Keysight Technologies Inc (KEYS) Reports Q1 2024 Earnings: Revenue and Profits Decline Amid ...

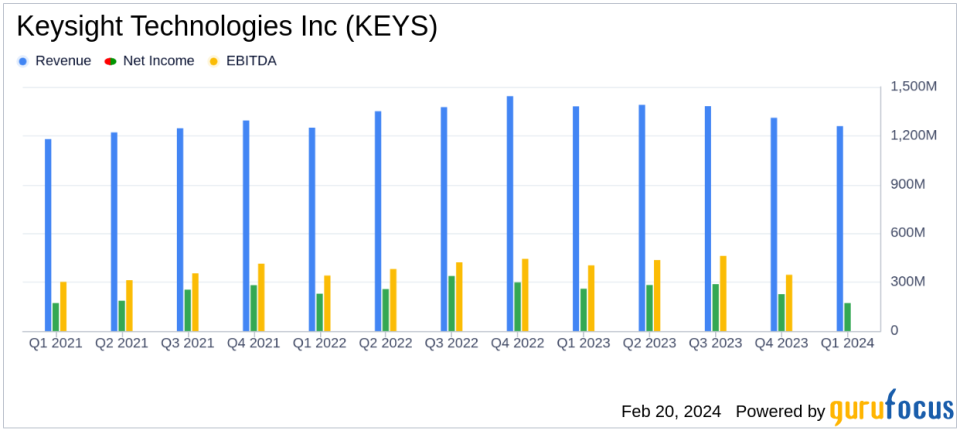

Revenue: $1.26 billion, a decrease from $1.38 billion in Q1 2023.

GAAP Net Income: $172 million, down from $260 million in Q1 2023.

Non-GAAP Net Income: $286 million, compared to $363 million in the prior year.

Earnings Per Share (EPS): GAAP EPS at $0.98, Non-GAAP EPS at $1.63.

Cash Flow: Operating cash flow of $328 million and free cash flow of $281 million.

Orders: Total orders of $1.22 billion, reflecting growth in aerospace, defense, and government solutions.

On February 20, 2024, Keysight Technologies Inc (NYSE:KEYS) released its 8-K filing, announcing financial results for the first fiscal quarter ended January 31, 2024. The company, a leader in electronic measurement and testing solutions, reported a revenue of $1.26 billion, a decrease from $1.38 billion in the same quarter of the previous year. GAAP net income also saw a decline, coming in at $172 million, or $0.98 per share, compared to $260 million, or $1.45 per share, in the first quarter of 2023.

Keysight's non-GAAP net income was $286 million, or $1.63 per share, a decrease from $363 million, or $2.02 per share, in the first quarter of 2023. The company's cash flow from operations was $328 million, with free cash flow of $281 million, both showing a slight decrease from the previous year's figures. Despite the constrained market conditions, Keysight's orders grew in specific sectors such as aerospace, defense, and government solutions, as well as AI-driven network and data center applications. The company also completed the acquisition of ESI, which is expected to contribute to its portfolio of electronic industrial solutions.

Segment Performance and Future Outlook

The Communications Solutions Group (CSG) reported revenue of $839 million, an 11 percent decrease from the previous year, primarily due to a decline in commercial communications. The Electronic Industrial Solutions Group (EISG) saw a 5 percent revenue decrease to $420 million, attributed to constraints in semiconductor and manufacturing-related customer spending, though partially offset by the addition of ESI.

Looking ahead, Keysight anticipates second fiscal quarter 2024 revenue to be in the range of $1.19 billion to $1.21 billion, with non-GAAP earnings per share expected to be between $1.34 and $1.40. These projections are based on a weighted diluted share count of approximately 175 million shares.

Financial Health and Investor Considerations

Keysight's balance sheet remains robust with cash and cash equivalents totaling $1.75 billion as of January 31, 2024. The company's financial health is further evidenced by its ability to generate strong cash flows even amidst a challenging demand environment. The completion of the ESI acquisition is a strategic move that could bolster Keysight's position in the electronic industrial solutions market.

For value investors, the company's disciplined execution and strategic acquisitions, coupled with its consistent cash flow generation, may present a compelling case for investment consideration. However, the current market challenges and the decline in revenue and net income highlight the importance of monitoring the company's performance and market conditions closely.

Keysight Technologies Inc (NYSE:KEYS) continues to navigate a complex market landscape, with its latest earnings report reflecting both the resilience and challenges faced by the company. As Keysight adapts to market demands and integrates its recent acquisition, investors and potential GuruFocus.com members will be watching closely to see how these factors influence the company's financial trajectory in the coming quarters.

Explore the complete 8-K earnings release (here) from Keysight Technologies Inc for further details.

This article first appeared on GuruFocus.