Kimberly-Clark (KMB) is Poised on Growth Efforts, FORCE Program

Kimberly-Clark Corporation KMB is committed to driving innovation across its product range to guarantee the delivery of an exceptional value proposition to consumers. Also, increasing market share is the primary focus of the company. Importantly, its pricing and cost-saving initiatives have proven effective in navigating cost inflation challenges.

Incidentally, Kimberly-Clark has been battling high input costs for the past few quarters. The company’s gross margin was partly affected by increased input costs of $30 million in the second quarter of 2023. Management expects input costs to create a headwind of $100 million in 2023.

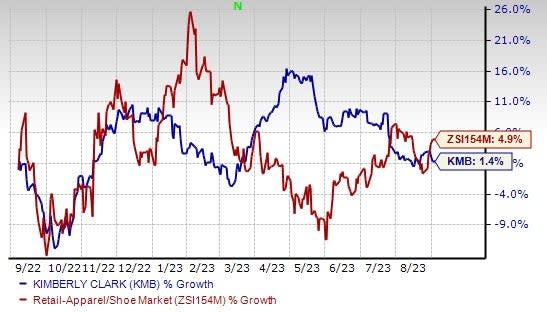

Image Source: Zacks Investment Research

What’s Working Well for KMB?

Kimberly-Clark has been steadfast in its commitment to three key strategic growth pillars, which encompass dedication to enhancing its core business in the developed markets, accelerating growth of its Personal Care segment in the developing and emerging markets, and bolstering its digital and e-commerce capabilities.

The company aims to achieve these objectives through product development across various categories, and harnessing its strengths in marketing and sales. Progress in these areas has not only contributed to portfolio enhancement but has also expanded the company's global presence.

Kimberly-Clark is committed to cost reduction and enhancing supply-chain productivity through the FORCE Program, which has consistently delivered significant cost savings and driven overall performance. In the second quarter of 2023, the company achieved savings of $80 million from the FORCE program. The company is focused on implementing revenue-management strategies to counteract the challenges posed by cost inflation.

KMB has been actively bolstering investments in specific capabilities. This ongoing commitment is driving the focus on revenue growth management and advancing the digital agenda, which encompasses upgrades to select systems, such as the migration to S4 HANA, and the strategic development of various other capabilities across the enterprise on a multi-year basis.

The company’s focus on key commercial sectors, effective digital engagement and innovation in sustainability are fueling the momentum in the K-C Professional segment. Segmental sales advanced 11% to $887 million and boasted 13% organic growth in the second quarter of 2023. Growth was observed across all regions. It is noteworthy that North America saw a positive volume trend following six consecutive quarters of a decline.

Wrapping Up

On its last earnings call, management raised the 2023 earnings per share (EPS) and operating profit outlook. The company envisions 2023 adjusted EPS to increase 10-14% from the adjusted EPS reported in 2022. Earlier, it was anticipated to rise 6-10%.

Management expects the operating margin to grow 150 basis points (bps) compared with an increase of 130 basis points (bps) stated earlier. It anticipates 2023 net sales between flat and 2% growth, while organic sales are projected to increase 3-5%. Earlier, organic sales were anticipated to increase 2-4%.

Shares of this Zacks Rank #3 (Hold) company have risen 1.4% in the past year as compared with the industry’s growth of 4.9%.

3 Picks You Can’t Miss Out On

Here we have highlighted three better-ranked stocks, namely Ollie's Bargain Outlet Holdings OLLI, Grocery Outlet GO and Celsius Holdings CELH.

Ollie's Bargain Outlet is a value retailer of brand-name merchandise at drastically reduced prices. It currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 26.9%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ollie's Bargain Outlet’s current fiscal-year sales and earnings suggests growth of 12.7% and 64.8%, respectively, from the year-ago reported numbers. OLLI has a trailing four-quarter earnings surprise of 1.3%, on average.

Grocery Outlet, the extreme value retailer of quality, name-brand consumables and fresh products, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 12.3%.

The Zacks Consensus Estimate for Grocery Outlet’s current financial-year sales and earnings suggests growth of 11.2% and 3.9%, respectively, from the year-ago reported numbers. GO has a trailing four-quarter earnings surprise of 14.3%, on average.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 88.9% and 168.8%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report