Key Variables Suggest Dell Technologies Is a Hold

Dell Technologies Inc.'s (NYSE:DELL) stock has experienced a scintillating run since the turn of the year, skyrocketing by more than 50%. Although a quality company benefitting from various idiosyncratic tailwinds, the company's beta coefficient of merely 0.96 suggests its recent surge is above its normal bounds. As such, a revision of the share price is prudent.

Without further ado, here are a few factors to consider before engaging with the stock.

Wells Fargo thinks Dell is a momentum play

Wells Fargo (NYSE:WFC) recently collated a list of 20 best-in-class momentum stocks. On the list was Dell Technologies, which it believes will be one of the primary beneficiaries of the momentum anomaly for the remainder of the year.

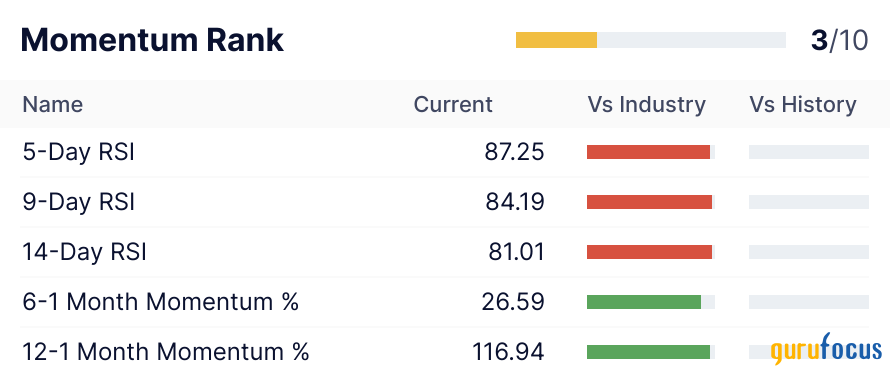

As per GuruFocus' data, Dell Technologies' 12-month momentum rating falls in the 96th industry percentile, confirming the basis of Wells Fargo's selection methodology.

However, a contra argument exists: momentum investing is only successful if the economic growth story remains unchanged. A pending U.S. interest rate pivot could alter the economic environment, consequently rerouting economic growth and momentum stocks alike.

With top-down coverage of Dell's momentum prospects settled, it is time to traverse into a fundamental analysis of the company.

Earnings release and outlook

Dell released its fourth-quarter earnings report last month, revealing stellar results, which saw the Texas-based technology company beat its revenue estimate by $150 million and its earnings per share estimate by 48 cents.

The company's fourth-quarter results capped off a mixed year. It achieved $7.70 billion in non-GAAP operating income, $8.70 billion in operating cash flow and non-GAAP diluted earnings per share of $7.13.

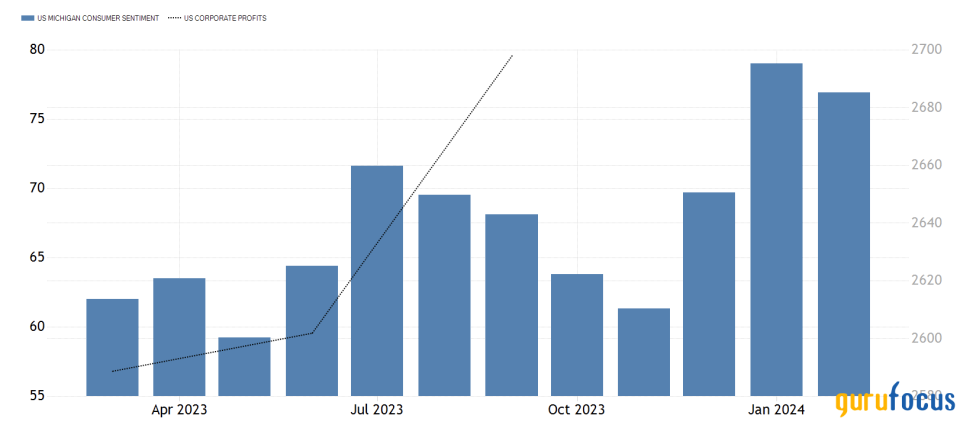

Dell's full-year results show a contrast, wherein its consolidated revenue dropped by 14% year over year, but its consolidated net income increased by 32%. Systemic drivers such as lower consumer confidence and corporate profitability explain the lower sales figures. However, disinflation tapered spending beyond Dell's sales pressure, allowing the company to widen its profit margins.

