Will Keurig's (KDP) Pricing & Innovation Efforts Revive Stock?

Keurig Dr Pepper KDP shares are currently distressed, driven by the significant pressures from input cost inflation, rising transportation costs and supply-chain disruptions, which have been taking a toll on its performance. These, along with the adverse impacts of higher marketing investment, have been key deterrents. Going ahead, management expects inflation to remain the greatest challenge.

During the first quarter of 2023, the company’s cost of sales increased to $1,609 million from $1,428 million reported in the year-ago period. This marred the company’s margins.

In first-quarter 2023, the adjusted operating income decreased 4.5% to $699 million. Meanwhile, the adjusted operating margin contracted 300 bps to 20.8%. This was mainly due to the comparison to year-ago benefits, broad-based inflationary pressure and increased marketing investment.

Additionally, the company is not free from the impacts of adverse currencies due to its worldwide operations. The weakening of foreign currencies against the U.S. dollar may require the company to either raise prices or contract profit margins in locations outside the country. Any fluctuation in foreign currency may act as a deterrent in the near term.

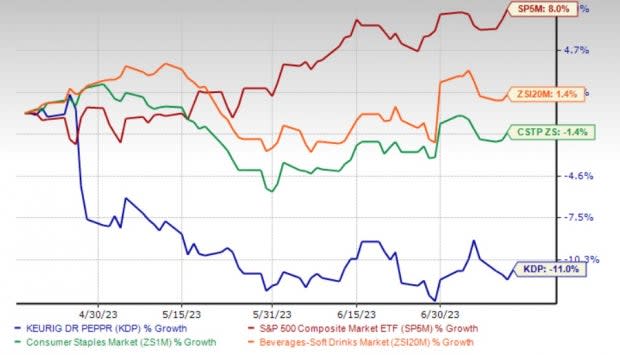

Thanks to the hardships, shares of the Zacks Rank #4 (Sell) company have lost 11% in the past three months against the industry’s growth of 1.4%. The company also compares unfavorably with the sector’s decline of 1.4% and the S&P 500’s rally of 8% in the same period.

Image Source: Zacks Investment Research

Do Pricing Actions & Innovation Place it Well?

Keurig seems to be strong on its continued brand strength, significant pricing actions, solid performance in its cold beverages and strong market share gains. These traits have been boosting the company’s sales performance in recent quarters.

The company has been particularly gaining traction in the Refreshment Beverage segment for quite some time now. The division reported strong sales growth for the first quarter, mainly on higher net price realization and a rise in volume/mix. The segment has witnessed strong traction from recent innovations, most notably Dr Pepper Strawberries & Cream, effective in-market execution and its recently announced sales and distribution partnership for C4 Energy. The continuation of this trend may help the company's bottom line in the short term.

The company is also witnessing remarkable trends on the market share front. It reported strong in-market performance in the Liquid Refreshment Beverages category in the first quarter on retail dollar consumption growing 13.6% and market share expansion above 88% of KDP's cold beverage portfolio.

The market share expansion mainly reflected strength in CSDs, seltzers, energy, apple juice, coconut waters and fruit drinks. Strength in Dr Pepper, Canada Dry, A&W, Sunkist, Squirt and Crush CSDs, Polar seltzers, Vita Coco, C4 Energy, Mott's and Hawaiian Punch also were key contributors. KDP’s manufactured shares in coffee were solid at 81%, driven by higher consumer mobility year over year.

Driven by the robust quarterly results, Keurig Dr Pepper has reaffirmed its view for 2023, which seems encouraging. The company expects sales growth of 5% and adjusted earnings increase of 6-7%.

Stocks to Consider

We highlighted some better-ranked stocks from the beverages space, namely The Duckhorn Portfolio NAPA, Molson Coors TAP and Coca-Cola FEMSA KOF.

Duckhorn currently carries a Zacks Rank #2 (Buy). NAPA has a trailing four-quarter earnings surprise of 14.2%, on average. Shares of NAPA have declined 13.1% in the past three months. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and earnings suggests growth of 8.3% and 4.8%, respectively, from the year-ago period's reported figures. NAPA has an expected earnings per share (EPS) growth rate of 6.6% for three to five years.

Molson Coors currently carries a Zacks Rank #2. The company has an expected EPS growth rate of 4.3% for three to five years. Shares of TAP have rallied 17.1% in the past three months.

The Zacks Consensus Estimate for Molson Coors’ sales and EPS for the current financial year suggests growth of 5.3% and 10.2%, respectively, from the year-ago period’s reported figures. TAP has a trailing four-quarter earnings surprise of 32.1%, on average.

Coca-Cola FEMSA has a trailing four-quarter earnings surprise of 33.8%, on average. It currently carries a Zacks Rank #2. Shares of KOF have risen 1.7% in the past three months.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and earnings suggests growth of 19.5% and 14.6%, respectively, from the year-ago period's reported figures. KOF has an expected EPS growth rate of 13.5% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report