Kicking Around Preliminary Earnings Trends in the Consumer Space

Never bet against the American consumer. That's what so many pundits say, and the December Retail Sales report put out by the US Census Bureau last Wednesday underscored strength in spending to wrap up 2023.[1] Both the headline figure and the "control group," which backs out some volatile categories, came in well above economists' estimates.[2] Later that morning, the National Retail Federation (NRF) confirmed that shoppers were indeed out and about during Q4 total holiday spending growth verified at +3.8% compared to 2022,[3] though that was within the NRF's forecast range from early November.[4]

Smaller Savings, Positive Real Wage Growth

So, all's well on the demand front, right? Well, not so fast. We are still a few weeks from hearing how the world's biggest and most important retailers performed around the holidays. It's reasonable to assert, however, that the bar has been raised in light of these new data points. While pandemic-related excess savings continues to dwindle, workers are earning positive real wages, perhaps to the tune of 1%-plus in 2024 if some forecasters are correct. That would be a significant tailwind for discretionary apparel and merchandise companies. Shares of said firms generally rallied over the final two months of last year. 2024 has been a tougher slog, though, as evidenced by a nearly 10% decline in the SPDR S&P Retail ETF (XRT) since a peak right after Santa's big scene.[5]

But are there clues we can glean from some of the smaller domestic retailers? Our team spotted three preliminary earnings reports that paint a mixed picture as to the state of household spending.

Boot Barn: Mixed Guidance Update, Earnings on Tap

Back on January 5, Boot Barn (NYSE:BOOT), a $2.2 billion market cap company in the Apparel Retail industry within the Consumer Discretionary sector, jumped following the release of an early read on its Q3 net income per diluted share. Its management team now expects the profit figure to come in ahead of its previous guidance range of $1.67 to $1.79, though the firm sees Q3 2024 net sales of $520.[4] million, below analysts' estimates. Overall, quarterly same-store sales are forecast to drop 9.7%, according to the company press release ahead of the ICR Conference earlier this month.[6]

BOOT has taken it on the chin since the stock notched a multi-month high above $100 last August. With shares now about 30% lower, investors hope that continued decent consumer spending in 2024 can lift both profits and the stock. We will find out more when the final Q3 numbers cross the wires on Wednesday, January 31 AMC.

BOOT 1-Year Stock Price History: Bears Kicking Shares Down Since August

Source: Stockcharts.com

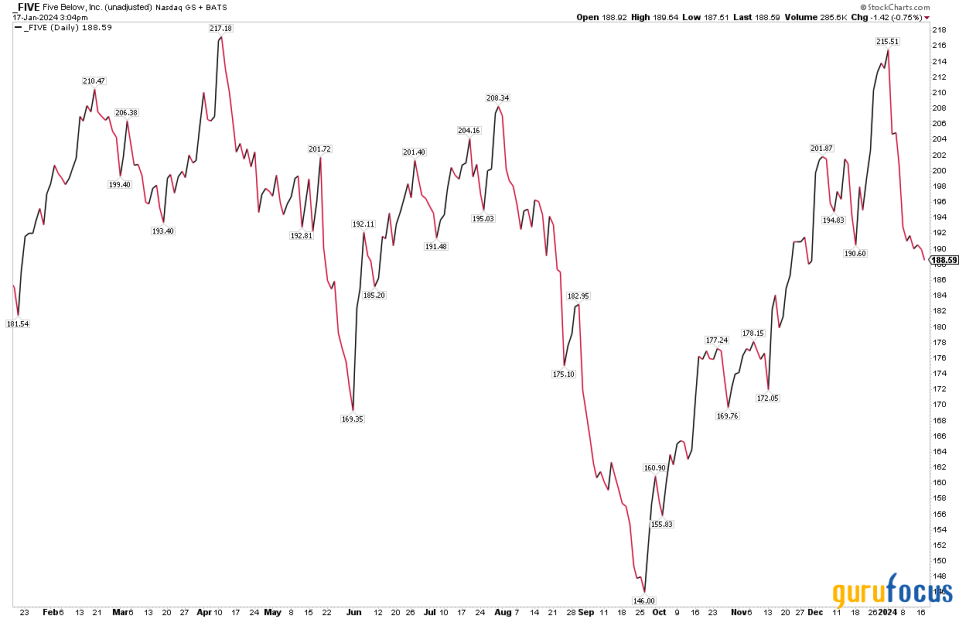

Five Below: Upbeat Earnings Outlook, Favorable CEO Comments

Just a few days later, another retail-related firm issued preliminary earnings. Five Below (NASDAQ:FIVE) has emerged as a household name for bargain-hunting shoppers. The $10.5 billion market cap Specialty Retailer, known for offering novelty products and practical knickknacks, also presented operational updates at the January ICR Conference. Its management team said it expects Q4 and full-year 2023 results within its previously given guidance ranges. Net sales are estimated to be in the upper half of guidance with comp-store sales growth near 3%. Shares didn't catch much of a bid despite CEO Joel Anderson citing broad-based strength across segments.[7]