Both consumer and corporate spending have recovered in recent months, and inflation remains in range. As such, a fundamental top-down view suggests Dell could enhance its broad-based financial results in 2024.

Source: Trading Economics - U.S. Consumer Confidence, Corporate Profits

A segmental look at Dell's prospects paints a clearer picture of its idiosyncratic value drivers. The company's infrastructure solutions group delivered $9.30 billion in fourth-quarter revenue, a 10% year-over-year increase. Additional momentum could occur in this segment as server, storage and adjacent product offerings will likely benefit from an enhanced corporate spending environment.

Furthermore, Dell's client solutions segment, which includes desktops, notebooks and monitors, among other products, is set to benefit from the same tailwinds as infrastructure solutions. However, this segment could benefit in excess from lower input costs as hardware product material costs have moderated. The client solutions segment delivered $11.70 billion in fourth-quarter revenue, a 5% year-over-year decrease, but as already mentioned, better days are likely ahead.

Artificial intelligence as a multiple amplifier

Artificial Intelligence has been a salient talking point ever since OpenAI's ChatGPT hit the market. As such, it is no surprise that Dell's AI integration has garnered a lot of traction from investors.

Dell's artificial intelligence offerings feature in both its hardware and software value chains. More specifically, its AI portfolio includes servers, storage for AI, data management for AI, Precision Workstations, APEX for Generative AI and professional services for AI.

Although the company's amalgamated portfolio can provide combined value, many of its end markets are captured by other companies. However, a significant opportunity exists in Dell's AI servers business. Dell's power-edge servers address the graphics processing units market with sub-categories such as neural networks, machine learning and high-performance simulation. Dell's existing presence in hardware can leverage its server business within the AI space, allowing for scalable profits.

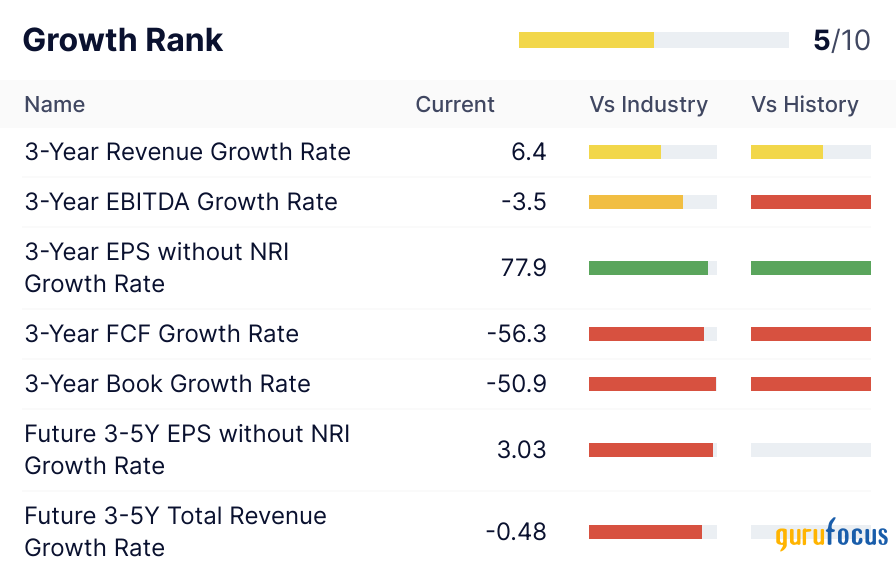

Dell Technologies' stock has a forward price-earnings multiple of 15.96, which is respectable. However, the company's AI integration will likely lift its existing three-year compound annual growth rate of 6.4%, consequently raising its fair price-earnings ratio.

Key operating metrics

A variety of Dell's operating metrics stand out.

The company's asset turnover ratio of 1.03 shows it takes advantage of its asset base to drive sales. In addition, as a technology company, much of Dell's assets are intangible and yet to be monetized. Thus, its asset turnover ratio could improve in due course.

