Kingsoft Cloud Holdings Ltd's Meteoric Rise: Unpacking the 52% Surge in Just 3 Months

Kingsoft Cloud Holdings Ltd (NASDAQ:KC), a leading independent cloud service provider in China, has seen a significant surge in its stock price over the past three months. The company's market cap stands at $1.37 billion, with its stock price currently at $5.85, marking a 52.30% increase from its price three months ago at $5.61. Over the past week alone, the stock has gained 13.40%. This impressive performance has caught the attention of investors and market analysts alike.

Understanding the GF Value

When assessing the valuation of Kingsoft Cloud Holdings Ltd, the GF Value is a crucial metric. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of Kingsoft Cloud Holdings Ltd is $7.15, indicating that the stock is modestly undervalued. This is a significant shift from three months ago when the GF Value was $27.29, suggesting a possible value trap.

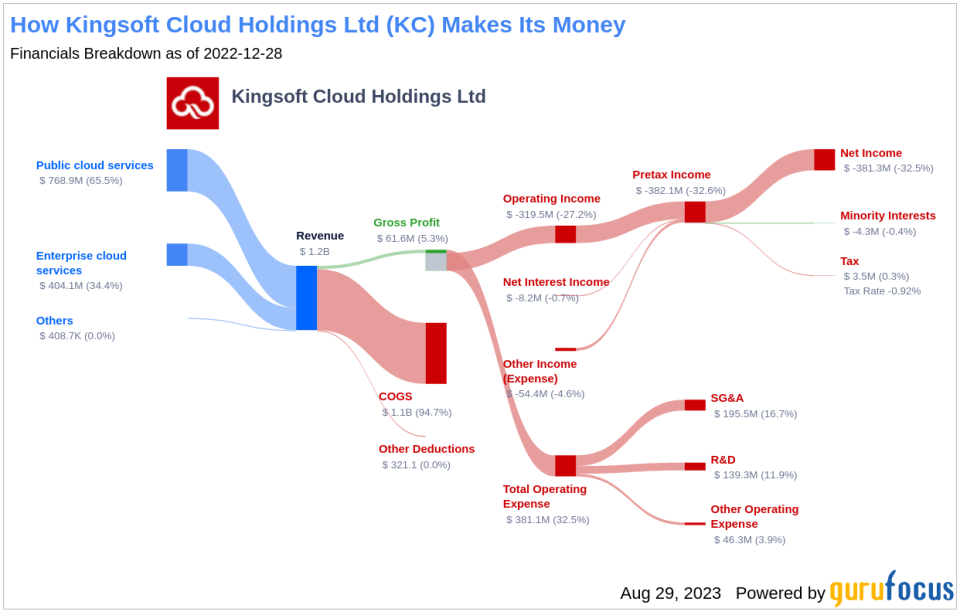

Profitability Analysis

Kingsoft Cloud Holdings Ltd's profitability rank is 3/10, indicating that the company's profitability is relatively low compared to other companies in the industry. The company's operating margin is -26.37%, which is better than 24.47% of companies in the same industry. The ROE and ROA are -26.97% and -13.62% respectively, while the ROIC stands at -21.61%. These figures suggest that the company has room for improvement in terms of profitability.

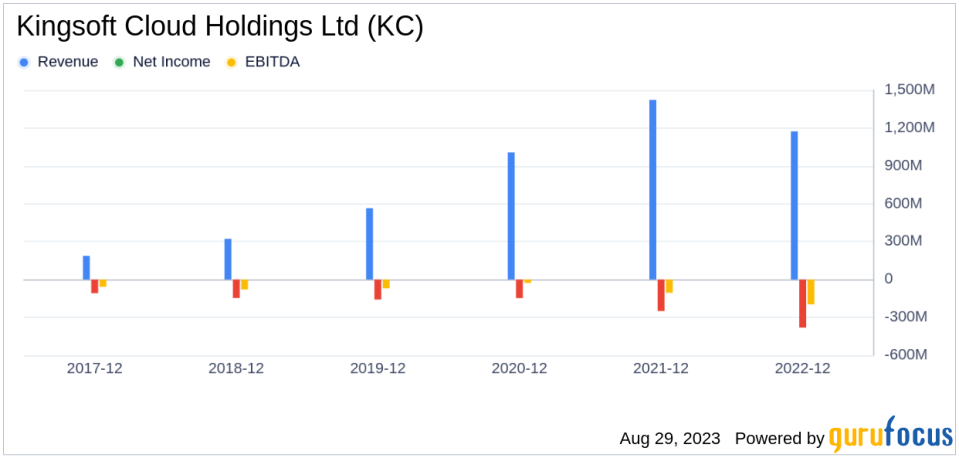

Growth Prospects

Despite the challenges in profitability, Kingsoft Cloud Holdings Ltd has demonstrated strong growth potential. The company's growth rank is 8/10, indicating a high growth rate compared to other companies in the industry. The 3-Year and 5-Year Revenue Growth Rate per Share are 28.00% and 45.60% respectively, outperforming 83.39% and 95.89% of companies in the same industry. The Total Revenue Growth Rate (Future 3Y To 5Y Est) is 6.29%, while the 3-Year and 5-Year EPS without NRI Growth Rate are -19.50% and -1.90% respectively.

Major Stock Holders

Among the major holders of Kingsoft Cloud Holdings Ltd's stock are Jim Simons (Trades, Portfolio) and Ray Dalio (Trades, Portfolio). Jim Simons (Trades, Portfolio) holds 1,023,600 shares, accounting for 0.44% of the company's stock, while Ray Dalio (Trades, Portfolio) holds 10,946 shares.

Competitive Landscape

Kingsoft Cloud Holdings Ltd operates in a competitive industry, with key competitors including Model N Inc(NYSE:MODN) with a stock market cap of $1.05 billion, Materialise NV(NASDAQ:MTLS) with a market cap of $401.087 million, and PDF Solutions Inc(NASDAQ:PDFS) with a market cap of $1.33 billion.

Conclusion

In conclusion, Kingsoft Cloud Holdings Ltd has demonstrated impressive stock performance over the past three months, with a significant surge in its stock price. Despite challenges in profitability, the company has shown strong growth potential, outperforming many companies in the industry. With major holders like Jim Simons (Trades, Portfolio) and Ray Dalio (Trades, Portfolio), and a competitive position in the industry, Kingsoft Cloud Holdings Ltd presents an interesting investment opportunity for those looking at the software industry.

This article first appeared on GuruFocus.