Kinross' (KGC) Q3 Earnings and Revenues Outpace Estimates

Kinross Gold Corporation KGC reported third-quarter 2023 profit of $109.7 million or 9 cents per share compared with $65.9 million or 5 cents per share reported in the year-ago quarter.

Adjusted earnings per share in the third quarter was 12 cents compared with 5 cents in the prior-year quarter. It beat the Zacks Consensus Estimate of 10 cents.

Revenues rose around 28.7% year over year to $1,102.4 million, surpassing the Zacks Consensus Estimate of $964 million. The upside is attributable to an increase in gold equivalent ounces sold as well as higher average realized gold prices.

Kinross Gold Corporation Price, Consensus and EPS Surprise

Kinross Gold Corporation price-consensus-eps-surprise-chart | Kinross Gold Corporation Quote

Operational Performance

The company produced 585,449 gold equivalent ounces from continuing operations in the reported quarter, up 10.6% year over year. The reported figure was higher than our estimate of 556,092 gold equivalent ounces. Average realized gold prices were $1,929 per ounce in the quarter, up around 11.4% from the year-ago quarter’s figure. The reported figure was higher than our estimate of $1,846 per ounce.

The production cost of sales per gold equivalent ounce was $911, down around 3.2% from the prior-year quarter. The reported figure was lower than our estimate of $995. All-in-sustaining cost per gold equivalent ounce sold rose roughly 1.1% year over year to $1,296. The reported figure was lower than our estimate of $1,330.

Margin per gold equivalent ounce sold was $1,018 in the quarter, up 28.7% from the prior quarter’s level of $791.

Financial Review

Operating cash flow from continuing operations was $406.8 million in the third quarter of 2023 compared with $173.2 million in the prior-year quarter.

Free cash flow from continuing operations was $122.9 million against an outflow of $24.1 million in the prior-year quarter.

Outlook

Kinross remains on track to meet its production guidance of 2.1 million gold equivalent ounces (+/- 5%) and all-in-sustaining cost guidance for 2023. The company is tracking the bottom end of its 2023 production cost of sales guidance and the upper end of its capital expenditure guidance.

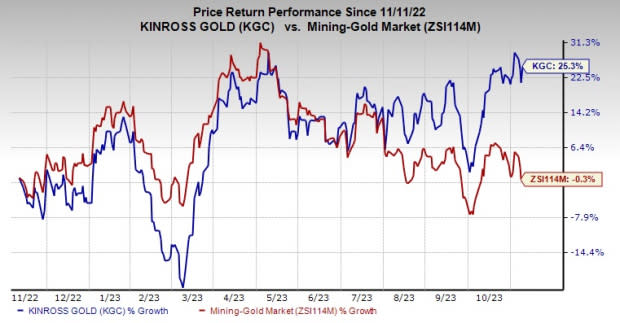

Price Performance

Shares of Kinross have soared 25.3% in the past year compared with a 0.3% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Kinross currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Carpenter Technology has a projected earnings growth rate of 213.2% for the current fiscal year. It currently carries a Zacks Rank #1 (Strong Buy). CRS delivered a trailing four-quarter earnings surprise of roughly 14.3%, on average. The stock is up around 62.2 % in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axalta has a projected earnings growth rate of 5.4% for the current year. It currently carries a Zacks Rank #1. AXTA delivered a trailing four-quarter earnings surprise of roughly 6.7%, on average. The stock is up around 13.4% in a year.

Andersons currently carries a Zacks Rank #2 (Buy). The stock has gained roughly 28.7% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report