Keysight Technologies Inc's CEO Satish Dhanasekaran Sells Shares: An Insider Analysis

Keysight Technologies Inc (NYSE:KEYS), a prominent player in the electronic measurement industry, has recently witnessed a significant insider sell by its President and CEO, Satish Dhanasekaran. On December 6, 2023, Dhanasekaran sold 11,138 shares of the company, a move that has caught the attention of investors and market analysts alike. This transaction is part of a series of insider activities that can provide valuable insights into the company's financial health and future prospects.

Who is Satish Dhanasekaran?

Satish Dhanasekaran is the President and CEO of Keysight Technologies Inc, a company that specializes in electronic measurement instruments and software, and related services. Dhanasekaran has been with Keysight since its inception as a spin-off from Agilent Technologies in 2014. Under his leadership, Keysight has continued to innovate and expand its product offerings, catering to industries ranging from telecommunications to aerospace and defense.

Keysight Technologies Inc's Business Description

Keysight Technologies Inc is a global leader in electronic measurement solutions, serving the communications, aerospace/defense, industrial, and semiconductor markets. The company's products are integral to the design, test, manufacture, and optimization of electronic equipment and systems. Keysight's offerings include hardware and software products for benchtop, modular, and field instruments, as well as extensive services and support. The company's commitment to innovation and quality has positioned it as a key enabler of technological advancements in various sectors.

Analysis of Insider Buy/Sell and Relationship with Stock Price

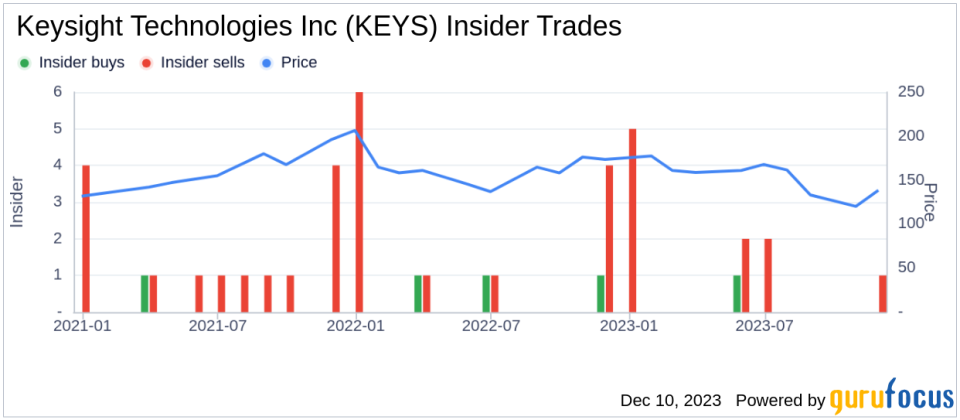

Insider transactions, particularly those executed by high-ranking executives, can be a strong indicator of a company's internal perspective on its stock's value. Over the past year, Satish Dhanasekaran has sold a total of 18,413 shares and has not made any purchases. This pattern of behavior could suggest that the insider may perceive the stock's current price as being relatively high or that they are diversifying their personal portfolio.

It is important to note that insider sells can occur for various reasons that may not necessarily reflect a lack of confidence in the company. These can include personal financial planning, tax considerations, or reaching liquidity events. However, when analyzing insider trends, the fact that there have been 8 insider sells compared to only 1 insider buy over the past year could signal a cautious stance from those with intimate knowledge of the company's workings.

On the day of the insider's recent sell, shares of Keysight Technologies Inc were trading at $140, giving the company a market cap of $25.2 billion. This valuation places the company in a strong position within the industry, yet the insider's decision to sell shares might lead some investors to question the stock's potential for short-term growth.

The price-earnings ratio of 24.38 is slightly higher than the industry median of 22.84 but lower than the company's historical median price-earnings ratio. This suggests that the stock is not overvalued compared to its peers and may still have room for growth based on historical standards.

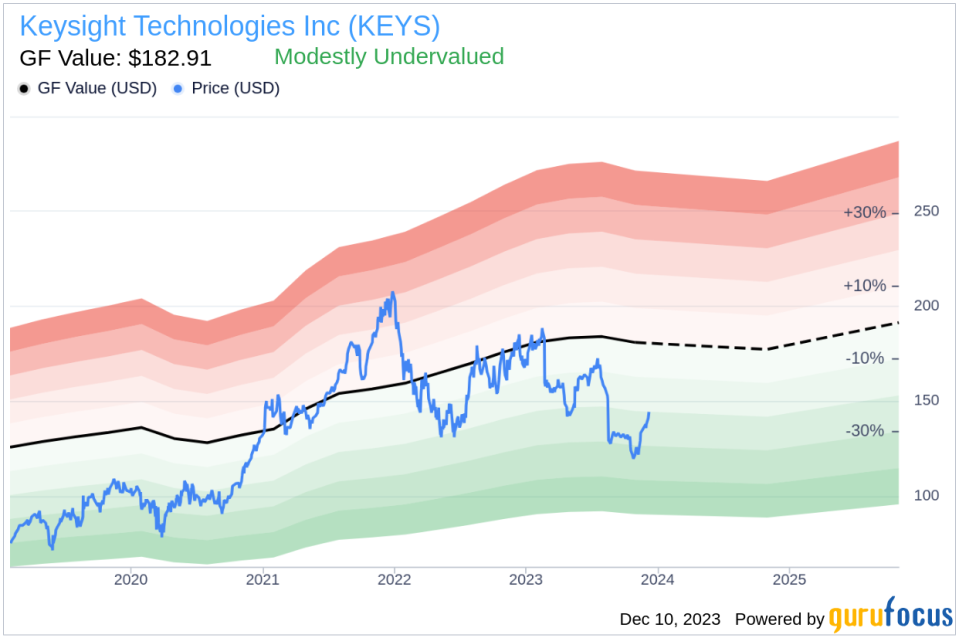

With a current price of $140 and a GuruFocus Value of $182.91, Keysight Technologies Inc has a price-to-GF-Value ratio of 0.77, indicating that the stock is modestly undervalued based on its GF Value. This intrinsic value estimate, which factors in historical multiples, a GuruFocus adjustment factor, and future business performance estimates, suggests that the stock may be an attractive buy for long-term investors.

The insider trend image above provides a visual representation of the recent insider transactions, which can be a useful tool for investors trying to interpret the significance of these sells.

The GF Value image further supports the notion that Keysight Technologies Inc's stock is currently undervalued, potentially offering a favorable entry point for value investors.

Conclusion

The recent insider sell by Satish Dhanasekaran, President and CEO of Keysight Technologies Inc, is a noteworthy event that warrants attention from the investment community. While the insider has sold a considerable number of shares over the past year, the company's strong market cap, reasonable price-earnings ratio, and undervalued GF Value ratio suggest that Keysight Technologies Inc remains a solid company with potential for growth. Investors should consider the context of insider transactions and the company's overall financial health when making investment decisions. As always, a diversified portfolio and thorough research are key to successful investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.