Kimco (KIM) to Report Q2 Earnings: What's in the Offing?

Kimco Realty Corporation KIM is slated to report second-quarter 2023 results on Jul 27 before the opening bell. While the company’s quarterly results are likely to display year-over-year revenue growth, funds from operations (FFO) per share are expected to decline from the prior-year quarter’s reported figure.

In the last reported quarter, this Jericho, NY-based retail real estate investment trust (REIT) delivered an in-line performance in terms of FFO per share. Results reflected better-than-anticipated revenues.

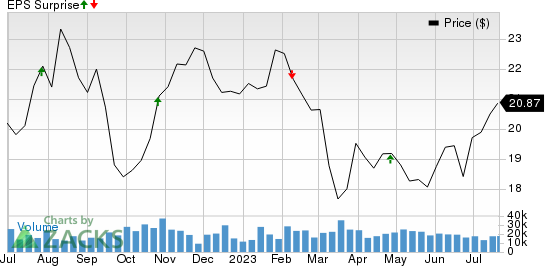

Over the preceding four quarters, Kimco’s FFO per share surpassed the Zacks Consensus Estimate on two occasions, met on another and missed the same once, the average beat being 1.96%. This is depicted in the graph below:

Kimco Realty Corporation Price and EPS Surprise

Kimco Realty Corporation price-eps-surprise | Kimco Realty Corporation Quote

Factors at Play

Per a Cushman & Wakefield CWK report, the U.S. retail real estate market has continued to exhibit remarkable strength in the second quarter of 2023, despite uncertainties in the economic outlook and notable bankruptcies.

The second quarter of 2023 witnessed a ninth consecutive quarter of positive net absorption in the retail market, totaling 7.1 million square feet (msf) nationally. The pace of absorption accelerated significantly compared to the first quarter, coming close to the average rate of the past year. New retail construction has remained subdued in the second quarter of 2023, with only 2 msf of space delivered nationwide.

The vacancy rate has dropped to 5.4% in the second quarter, down 60 basis points compared to the same period in 2022 and 80 basis points lower than the pre-pandemic rate. The limited new supply and robust demand have given landlords significant leverage in the market, leading to an increase in asking rents. On average, nationally, asking rents stood at $23.47 per square foot (psf) in the second quarter, representing a 4.7% year-over-year

increase from the previous year.

Kimco’s well-located and largely grocery-anchored portfolio, which offers essential goods and services, is anticipated to have benefited from the abovementioned factors. Its properties are in the drivable first-ring suburbs of its top major metropolitan Sunbelt and coastal markets, having several growth levers.

Amid growing consumers’ preference for in-person shopping experiences following the pandemic downtime, the demand for KIM’s properties is likely to have remained healthy, aiding occupancy levels and leasing activity in the quarter. Moreover, Kimco’s significant diversification with respect to geography and tenants is expected to have aided stable cash flows.

Kimco has been focusing on its mixed-use assets clustered in strong economic metropolitan statistical areas that serve the last mile. This segment is gaining from the recovery in the apartment and retail sectors. The company's strategic focus on a carefully curated selection of mixed-use projects, redevelopments and active investment management has been geared toward boosting its net asset value, a goal that appears to have yielded promising results. The company’s top line is expected to have improved due to these tailwinds.

The Zacks Consensus Estimate for KIM’s quarterly revenues stands at $435.08 million, calling for 1.84% growth from the prior-year reported number. The Zacks Consensus Estimate for revenues from the rental property is currently pegged at $434.94 million, up from $423.27 million in the year-ago period.

We expect same-property net operating income (NOI) to increase 1.5% year over year and leased occupancy of 95.9%, implying a slight uptick from the prior quarter.

Kimco’s robust balance sheet position is likely to have supported its strategic expansions to enhance its portfolio quality.

However, the economic slowdown amid macroeconomic uncertainty and higher e-commerce adoption might have cast a pall on Kimco’s performance in the to-be-reported quarter.

Also, a high interest rate environment adds to the company’s woes. We estimate a 12.6% year-over-year increase in interest expenses in the second quarter for Kimco.

Before the second-quarter earnings release, the company’s activities were not adequate to gain analysts’ confidence. The Zacks Consensus Estimate for the quarterly FFO per share has remained unchanged in the past month at 39 cents. Also, it suggests a year-over-year decline of 2.5%.

Here Is What Our Quantitative Model Predicts:

Our proven model does not conclusively predict a positive surprise in terms of FFO per share for Kimco this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an FFO beat. However, that’s not the case here.

Kimco currently carries a Zacks Rank #3 and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are two stocks from the retail REIT sector — Simon Property Group SPG and Acadia Realty Trust AKR — that you may want to consider as our model shows that these have the right combination of elements to report a surprise this quarter.

Simon Property Group is slated to report quarterly numbers on Aug 2. SPG has an Earnings ESP of +1.42% and carries a Zacks Rank of 3 presently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Acadia Realty Trust, scheduled to report quarterly numbers on Aug 1, has an Earnings ESP of +2.11% and carries a Zacks Rank of 3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Acadia Realty Trust (AKR) : Free Stock Analysis Report

Cushman & Wakefield PLC (CWK) : Free Stock Analysis Report