KeyCorp (KEY) Grapples with Charges in Q4; Maintains Strong Capital Position

Net Income: Reported at $30 million, or $0.03 per diluted common share, including significant charges.

Capital Strength: Common Equity Tier 1 ratio at 10.0%, reflecting a robust capital position.

Risk-Weighted Assets: Achieved a $14 billion reduction, surpassing the full-year optimization goal.

Credit Quality: Net charge-offs to average loans remained low at 26 basis points.

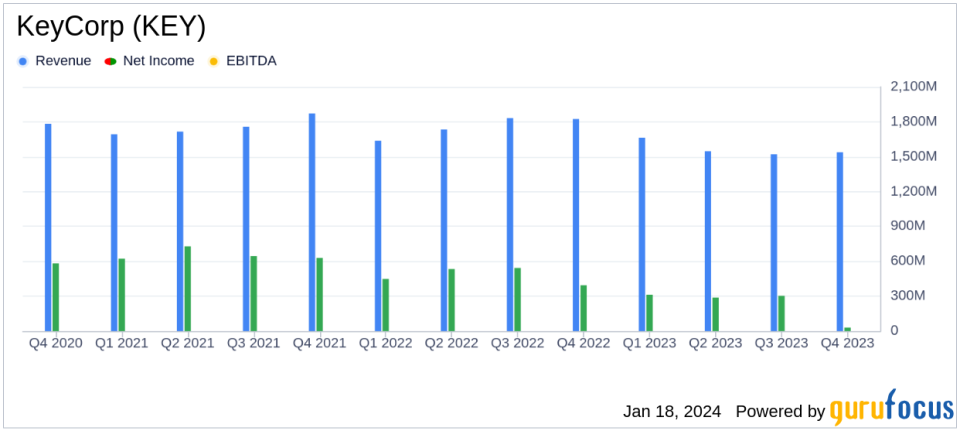

Revenue: Total revenue (TE) decreased by 19.0% year-over-year to $1,538 million.

Noninterest Expense: Increased significantly due to FDIC special assessment and other charges.

Balance Sheet Optimization: Continued efforts resulted in a decrease in average loan balances.

On January 18, 2024, KeyCorp (NYSE:KEY) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The Ohio-based financial services company, with assets of approximately $188 billion and a network spanning 15 states, reported a net income of $30 million, or $0.03 per diluted common share. This figure includes $209 million of after-tax expenses, or $0.22 per share, from items such as an FDIC special assessment, efficiency-related expenses, and a pension settlement charge.

Despite the charges, KeyCorp's underlying performance remained solid, with a stabilized net interest income and well-controlled expenses. The company's credit costs stayed low, and it continued to improve its capital position, ending the quarter with a Common Equity Tier 1 ratio of 10.0%. KeyCorp also exceeded its 2023 full-year balance sheet optimization goal by reducing risk-weighted assets by $14 billion.

Chairman and CEO Chris Gorman commented on the results, highlighting the company's resilience amidst a challenging year. He expressed confidence in KeyCorp's strategic actions positioning the company for profitable growth and value creation for stakeholders.

Underlying performance in the quarter was solid. Net interest income stabilized, expenses were well-controlled, credit costs remained low, and our capital position continued to improve. We also continued to invest in our differentiated fee-based businesses which we anticipate will gain traction as conditions improve in the capital markets. I am proud of the work and dedication of our teammates in executing on our strategic priorities and steadfastly serving our clients while navigating a turbulent year. In 2023, we grew relationship deposits, improved balance sheet resiliency, exceeded our goal of reducing risk-weighted assets, maintained expense discipline, and benefited from our de-risked loan portfolio and distinctive underwrite-to-distribute model. I am fully confident these actions will position Key to deliver sound, profitable growth, realize our earnings potential, and drive substantive value for all of our stakeholders in the years ahead."

KeyCorp's net interest margin (TE) for the quarter was 2.07%, a decrease from 2.73% in the same quarter of the previous year. The decline in net interest income and margin was attributed to the impact of higher interest rates, partially offset by a favorable earning asset mix. Noninterest income saw a decrease of 9.1% year-over-year, mainly due to lower investment banking and debt placement fees, as well as a decline in corporate services income.

Noninterest expenses rose significantly, driven by the aforementioned special charges. Personnel expenses also increased, primarily due to severance as part of efficiency-related expenses. The balance sheet reflected a decrease in average loans, consistent with KeyCorp's optimization efforts, while average deposits remained relatively stable.

KeyCorp's solid capital and credit quality metrics, along with its strategic balance sheet management, are crucial for the company's stability and future growth, especially in the banking industry where capital adequacy and asset quality are key indicators of financial health.

As KeyCorp navigates the complexities of the current economic environment, its focus on maintaining a strong capital position and optimizing its balance sheet is expected to support its ongoing efforts to deliver value to its clients and shareholders.

Explore the complete 8-K earnings release (here) from KeyCorp for further details.

This article first appeared on GuruFocus.