We'll have to be patient regarding the full Q4 2023 profit report FIVE's next reporting date is unconfirmed to take place on Wednesday, March 13 AMC. An analyst at Craig-Hallum was skeptical about what the general merchandise company could deliver in a note last month due to, among other factors, supply chain issues, inventory shrink, and inflation.[8]

FIVE 1-Year Stock Price History: A 2024 Pullback Following a Q4 Rally

Source: Stockcharts.com

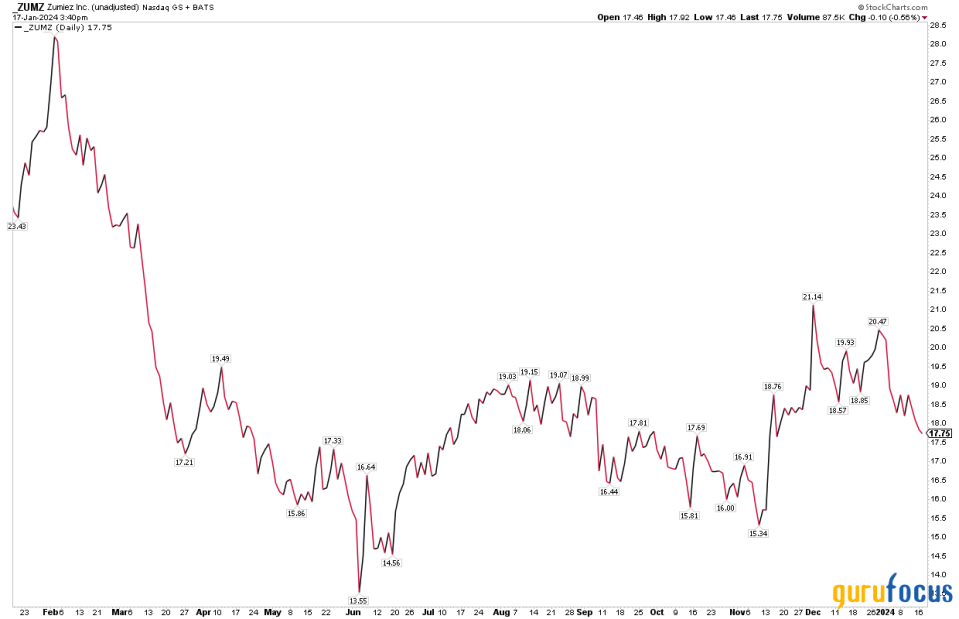

Zumiez (NASDAQ:ZUMZ): Lower EPS Outlook

Finally, let's turn to the volatile small-cap space. Zumiez (NASDAQ:ZUMZ), a $354 million market cap Apparel Retail industry firm based in Washington state caters to young folks. The company announced in an interim report that net sales declined 4.4% for the 9 weeks ending December 30, 2023, on a year-over-year basis. Comp-store sales dipped 5.9% during the same stretch with particular weakness in its North America segment. ZUMZ now anticipates Q4 23 revenue to come in at the low end of its guidance range, and the same goes for its quarterly EPS, now expected to be $0.24 to $0.34.[9]

The next volatility catalyst may come about on March 7, 2024, when the firm reports Q4 results along with same-store sales numbers for that quarter.

ZUMZ 1-Year Stock Price History: Struggling Following a Weak January Preliminary Earnings Announcement

Source: Stockcharts.com

The Bottom Line

Consumer spending trends appear healthy as the new year is well underway. Retailers' Q4 earnings reports are still a few weeks down the line, but can we scoop up breadcrumbs being left by small-firm executives? That may be parsing the data quite a bit, but stock prices among domestic consumer companies have been unimpressive lately despite robust macro spending trends. Keep your eye out for additional preliminary profit updates that could offer additional clues.

1 Advance Monthly Sales for Retail and Food Services, United States Census, January 17, 2024, https://www.census.gov2 U.S. Retail Sales, Trading Economics, January 19, 2024, https://tradingeconomics.com3 Strong US holiday sales in 2023 underline consumer resilience, Yahoo Finance, Reuters, January 17, 2024, https://finance.yahoo.com4 2023 Holiday to Reach Record Spending Levels, National Retail Federation, November 2, 2023, https://nrf.com5 XRT SDPR S&P Retail ETF, StockCharts, January 19, 2024, https://schrts.co/xevTaBNz6 Boot Barn Holdings, Inc. Announces Preliminary Third Quarter Results and Participation in the 2024 ICR Conference, Boot Barn Holdings, Inc., January 5, 2024, https://investor.bootbarn.com7 Five Below, Inc. Announces Holiday Sales Results for Quarter-To-Date Through January 6, 2024, Five Below, Inc., January 8, 2024, https://investor.fivebelow.com8 Fewer shopping days next holiday season nets Five Below a downgrade - analyst, Seeking Alpha, Amy Thielen, January 16, 2024, https://seekingalpha.com9 Zumiez Inc. Reports Holiday 2023 Sales Results, Zumiez Inc., January 8, 2024, https://ir.zumiez.com

Copyright 2024 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon's prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

This article first appeared on GuruFocus.