Kimball Electronics Inc (KE) Faces Headwinds as Q2 Sales Dip, Margins Hold Steady

Net Sales: $421.2 million, a 4% decrease year-over-year.

Operating Income: $16.6 million, representing 3.9% of net sales.

Net Income: $8.3 million, or $0.33 per diluted share.

Adjusted Operating Income: $17.1 million, or 4.1% of net sales.

Capital Expenditures: $13.2 million, with unchanged guidance for fiscal 2024.

Cash and Cash Equivalents: $39.9 million at the end of Q2.

Updated Guidance: Net sales expected to decline 2% to 4% for fiscal 2024.

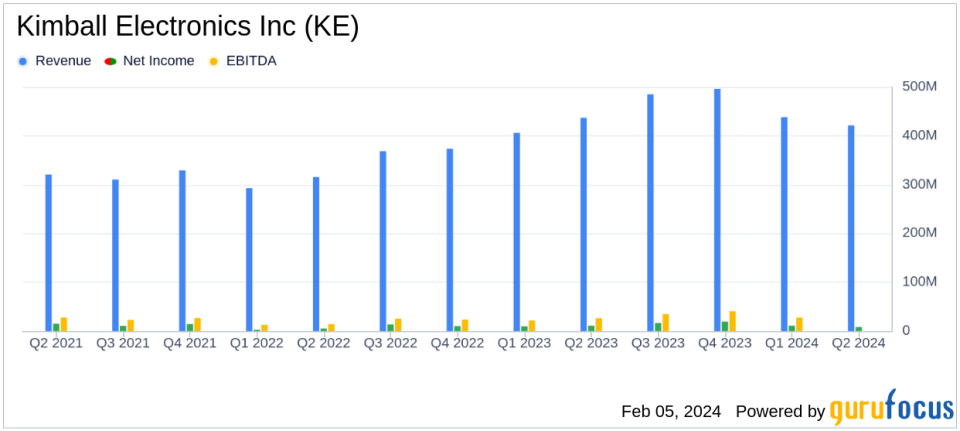

On February 5, 2024, Kimball Electronics Inc (NASDAQ:KE) released its 8-K filing, detailing the financial outcomes for the second quarter of fiscal 2024. The company, a prominent contract electronic manufacturing services provider, reported a 4% decrease in net sales compared to the same quarter of the previous fiscal year, with net sales totaling $421.2 million. Despite the sales decline, Kimball Electronics managed to maintain stable margins, with operating income at $16.6 million, or 3.9% of net sales.

Performance Amidst Challenges

Kimball Electronics, which specializes in durable electronics for various sectors including automotive, medical, and industrial, faced a challenging operating environment in Q2. CEO Richard D. Phillips cited global macro headwinds and a pullback in consumer spending as primary factors affecting the company's performance. The company's automotive segment, which includes electronic power steering and automated driver assist systems, saw a slight 2% decrease in sales, while the medical and industrial segments experienced more significant declines of 14% and an increase of 7%, respectively.

Despite these challenges, the company's proactive measures to align costs with slowing sales have helped maintain stable margins. The adjusted operating income stood at $17.1 million, or 4.1% of net sales, which is consistent with the same period last year. This demonstrates the company's resilience and ability to manage costs effectively in a difficult market.

Financial Highlights and Updated Guidance

Kimball Electronics' financial achievements in the face of industry-wide pressures are noteworthy. The company ended the quarter with $39.9 million in cash and cash equivalents, and a total borrowing capacity of $65.8 million available. However, the company used $30.7 million in cash from operating activities during the quarter and invested $13.2 million in capital expenditures, reflecting its commitment to long-term growth despite the current economic climate.

For fiscal 2024, Kimball Electronics has updated its guidance, expecting net sales to decline by 2% to 4% compared to fiscal year 2023. Operating income is projected to be between 4.2% to 4.6% of net sales. The company's capital expenditure guidance remains unchanged, with an anticipated range of $70 to $80 million.

"It is important to highlight that our second quarter results included an atypical charge in selling and administrative expenses. We recorded a $2 million allowance for credit losses associated with a customer who is not in bankruptcy, but their ability to pay an outstanding balance was deemed questionable. This item negatively impacted our operating income by approximately 40 basis points in the quarter," stated Jana T. Croom, Chief Financial Officer.

Ms. Croom also emphasized the company's focus on working capital management, indicating an opportunity to improve cash conversion days through better management of receivables and payables, which will support a return to free cash flow generation in future quarters.

Conclusion

Kimball Electronics Inc (NASDAQ:KE) continues to navigate through a turbulent macroeconomic landscape, with its Q2 results reflecting the impacts of global challenges. The company's ability to maintain stable margins despite a sales decline is a testament to its strategic cost management and operational efficiency. With updated guidance for fiscal 2024 and a strong focus on capital allocation and customer relationships, Kimball Electronics remains committed to its long-term growth trajectory. Investors and stakeholders will be watching closely to see how the company adapts to the evolving market conditions in the coming months.

For more detailed information and to participate in the upcoming conference call on February 6, 2024, please visit Kimball Electronics' investor relations page.

Explore the complete 8-K earnings release (here) from Kimball Electronics Inc for further details.

This article first appeared on GuruFocus.