Kinsale Capital (KNSL) Q4 Earnings Beat, Revenues Rise Y/Y

Kinsale Capital Group, Inc. KNSL delivered fourth-quarter 2023 net operating earnings of $3.87 per share, which outpaced the Zacks Consensus Estimate by 12.5%. The bottom line increased 48.8% year over year.

The results benefited from favorable pricing environment, premium growth, rate increases and improved combined ratio, partially offset by higher expenses.

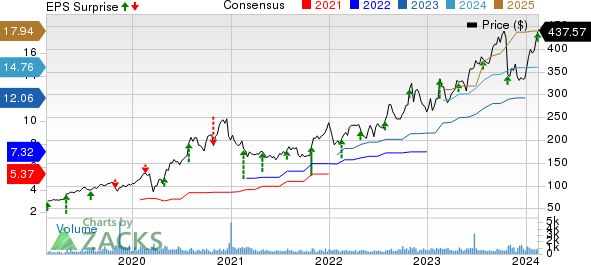

Kinsale Capital Group, Inc. Price, Consensus and EPS Surprise

Kinsale Capital Group, Inc. price-consensus-eps-surprise-chart | Kinsale Capital Group, Inc. Quote

Operational Update

Operating revenues jumped 41.5% year over year to about $351.2 million. The growth can primarily be attributed to a rise in premiums, fee income, higher net investment income and other income. Revenues beat the consensus estimate by 3.8%.

Gross written premiums of $395.2 million rose 33.8% year over year, driven by strong submission flow from brokers and a favorable pricing environment. Our estimate was $372.9 million.

Net written premiums climbed 26.5% year over year to $306.3 million in the quarter. Our estimate is pegged at $308.8 million.

Net investment income increased 71.2% year over year to $30.4 million in the quarter and beat our estimate of $29.8 million. The increase was driven by growth in the company's investment portfolio generated primarily from the investment of strong operating cash flows since Dec 31, 2022 and higher interest rates relative to the prior-year periods. The Zacks Consensus Estimate was pegged at $28.7 million.

Total expenses increased 34.8% year over year to $221.1 million due to a rise in losses and loss adjustment expenses, underwriting, acquisition and insurance expenses and interest expense. Our estimate was pegged at $235.6 million.

Kinsale Capital’s underwriting income was $84.8 million, which grew 42.6% year over year. The increase was due to a combination of premium growth, rate increases, favorable loss experience, lower net commissions and scale. Our estimate was $68.6 million.

The combined ratio improved 100 basis points (bps) to 72.1 in the quarter under review.

While the expense ratio improved 190 bps to 19.9 in the quarter, the loss ratio deteriorated 90 bps to 52.2.

Financial Update

Kinsale Capital exited the fourth quarter with cash and cash equivalents of $126.7 million, which decreased 18.9% from the 2022-end level. As of Dec 31, 2023, stockholders’ equity increased 45.8% to $1 billion from the 2022-end level.

Annualized operating return on equity expanded 50 bps year over year to 35.9% in the reported quarter.

Full-Year Highlights

Operating income of $12.50 per share beat the Zacks Consensus Estimate by 3.5%. The bottom line improved 60.2% year over year.

Operating revenues came in at $1.2 billion, up 45.9% year over year, on the back of higher premiums, fee income, improved net investment income and other income. The top line matched the Zacks Consensus Estimate.

Kinsale Capital’s underwriting income soared 54% year over year to $270.4 million. The combined ratio was 75.4, which improved 310 bps year over year.

Zacks Rank

Kinsale Capital currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other P&C Insurers

The Travelers Companies TRV reported its fourth-quarter 2023 core income of $7.01 per share, which beat the Zacks Consensus Estimate of $5.04. The bottom line more than doubled year over year, driven by higher underlying underwriting gain, lower catastrophe losses and higher net investment income. Travelers’ total revenues increased 13.5% from the year-ago quarter to $10.9 billion, primarily driven by higher premiums. The top-line figure beat the Zacks Consensus Estimate by 0.2%.

Net written premiums increased 13% year over year to about $10 billion, driven by strong growth across all three segments. The figure was higher than our estimate of $9.7 billion. Travelers witnessed an underwriting gain of $1.4 billion, up more than three-fold year over year, driven by higher business volumes. The combined ratio improved 870 bps year over year to 85.8, driven by a lower underlying combined ratio and lower catastrophe losses.

W.R. Berkley Corporation’s WRB fourth-quarter 2023 operating income of $1.45 per share beat the Zacks Consensus Estimate of $1.35 by 7.4%. The bottom line improved 25% year over year. W.R. Berkley’s net premiums written were $2.7 billion, up 12% year over year. The figure was lower than our estimate of $2.8 billion. Operating revenues came in at $3.2 billion, up 9.3% year over year, on the back of higher net premiums earned as well as improved net investment income. The top line beat the consensus estimate by 1.3%.

Net investment income rose 35.5% to a record $313.3 million, driven by a 52.9% increase in the core portfolio. The figure was higher than our estimate of $276 million. The loss ratio improved 60 bps to 60, while the expense ratio deteriorated 60 bps year over year to 28.4. Catastrophe losses of $32 million in the quarter were wider than the $30.8 million incurred in the year-ago quarter. Pre-tax underwriting income increased 8.2% to $315.9 million. The consolidated combined ratio (a measure of underwriting profitability) remained flat year over year to 88.4.

AXIS Capital Holdings Limited AXS posted fourth-quarter 2023 operating income of $2.94 per share, in contrast to the Zacks Consensus Estimate of a loss of $1.25. The bottom line increased 50.8% year over year. Total operating revenues of $1.5 billion beat the Zacks Consensus Estimate by 2.7%. The top line, however, declined 2.1% year over year on lower premiums earned.

Net premiums written decreased 2% to $1.1 billion, attributable to a 51% decline in the Reinsurance segment, partially offset by a 9% increase in the Insurance segment. Our estimate was $1 billion.

Net investment income improved 27.2% year over year to $187 million, primarily driven by a rise in income from the fixed maturities portfolio due to increased yields. Our estimate was $185.2 million. Catastrophe and weather-related losses and net of reinsurance were $25.9 million, narrower than the year-ago loss of $63.6 million. AXIS Capital incurred an underwriting loss of $274.1 million against the year-ago income of $132 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report