Kinder Morgan (KMI) Lags on Q3 Earnings, Revises Net Income View

Kinder Morgan, Inc. KMI reported third-quarter 2023 adjusted earnings per share of 25 cents, missing the Zacks Consensus Estimate by a penny. The bottom line is in line with the year-ago quarter’s earnings of 25 cents per share.

Total quarterly revenues of $3,907 million missed the Zacks Consensus Estimate of $4,253 million and also declined from $5,177 million in the prior-year quarter.

Lower-than-expected quarterly earnings were primarily driven by a decline in realized natural gas liquid price. The negatives were partially offset by higher gathering and transport volumes.

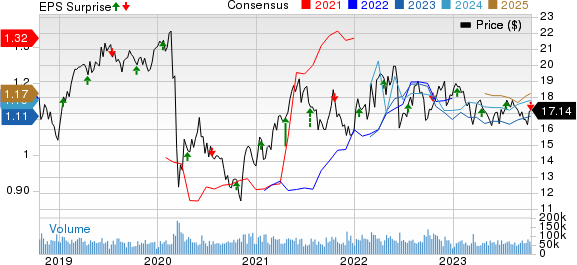

Kinder Morgan, Inc. Price, Consensus and EPS Surprise

Kinder Morgan, Inc. price-consensus-eps-surprise-chart | Kinder Morgan, Inc. Quote

Segmental Analysis

Natural Gas Pipelines: In the September-end quarter, adjusted earnings before depreciation, depletion and amortization expenses, including the amortization of the excess cost of equity investments (EBDA), rose to $1,199 million from $1,159 million a year ago. The reported figure is slightly below our estimated EBDA of $1,221.4 million for the business unit. Higher gathering and transport volumes primarily aided the segment.

Product Pipelines: The segment’s EBDA in the third quarter was $313 million, reflecting an increase from $257 million a year ago. The reported figure also beat our estimated figure of $249.8 million. Higher volumes of gasoline and jet fuel aided the segment.

Terminals: Through the segment, Kinder Morgan generated quarterly EBDA of $259 million, higher than the year-ago period’s number of $240 million and our estimate of $232.9 million. Increased average charter rates aided the outperformance.

CO2: The segment’s EBDA was $175 million, down from the year-ago quarter’s figure of $195 million and our estimate of $181.2 million. The underperformance was caused by a decline in realized natural gas liquids prices.

Operational Highlights

Expenses related to operations and maintenance totaled $738 million, up from $712 million a year ago and our estimate of $719 million. Total operating costs, expenses and other were down to $2,969 million from $4,246 million and our estimate of $3,470 million. Our estimate for total operating costs, expenses and other was higher since our projection for the cost of sales for third-quarter 2023 was considerably elevated on account of our higher expectations for revenues.

Distributable Cash Flow (DCF)

Kinder Morgan’s third-quarter DCF was $1,094 million compared with $1,122 million a year ago.

Balance Sheet

As of Sept 30, 2023, KMI reported $80 million in cash and cash equivalents. Its long-term debt amounted to $27,863 million at the quarter end.

Guidance

For 2023, Kinder Morgan reiterated its net income guidance of $2.5 billion. For this year, KMI expects DCF to be $4.8 billion. For 2023, the midstream energy player projects its dividend at $1.13 per share, suggesting a year-over-year increase of 2%.

Zacks Rank & Other Stocks to Consider

Kinder Morgan currently carries a Zacks Rank #2 (Buy).

Investors interested in the energy sector may look at some other top-ranked companies mentioned below. The three companies presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Matador Resources Company MTDR is among the leading oil and gas explorers in the shale and unconventional resources in the United States. MTDR’s prime priorities include lowering debt, delivering free cashflows and maintaining or increasing dividends.

Matador Resources has witnessed upward earnings estimate revisions for 2023 and 2024 in the past seven days. The consensus estimate for MTDR’s 2023 and 2024 earnings per share is pegged at $6.59 and $8.84, respectively.

SM Energy Company SM is an independent oil and gas company that explores, exploits, develops, acquires, and produces oil and gas in North America. SM's strong cash generation places it in a better financial position, allowing for investments in dividends, debt reduction and future growth.

SM Energy has witnessed upward earnings estimate revisions for 2023 in the past seven days. The consensus estimate for SM’s 2023 and 2024 earnings per share is pegged at $5.79 and $7.03, respectively.

APA Corporation APA boasts a large, geographically diversified reserve base with multi-year trends in reserve replacement. The company’s high-quality drilling inventory with greater resource potential should enable it to deliver competitive per-share growth.

APA Corp has witnessed upward earnings estimate revisions for 2023 and 2024 in the past seven days. The consensus estimate for APA’s 2023 and 2024 earnings per share is pegged at $4.72 and $6.52, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

APA Corporation (APA) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report