Kimbell Royalty Partners LP Reports Record Fourth Quarter and Full Year 2023 Results

Record Production: Q4 run-rate daily production reached 24,332 Boe/d, surpassing guidance and marking a 3.4% increase from Q3 2023.

Financial Strength: Net Debt to Trailing Twelve Month Consolidated Adjusted EBITDA stood at a conservative 1.0x.

Cash Distribution: Announced Q4 2023 cash distribution of $0.43 per common unit.

Acquisition Impact: Largest acquisition to date in 2023, significantly accretive to distributable cash flow.

Reserve Growth: Year-over-year increase of 41% in proved developed reserves, now exceeding 65 MMBoe.

Operational Efficiency: Superior five-year average PDP decline rate of 14% requires only an estimated 5.8 net wells annually to maintain flat production.

On February 21, 2024, Kimbell Royalty Partners LP (NYSE:KRP) released its 8-K filing, announcing a record-setting fourth quarter and full year for 2023. The company, a leading owner of oil and natural gas mineral and royalty interests across the United States, reported a run-rate daily production of 24,332 barrels of oil equivalent per day (Boe/d) for Q4, which exceeded the high end of their guidance and represented an organic growth of 3.4% from Q3 2023.

Kimbell's financial position remains robust, with an increase in the borrowing base on its secured revolving credit facility to $550 million and a conservative balance sheet showcasing a net debt to trailing twelve-month consolidated Adjusted EBITDA of 1.0x. The company also announced a Q4 2023 cash distribution of $0.43 per common unit, maintaining its strategy of paying out 75% of cash available for distribution and using the remaining 25% to pay down debt.

Chairman and CEO Robert Ravnaas highlighted the year's achievements, including the company's largest acquisition to date, which bolstered the Permian as the leading basin for the company in terms of production and active rig count. Ravnaas also noted the company's significant organic growth in Q4 2023 due to high-interest wells coming online, particularly in the Permian and Haynesville regions.

We expect to continue this operational momentum as we progress through 2024 given that our rig count remains near record highs with 98 rigs actively drilling in the U.S.," said Ravnaas.

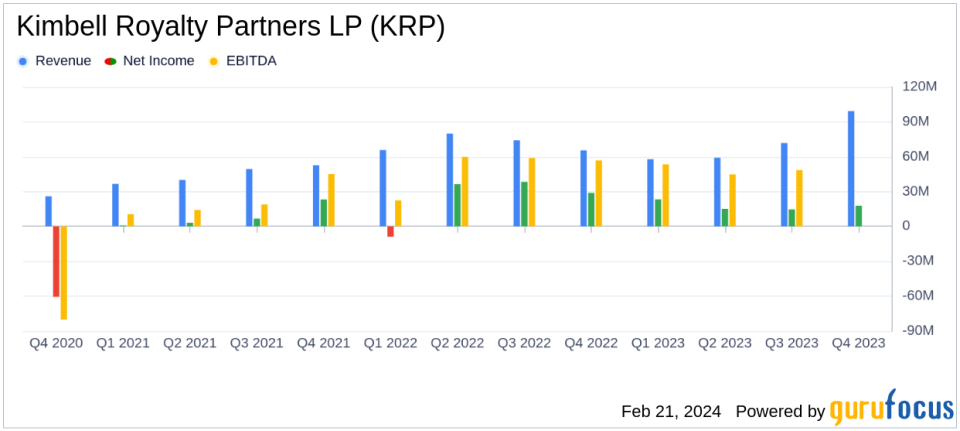

Kimbell's financial highlights for the fourth quarter of 2023 include total revenues of $99.2 million, net income of approximately $17.8 million, and net income attributable to common units of approximately $9.8 million, or $0.14 per common unit. The company also recorded a non-cash ceiling test impairment expense of $18.2 million during the quarter, primarily related to the decline in commodity prices.

On the operational front, Kimbell's major properties had 807 gross (4.55 net) drilled but uncompleted wells (DUCs) and 727 gross (3.83 net) permitted locations as of December 31, 2023. The company's reserves also saw significant growth, with proved developed reserves increasing by approximately 41% year-over-year to over 65 million Boe, reflecting both acquisitions and continued development.

Kimbell's guidance for 2024 anticipates net production between 22.5 and 25.5 Mboe/d, with a payout ratio of 75% for its projected cash available for distribution. The company plans to continue using the remaining 25% to pay down debt under its secured revolving credit facility.

For detailed financial information, readers can refer to the condensed consolidated balance sheet and statements of operations provided in the earnings release. Kimbell Royalty Partners LP remains a significant player in the oil and gas sector, with a clear strategy for growth and value creation for its unitholders.

Explore the complete 8-K earnings release (here) from Kimbell Royalty Partners LP for further details.

This article first appeared on GuruFocus.