Keurig Dr Pepper (KDP) Cheers Investors With Dividend Hike

Keurig Dr Pepper KDP announced that its board of directors raised its quarterly cash dividend by 7.5% to 86 cents per share. The dividend will be paid out on Oct 13, 2023, to shareholders of record at the close of the business on Sep 29, 2023.

The company has a five-year annualized dividend growth rate of 3%, reflecting dividend increases for five consecutive years. KDP’s current dividend payout ratio is 58.1%.

KDP’s ability to reward shareholders with dividends and buybacks is backed by a strong cash flow and revenue generation capacity. The company’s annualized cash flow growth rate has been 22% over the past three-five years versus the industry average of 4.93%.

The move comes after its solid second-quarter 2023 results, which gained from continued brand strength and significant pricing. Adjusted earnings of 42 cents per share grew 7.7% year over year. Net sales of $3,789 million jumped 6.6% from the year-ago quarter on a reported basis and increased 6.1% on a constant-currency basis.

Other Factors to Consider

Keurig Dr Pepper has been witnessing continued momentum in the Refreshment Beverages segment for a long time now. The segment reported sales of $2,330 million, which beat our estimate of $2,180.3 million. Sales in this segment grew 11.8% in the second quarter, gaining from higher net price realization of 12% and a 0.2% decline in the volume/mix. The results were driven by recent innovations and effective in-market execution, along with the contribution from its sales and distribution partnership for C4 Energy.

Strength in-market performance in the Liquid Refreshment Beverages category bodes well. The company witnessed retail dollar consumption growing 10.7% and market share expansion more than 85% of KDP's cold beverage portfolio during the second quarter. This mainly reflected strength in CSDs, seltzers, energy, apple juice, coconut waters and fruit drinks.

Also, strength in Dr Pepper and Squirt in CSDs, as well as Polar seltzers, Vita Coco, C4 Energy, Evian, Mott's and Hawaiian Punch, aided the results. In coffee, KDP’s manufactured shares were solid at 79%, driven by higher consumer mobility year over year.

Consequently, management raised its sales view for 2023. The company expects sales growth to be 5-6%, which is higher than 5% projected earlier. For adjusted earnings, it expects an increase of 6-7%.

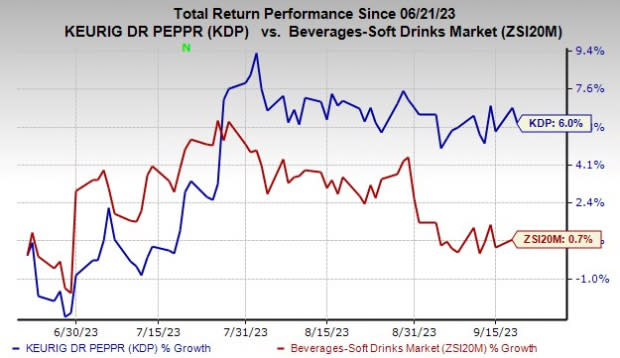

Image Source: Zacks Investment Research

Notably, shares of this Zacks Rank #3 (Hold) company have gained 6% in the past three months compared with the industry’s 0.7% growth.

However, the company has been reeling under continued cost pressures in transportation, warehousing and labor. These, along with the adverse impacts of higher marketing investment, acted as deterrents.

Also, it has been witnessing sluggishness in its coffee segment for a while now. In second-quarter 2023, sales in the U.S. Coffee segment declined 5.7% year over year to $970 million. At-home coffee consumption continued to be impacted by mobility changes on a year-over-year basis. Further, pod revenues fell 4.6%, including a shipment drop of 7.7%, mainly owing to the mobility-driven category softness and the exit of certain lower-margin private label contracts.

All said, Keurig Dr Pepper’s impressive fundamentals, strong footing in the industry and solid portfolio make it a promising stock. KDP draws further investor attention through its regular dividend payouts and commitment to enhancing shareholder returns.

Stocks to Consider

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The expected earnings per share (EPS) growth rate for three to five years is 2.3%.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago period’s actual. FLO has a trailing four-quarter earnings surprise of 7.6%, on average.

The J. M. Smucker Company SJM, which manufactures and markets branded food and beverage products, presently has a Zacks Rank of 2. SJM has a trailing four-quarter earnings surprise of 14%, on average.

The Zacks Consensus Estimate for The J. M. Smucker’s current financial-year earnings suggests growth of 6.8% from the year-ago reported figure.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks. It currently carries a Zacks Rank of 2. UTZ’s expected EPS growth rate for three to five years is 11.4%.

The Zacks Consensus Estimate for Utz Brands’ current fiscal-year sales suggests growth of 3.7% from the year-ago reported numbers. UTZ has a trailing four-quarter earnings surprise of 12.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report