Kezar (KZR) Falls 10% on Strategic Update, Reduces Workforce

Kezar Life Sciences, Inc. KZR, an early-to-mid clinical-stage company, announced initiating a strategic restructuring program to focus on its clinical-stage studies, which is expected to fuel long-term growth.

The company currently has two clinical-stage candidates in its pipeline, zetomipzomib (KZR-616) and KZR-261. Zetomipzomib is currently being evaluated in two separate mid-stage studies, PALIZADE and PORTOLA, to treat lupus nephritis (LN) and autoimmune hepatitis, respectively. KZR-261, on the other hand, is being evaluated in an early-stage study to treat advanced or metastatic solid tumors.

The objective of Kezar’s reprioritization efforts is to extend operating capital to fund the phase IIb PALIZADE study of zetomipzomib in LN.

However, the stock of the company declined about 9.6% on Tuesday due to Kezar’s decision to pause all other research and drug discovery activities. This seemingly radical decision puts extra burden on KZR’s ongoing clinical studies.

Kezar will explore strategic partnering alternatives for its protein secretion platform and preclinical programs. The company also announced its decision to reduce its workforce by approximately 41% to optimize capital allocation and align with strategic priorities.

Furthermore, to conserve cash resources, Kezar expects to reduce the number of planned expansion cohorts in its phase I study, KZR-261, in solid tumors, which could reduce the accuracy of results from the study. The company will continue to evaluate the safety and biologic activity of treatment with KZR-261 in the ongoing study.

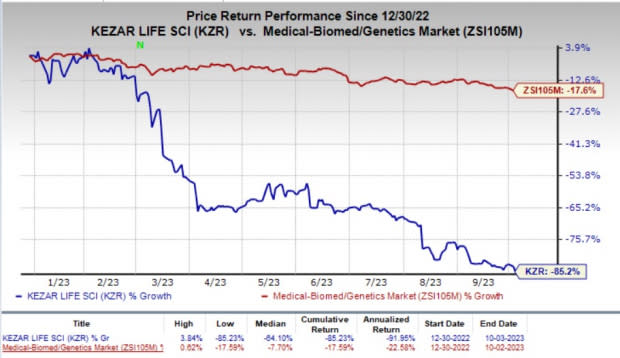

Year to date, shares of KZR have plummeted 85.2% compared with the industry’s 17.6% fall.

Image Source: Zacks Investment Research

Kezar expects all these cost-saving measures, by prioritizing the PALIZADE study of zetomipzomib in LN, to extend its cash runway into late 2026. Such measures are also expected to focus the company’s resources to achieve important clinical data readouts for KZR-616 and KZR-261 in their respective indications.

Top-line data from the phase I study of KZR-261 in solid tumors is anticipated in 2024, while those from KZR’s PORTOLA and PALIZADE studies of zetomipzomib are expected in mid-2025 and mid-2026, respectively.

In the same press release, Kezar also announced a few changes in its management. Most notably, John Fowler will be stepping down from the role of chief executive officer (CEO), effective Nov 7, 2023. Fowler will continue to be a member of the company’s board of directors. This could have also contributed to the fall of the stock price in the last trading session.

Christopher Kirk has been appointed as the new CEO of Kezar. Kirk is a co-founder and member of the board of directors of KZR and has previously served as the company’s president and chief scientific officer from March 2015 to April 2023.

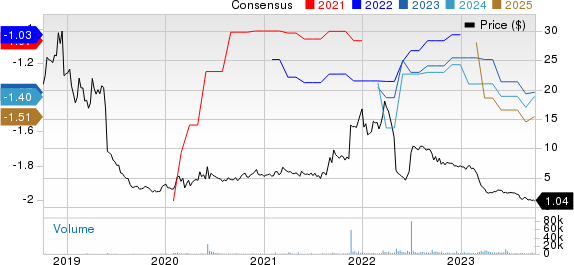

Kezar Life Sciences, Inc. Price and Consensus

Kezar Life Sciences, Inc. price-consensus-chart | Kezar Life Sciences, Inc. Quote

Zacks Rank and Stocks to Consider

Kezar currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall medical sector are Corcept Therapeutics CORT, Annovis Bio ANVS and Better Therapeutics BTTX, each carrying a Zacks Rank #2 (Buy) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 30 days, the Zacks Consensus Estimate for Corcept’s 2023 earnings per share has remained constant at 78 cents. During the same period, the estimate for Corcept’s 2024 earnings per share has also remained constant at 83 cents. Year to date, shares of CORT have gained 28.8%.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2023 loss per share has remained constant at $4.38. During the same period, the estimate for Annovis’ 2024 loss per share has also remained constant at $2.77. Year to date, shares of ANVS have lost 33.8%.

ANVS’ earnings beat estimates in three of the trailing four quarters and missed the mark on one occasion, delivering an average surprise of 13.40%.

In the past 30 days, the Zacks Consensus Estimate for Better Therapeutics’ 2023 loss per share has remained constant at 98 cents. During the same period, Better Therapeutics’ 2024 loss per share has also remained constant at 80 cents. Year to date, shares of BTTX have lost 68.4%.

BTTX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 24.22%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Kezar Life Sciences, Inc. (KZR) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Better Therapeutics, Inc. (BTTX) : Free Stock Analysis Report