Kinsale Capital Group Inc (KNSL) Reports Stellar Year-End Financials with Net Income Doubling

Net Income: $308.1 million for 2023, a 93.6% increase from 2022.

Diluted Earnings Per Share: $13.22 for 2023, up from $6.88 in 2022.

Gross Written Premiums: Increased by 42.3% to $1.6 billion for the full year.

Net Investment Income: Grew by 99.6% to $102.3 million for 2023.

Combined Ratio: Improved to 75.4% for 2023 from 78.5% in 2022.

Operating Return on Equity: Rose to 31.8% for 2023, up from 25.0% in 2022.

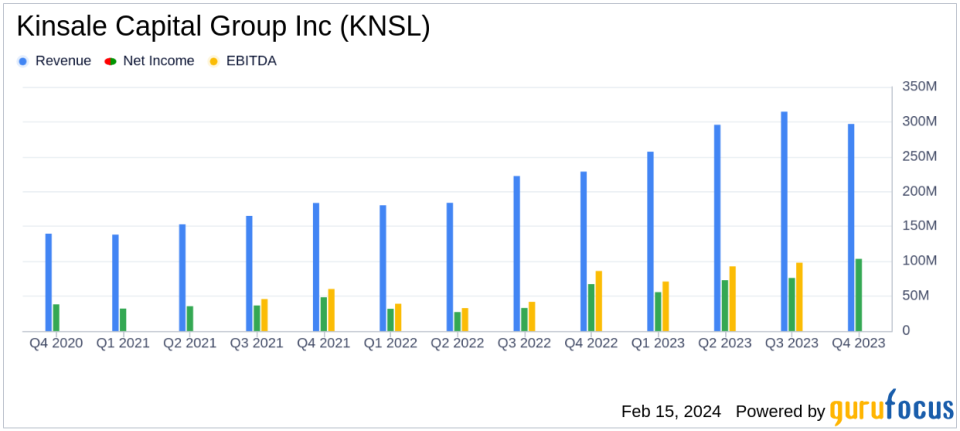

On February 15, 2024, Kinsale Capital Group Inc (NYSE:KNSL), a specialty insurance group, released its impressive year-end financial results through an 8-K filing. The company, which operates in the Excess and Surplus Lines Insurance segment, reported a significant increase in net income and diluted earnings per share for both the fourth quarter and the full year of 2023, compared to the same periods in 2022. These results reflect Kinsale's focus on disciplined underwriting and technology-enabled expense management, which have proven effective in a favorable E&S market.

Financial Highlights and Performance Analysis

Kinsale's net income for the fourth quarter of 2023 was $103.4 million, or $4.43 per diluted share, a 53.7% increase from the fourth quarter of 2022. The full year net income reached $308.1 million, or $13.22 per diluted share, nearly doubling from the previous year. This remarkable growth was attributed to strong premium growth, rate increases, and favorable loss experience.

The company's gross written premiums saw a substantial rise of 33.8% in the fourth quarter and 42.3% for the full year, reaching $1.6 billion. This growth was driven by robust submission flow from brokers and a favorable pricing environment. Net investment income also soared by 71.2% for the quarter and 99.6% for the year, benefiting from strong operating cash flows and higher interest rates.

Underwriting income for the fourth quarter was $84.8 million, resulting in a combined ratio of 72.1%, an improvement from the 73.1% in the same period last year. For the full year, underwriting income was $270.4 million with a combined ratio of 75.4%, better than the 78.5% in 2022. The improved combined ratio is a key metric in the insurance industry, indicating Kinsale's efficiency in managing claims and expenses relative to premium income.

Balance Sheet and Investment Results

Kinsale's balance sheet strengthened with stockholders' equity reaching $1.1 billion at the end of 2023, up from $745.4 million at the end of 2022. The book value per share increased to $46.88, reflecting the company's overall financial health and profitability.

The company's investment portfolio, excluding cash and cash equivalents, yielded a gross investment return of 4.0% for the year, up from 3.0% in the previous year. This performance underscores the effectiveness of Kinsale's conservative investment strategy, focusing on high-quality securities with an average credit quality of "AA-".

CEO's Commentary and Future Outlook

Michael P. Kehoe, Chief Executive Officer, expressed confidence in the company's strategy, stating,

We generated record growth and profitability in 2023 by executing our business plan and capitalizing on favorable E&S market conditions. These results demonstrate our ability to deliver exceptional shareholder returns as we continue to focus on disciplined underwriting and technology-enabled expense management. We are confident that the execution of our differentiated strategy provides an enduring competitive advantage."

Kinsale's robust financial performance in 2023 sets a positive tone for the future. With a disciplined approach to underwriting and a strategic focus on technology, Kinsale Capital Group Inc (NYSE:KNSL) is well-positioned to navigate the dynamic insurance market and continue delivering value to its shareholders.

For more detailed information on Kinsale Capital Group Inc's financial results, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Kinsale Capital Group Inc for further details.

This article first appeared on GuruFocus.