Keysight (KEYS) Solution Validates MediaTek 5G Modem Technology

Keysight Technologies, Inc. KEYS announced that it has successfully conducted 5G New Radio (NR) and 5G Red Cap (reduced capability) interoperability development testing (IODT) for MediaTek 5G modem technologies. Advanced 5G specifications were utilized under specific test conditions to verify the 5G communication link between base stations and devices. Keysight’s industry-leading 5G Network Emulation portfolio was leveraged during the process. This encompasses a wide array of 5G protocol testing solutions that support the entire device development cycle, from early chipset development and device integration to matching regulatory standards.

MediaTek 5G modem solution was evaluated for various capabilities, including bandwidth part definition, radio resource management, network control device synchronization, sounding reference signal and more. MediaTek is aiming to develop cutting-edge 5G modem platforms to accelerate the advancement of 5G NR and RedCap technology. This successful verification will enable manufacturers to conduct interoperability tests seamlessly prior to the commercial launch of their products.

RedCap is a lighter variant of the 5G standard. Devices powered by 5G RedCap offer greater affordability and energy efficiency compared to traditional 5G devices. The technology is designed for applications that have a certain throughput requirement, but ultra-low latency is not a necessary condition. The reduced capability 5G has a variety of use cases, such as wearables, industrial wireless sensors and video surveillance cameras. The IODT testing conducted by Keysight in collaboration with MediaTek is a vital step in enhancing the development of these applications.

Keysight 5G wireless test platform is optimized for protocol, radio frequency and functional testing. It enables 5G device innovators to swiftly obtain required certifications, including the 3GPP Release 17 standard, expediting their time to market.

The company is gaining traction with strong industry-wide growth. It is witnessing solid adoption of its electronic design and test solutions. Electronic devices form the fulcrum of IoT services, wireless devices, data centers and 5G technologies. The rapid adoption of these devices is increasing demand for electronics testing equipment.

Keysight boasts a robust 5G portfolio. Its 5G product design validation solutions, ranging from Layer 1 to 7, enable telecom and semiconductor companies to accelerate their 5G initiatives. Apart from strength in the 5G domain, the company is expected to benefit from the growing proliferation of electronic content in vehicles, momentum in space and satellite applications and rising adoption of driver-assistance systems globally.

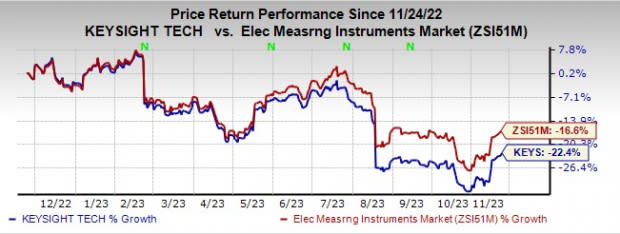

Shares of the company have declined 22.4% over the past year compared with the industry’s fall of 16.6%.

Image Source: Zacks Investment Research

Keysight currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Model N Inc MODN, sporting a Zacks Rank #1 (Strong Buy), delivered an earnings surprise of 20.78%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 3.33%. You can see the complete list of today’s Zacks #1 Rank stocks here.

MODN provides revenue management solutions for life sciences and technology companies, including applications for configuration, price, quote, rebate management and regulatory compliance.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered an earnings surprise of 18.99%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 19.64%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to artificial intelligence-based solutions that support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista delivered an earnings surprise of 12%, on average, in the trailing four quarters.

ANET holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gigabit high-performance switching products and is well-positioned for healthy growth in the data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report