Key Factors to Impact Mid-America Apartment's (MAA) Q3 Earnings

Mid-America Apartment Communities MAA — commonly known as MAA — is a real estate investment trust (REIT) that focuses on owning, operating and acquiring apartment communities in the Southeast, Southwest and Mid-Atlantic regions of the United States. The company is slated to report third-quarter 2023 results on Oct 25 after the closing bell.

The Germantown, TN-based residential REIT delivered a surprise of 0.44% in terms of core funds from operations (FFO) per share in the last reported quarter. Its quarterly results were driven by an increase in the average effective rent per unit for the same-store portfolio.

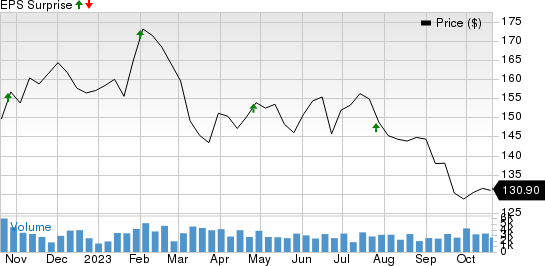

Over the trailing four quarters, MAA’s core FFO per share surpassed the Zacks Consensus Estimate on all occasions, the average being 2.08%. This is depicted in the chart below:

Mid-America Apartment Communities, Inc. Price and EPS Surprise

Mid-America Apartment Communities, Inc. price-eps-surprise | Mid-America Apartment Communities, Inc. Quote

Factors to Note

U.S. Apartment Market in Q3

Per a recent RealPage report, apartment demand in the United States during the third quarter continued to show signs of solid rebound even though rent growth was somewhat flat.

The U.S. apartment market absorbed 90,827 units per the RealPage Market Analytics. Although the figure does not compare to the historically robust demand of 2021, it still marks the largest quarterly tally in nearly two years and is in sync with the long-term seasonal norms.

However, the quarter saw the highest levels of apartment completions since the 1980s, with more than 128,000 units coming online nationally, shifting the balance of power in the rental market back to renters.

The effective asking rents fell 0.3% in September. As a result, year-over-year rent growth was just 0.1% during the quarter. This compares with 9% recorded a year ago. The key reason behind this is that apartment operators are prioritizing occupancy rates over rents to safeguard cash flow, leading to more options for renters and putting downward pressure on rent growth.

Speaking of the U.S. apartment occupancy, despite the supply surge, the solid demand helped maintain occupancy levels near the long-term average. After slipping only 10 basis points (bps) in September, occupancy at the end of the third quarter was 94.4%.

MAA's Portfolio and Strategy

MAA owns a well-diversified Sunbelt-focused portfolio of apartment communities. The company is likely to have capitalized on the favorable fundamentals of this market backed by the promising in-migration trends of jobs and households. This is expected to have boosted demand for its apartment units, aiding the top line.

The company’s development/redevelopment projects to upgrade its amenities and technology to meet the evolving needs of renters are likely to have enabled it to attract and retain tenants at its properties. Such efforts, backed by a solid balance sheet position, are expected to have aided occupancy rates and rental income.

This residential REIT is also leveraging technological initiatives to drive margin expansion. Particularly, it continues to implement its three internal investment programs — interior redevelopment, property repositioning projects and Smart Home installations. The programs are anticipated to have helped the company capture the upside potential in rent growth, generate accretive returns and boost earnings from its existing asset base.

Nonetheless, the elevated supply of rental units in some of its markets may have limited rent growth, impeding the company’s quarterly performance to a certain extent. In addition, a high interest rate environment is likely to have acted as a spoilsport.

Projections for Q3

For the third quarter of 2023, we expect the company’s same-store net operating income to increase 5% year over year. Average physical occupancy is estimated at 95.6%, slightly higher than the prior quarter’s reported figure.

The Zacks Consensus Estimate for quarterly revenues is pegged at $540.35 million. The figure suggests a 3.8% rise from the year-ago quarter’s reported figure.

MAA projected third-quarter 2023 core FFO per share in the band of $2.18-$2.34, with $2.26 being the midpoint.

The company’s activities during the to-be-reported quarter were inadequate to secure analysts’ confidence. The Zacks Consensus Estimate for the quarterly FFO per share has been unchanged at $2.28 over the past month. The figure, however, suggests year-over-year growth of 4.1%.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict a surprise in terms of FFO per share for MAA this season. The right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — increases the odds of a beat. However, that is not the case here.

Earnings ESP: MAA has an Earnings ESP of -0.05%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: MAA currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks That Warrant a Look

Here are some stocks that are worth considering from the residential REIT sector, as our model shows that these have the right combination of elements to deliver a surprise this reporting cycle:

AvalonBay Communities AVB is slated to report quarterly numbers on Oct 25. AVB has an Earnings ESP of +0.76% and carries a Zacks Rank #2 (Buy) presently.

United Dominion Realty Trust UDR is slated to report quarterly numbers on Oct 26. UDR has an Earnings ESP of +0.16% and carries a Zacks Rank #3 presently.

Equity Residential EQR is slated to report quarterly numbers on Oct 31. EQR has an Earnings ESP of +0.50% and carries a Zacks Rank of 3 presently.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

United Dominion Realty Trust, Inc. (UDR) : Free Stock Analysis Report

Mid-America Apartment Communities, Inc. (MAA) : Free Stock Analysis Report