivered on our financial commitments while simultaneously enhancing the composition of our earnings profile and strengthening our balance sheet."

Looking ahead, KDP expects to deliver on-algorithm net sales and adjusted EPS growth in 2024, with a mid-single-digit range net sales growth and high-single-digit range adjusted diluted EPS growth. This outlook is based on the company's strong foundation and strategic focus, bolstered by a refreshed executive leadership team.

For value investors and potential GuruFocus.com members, KDP's performance demonstrates a robust business model capable of navigating market challenges and delivering consistent growth. The company's strategic investments and market share gains position it well for continued success in the competitive beverage industry.

Explore the complete 8-K earnings release (here) from Keurig Dr Pepper Inc for further details.

This article first appeared on GuruFocus.