Kingsoft Cloud Holdings (NASDAQ:KC investor three-year losses grow to 78% as the stock sheds US$88m this past week

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Kingsoft Cloud Holdings Limited (NASDAQ:KC); the share price is down a whopping 78% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. More recently, the share price has dropped a further 35% in a month. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

After losing 7.1% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Kingsoft Cloud Holdings

Kingsoft Cloud Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, Kingsoft Cloud Holdings saw its revenue grow by 24% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 21% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

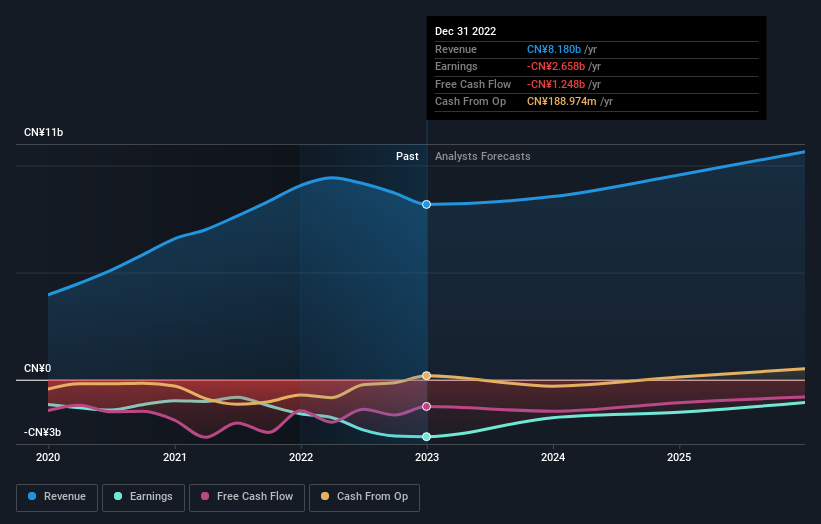

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Kingsoft Cloud Holdings is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's nice to see that Kingsoft Cloud Holdings shareholders have gained 44% (in total) over the last year. This recent result is much better than the 21% drop suffered by shareholders each year (on average) over the last three. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It's always interesting to track share price performance over the longer term. But to understand Kingsoft Cloud Holdings better, we need to consider many other factors. Even so, be aware that Kingsoft Cloud Holdings is showing 2 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here