Kimberly-Clark (KMB) Ups View on Q2 Earnings & Sales Beat

Kimberly-Clark Corporation KMB came out with robust second-quarter 2023 results, with both the top and bottom lines beating the Zacks Consensus Estimate and increasing year over year. Results continued to gain from revenue growth management efforts.

Management raised its organic sales, operating margin and adjusted EPS growth targets for 2023 while keeping the net sales growth guidance unchanged. Further, the company’s enhanced gross margin places it well to make investments in premium brand value proposals (such as innovation). This is likely to help Kimberly-Clark increase market share over time.

During the quarter, Kimberly-Clark concluded the divestiture of its Brazil tissue assets (in June).

Quarter in Detail

Adjusted earnings came in at $1.65 per share, which surpassed the Zacks Consensus Estimate of $1.48. The bottom line rose 23% year over year, mainly due to increased adjusted operating profit, together with equity income gains and reduced income taxes.

Kimberly-Clark Corporation Price, Consensus and EPS Surprise

Kimberly-Clark Corporation price-consensus-eps-surprise-chart | Kimberly-Clark Corporation Quote

Kimberly-Clark’s sales totaled $5,134 million, beating the consensus estimate of $5,112 million. The metric increased 1% compared with the year-ago period’s figure.

Organic sales increased 5%, with 9% growth in price and a favorable product mix stemming from ongoing revenue growth management programs. These were offset by a 3% decline in volumes. Unfavorable foreign currency rates affected sales by nearly 4%.

In North America, organic sales rose 6% year over year, which included 1% growth in Personal Care, a 7% increase in Consumer Tissue and a 17% improvement in K-C Professional. Outside North America, organic sales rose 6% in developing and emerging markets while increasing 4% in developed markets (Australia, South Korea and Western/Central Europe).

The adjusted gross margin expanded 380 basis points (bps) to 34% compared with our estimate of 31%. The upside can be attributed to increased net revenue realization and cost savings. This was partially countered by increased input costs to the tune of $30 million.

The adjusted operating profit grew 17% on a greater gross profit, including $80 million of FORCE (Focus on Reducing Costs Everywhere) savings. These were offset by marketing, research and general expenses. Adverse currency fluctuations hurt the operating profit by $100 million.

Kimberly-Clark’s adjusted operating margin came in at 14.2%, up 190 bps compared with the year-ago quarter’s figure. Our estimate for the adjusted operating margin stood at 12.8%.

Image Source: Zacks Investment Research

Segment Details

Personal Care: Segment sales of $2,685 million decreased 1% year over year, while it surpassed our estimate of $2,611.9 million. Organic sales rose 4% on a favorable price and mix, somewhat offset by reduced volumes. Management highlighted that robust revenue growth management and commercial execution led to positive trends in net revenue realization.

Consumer Tissue: Segment sales of $1,549 million rose 1% year over year compared with our estimate of $1,555 million. Impressive revenue growth management and enhanced service levels led to sales growth. Organic sales increased 4% on favorable pricing. This was somewhat offset by drab volumes.

K-C Professional: Segment sales advanced 11% to $887 million in comparison with our estimate of $819.2 million. Organic sales jumped 13% on a favorable price and mix. These were somewhat offset by lower volumes. The company witnessed growth across key categories and regions, especially North America.

Other Financial Updates

Kimberly-Clark ended the quarter with cash and cash equivalents of $580 million, long-term debt of $7,947 million and total stockholders’ equity of $651 million. KMB generated cash from operations of $1,400 million during the six months ended Jun 30.

Management incurred capital spending of $389 million in the same time frame.

Kimberly-Clark concluded its share repurchases of 485,000 for $65 million in the first half of 2023. Management projected share buybacks in the band of $100-$150 million for 2023.

Guidance

Organic sales are projected to increase 3-5% now, up from the earlier view of 2-4% growth.

Management still anticipates net sales growth in 2023 in the range of flat to 2%. Unfavorable foreign currency exchange rates are likely to hurt net sales by 2%. Further, acquisition/divestitures are expected to hurt net sales by 1% in 2023.

Management expects operating profit to be affected by input costs to the tune of $100 million. Currency headwinds are likely to lower the 2023 operating profit by about $300 million to $400 million.

Kimberly-Clark envisions 2023 adjusted EPS to increase 6-10% from the adjusted EPS of 2022. Earlier, it was anticipated to increase in the range of 6-10%. The effective tax rate is likely to be in the band of 23-25%.

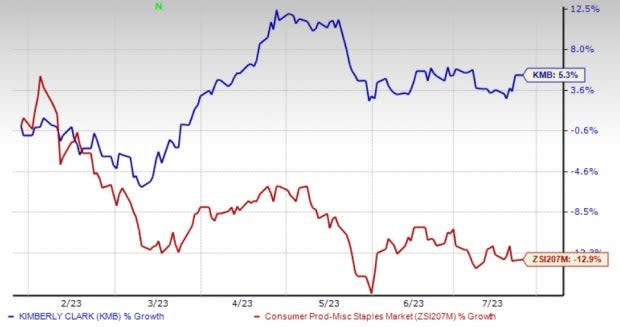

This Zacks Rank #2 (Buy) stock has risen 5.3% in the past six months against the industry’s 12.9% decline.

Other Solid Staple Stocks

Some other top-ranked consumer staple stocks are Energizer Holdings, Inc. ENR, TreeHouse Foods THS and Celsius Holdings CELH.

Energizer Holdings, which manufactures, markets and distributes household batteries, specialty batteries and lighting products, currently sports a Zacks Rank #1 (Strong Buy). ENR has a trailing four-quarter earnings surprise of 7.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Energizer Holdings’ current fiscal-year earnings suggests growth of about 2% from the year-ago reported numbers.

TreeHouse Foods, a food and beverage product company, currently sports a Zacks Rank #1. THS has a trailing four-quarter earnings surprise of 49.3%, on average.

The Zacks Consensus Estimate for TreeHouse Foods’ current fiscal-year earnings suggests growth of 120.1% from the year-ago reported figures.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 69.6% and 154.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

Energizer Holdings, Inc. (ENR) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report