Kirby Corp (KEX) Reports Strong Earnings Growth and Positive Outlook for 2024

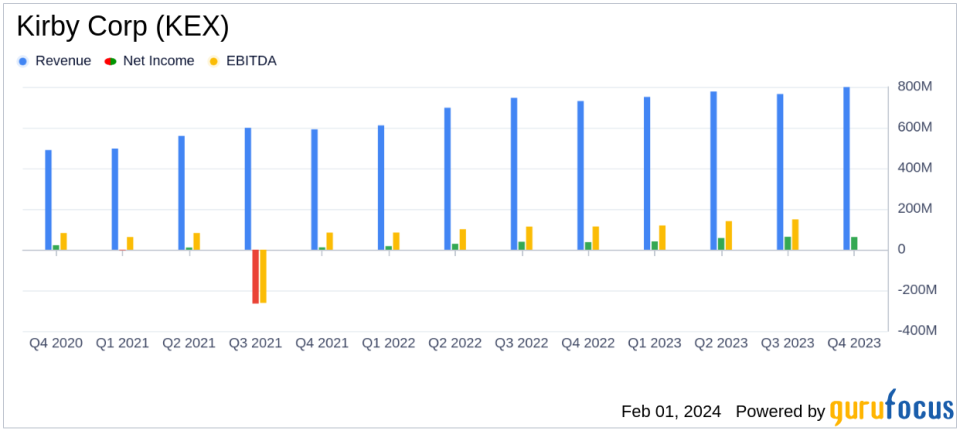

Quarterly Earnings: Kirby Corp (NYSE:KEX) reported Q4 earnings of $1.04 per share, up from $0.62 in Q4 2022.

Annual Earnings: Full-year earnings per share reached $3.72, compared to $2.03 in the previous year.

Revenue Growth: Q4 revenues increased to $799.2 million, up from $730.2 million in the same quarter last year.

Debt Reduction: Total debt decreased to $1,016.6 million, with a debt-to-capitalization ratio improvement to 24.2%.

Share Repurchase: Kirby repurchased over 1.4 million shares for $112.8 million in the full year.

Cash Flow Projection: 2024 projected cash flow from operations is expected to be between $600 million to $700 million.

Leadership Transition: Joseph H. Pyne to retire as Chairman, with Richard J. "Dick" Alario elected as successor.

Kirby Corp (NYSE:KEX), a leading domestic tank barge operator, released its 8-K filing on February 1, 2024, detailing robust fourth-quarter and full-year financial results for 2023. The company's performance was bolstered by strong market conditions in its Marine Transportation segment and sequential revenue growth in Distribution and Services, despite supply chain delays.

Marine Transportation Segment Highlights

Marine transportation revenues for Q4 2023 were $452.6 million, up from $422.7 million in the same period last year. The segment's operating income rose to $68.2 million, with an operating margin of 15.1%, compared to 11.1% in Q4 2022. Inland marine saw an 11% revenue increase due to higher pricing and barge utilization, with operating margins in the high-teens. Coastal marine revenues were up 4% sequentially, with operating margins in the low single digits.

Distribution and Services Segment Performance

The Distribution and Services segment reported Q4 revenues of $346.6 million, a rise from $307.4 million in Q4 2022. Operating income for the quarter was $28.7 million, with an operating margin of 8.3%. The commercial and industrial market saw a 24% revenue increase compared to the same quarter last year, while the oil and gas market experienced a 3% revenue decrease but a significant increase in operating income.

Financial Strength and Share Repurchases

Kirby demonstrated financial strength by reducing its total debt to $1,016.6 million and improving its debt-to-capitalization ratio to 24.2%. The company also actively repurchased shares, buying back 673,279 shares at an average price of $77.08 for $51.9 million in Q4, and 1,485,159 shares at an average price of $75.95 for $112.8 million for the full year.

Forward-Looking Statements

President and CEO David Grzebinski expressed optimism for 2024, anticipating 30% to 40% earnings growth year-over-year. The company expects strong demand in marine transportation and new orders in manufacturing to drive performance. However, Kirby remains cautious about potential risks such as a recession or lingering inflation.

"We ended 2023 in a position of strength in both of our segments. In marine transportation, barge utilization and customer demand remain strong, and rates continue to increase. In distribution and services, demand for our products and services remains strong, and we continue to receive new orders in manufacturing. Overall, we anticipate our businesses to deliver 30% to 40% earnings growth in 2024," said Mr. Grzebinski.

Kirby's leadership will also see a transition, with the retirement of Joseph H. Pyne as Chairman of the Board and the election of Richard J. "Dick" Alario as his successor.

Value investors may find Kirby Corp's strong earnings growth, share repurchase program, and positive outlook for 2024 compelling reasons to consider the stock. With a solid financial position and strategic leadership changes, Kirby is well-positioned to navigate the challenges and opportunities that lie ahead.

Explore the complete 8-K earnings release (here) from Kirby Corp for further details.

This article first appeared on GuruFocus.