Furthermore, Dell has an interest coverage ratio of 3.94 and a cash position of $7.37 billion, allowing it to develop internally or acquire for additional growth. In addition, the company's senior unsecured notes hold a BB2 credit score from Moody's, suggesting the company has easy access to the debt market to assist its capital expenditure roadmap.

Price action

As mentioned, Dell has a forward price-earnings ratio of 15.96, which is well-placed for a growth stock. Moreover, the company's price-earnings to growth ratio of 0.81 is below one, indicating the market underappreciated the stock's earnings per share growth.

Furthermore, a journey up Dell's income statement adds substance to the claim that the stock is undervalued. For instance, its price-sales ratio of 1.01 conveys relative value as it is below the sector average.

In addition to the stock's appreciation benefits, Dell has a complimentary dividend profile. The forward dividend yield of 1.46% is joined by a 4.33 dividend coverage ratio, providing investors comfort that the stock presents sustainable income.

Technical analysis

Dell Technologies is touted as a momentum play. However, additional technical analysis data points provide telling input into whether the stock is underpriced or not.

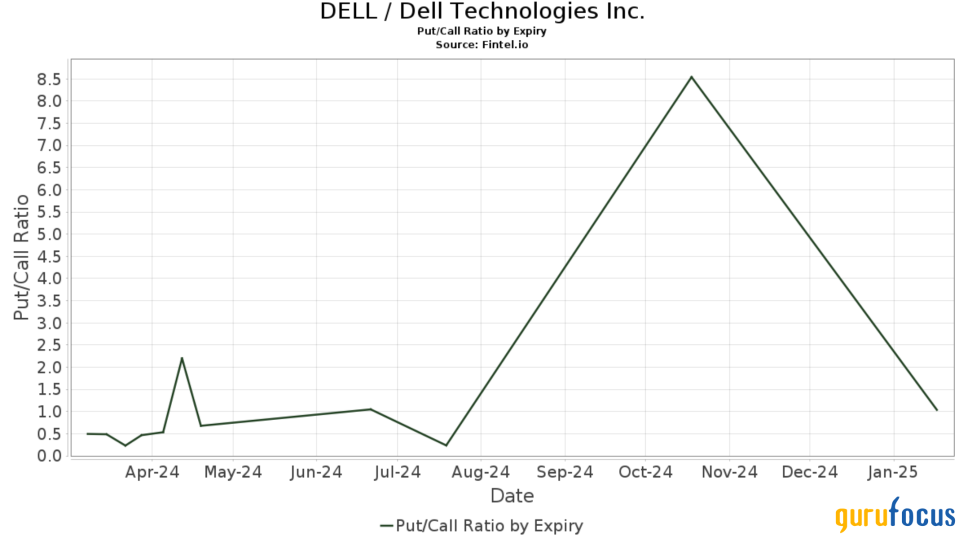

The put/call ratio of 0.78 shows that near-term options are bullish by buying more call options than put options. Although this may signal short-term price support for Dell, the put/call ratio is countercyclical. Therefore, it raises the possibility of a correction toward the mid-to-late stage of the year.

Source: Fintel

Further, Dell's relative strength index of 81 is higher than most investors would desire. An RSI above 70 is usually considered a bearish signal, providing a worthwhile consideration to those considering entering a position.

Final word

Dell Technologies' year-to-date performance has been scintillating, to say the least. However, a juxtaposition between the stock's near-term and long-term prospects exists.

As conveyed by its latest earnings report, Dell's fundamentals are robust. A rebound in consumer sentiment paired with artificial intelligence integration adds allure to Dell's fundamental prospects. Moreover, its valuation multiples show the stock remains undervalued despite its latest surge.

Despite its flourishing fundamentals, Dell's stock faces technical headwinds, with its put/call ratio and relative strength index aligning with a pullback. As such, this diminishes its near-term prospects.

Essentially, investing in Dell at its current price depends on an investor's methodology. Fundamental data shows long-term investors look set to profit from Dell throughout the economic cycle. However, shorter-term technical investors would likely be best suited to staying away from the stock until its technical data points improve.

This article first appeared on GuruFocus.