Kirby Corp Vice President and Controller Ronald Dragg Sells 1,413 Shares

Ronald Dragg, Vice President and Controller of Kirby Corp (NYSE:KEX), executed a sale of 1,413 shares in the company on February 7, 2024, according to a recent SEC Filing. Kirby Corp is a Houston-based marine transportation and diesel engine services company, operating the largest fleet of inland tank barges and towing vessels in the United States. The company's marine transportation segment is a provider of marine transportation services, offering customers efficient, reliable, and responsible solutions to transport bulk liquid products throughout the Mississippi River System, on the Gulf Intracoastal Waterway, along all three U.S. coasts, and in Alaska and Hawaii. The diesel engine services segment provides after-market service and genuine replacement parts for diesel engines, transmissions, reduction gears, and related equipment used in oilfield services, marine, power generation, on-highway, and other industrial applications.

The insider sold the shares at an average price of $84.68, resulting in a transaction amount of $119,708.44. Following this transaction, the insider's stake in Kirby Corp stands adjusted, reflecting the latest sale.

Over the past year, Ronald Dragg has engaged in multiple transactions, selling a cumulative total of 7,329 shares and making no purchases of the company's stock.

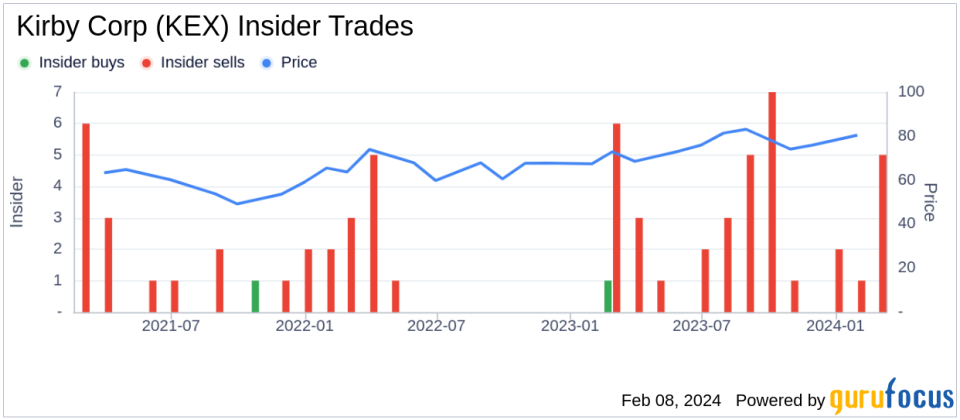

The insider transaction history for Kirby Corp indicates a pattern of more frequent selling than buying among insiders. In the past year, there has been a single insider buy compared to 36 insider sells.

On the valuation front, Kirby Corp's shares traded at $84.68 on the day of the insider's sale, giving the company a market capitalization of $5.006 billion. The price-earnings ratio of the stock stands at 22.77, which is above the industry median of 13.83 but below the company's historical median price-earnings ratio.

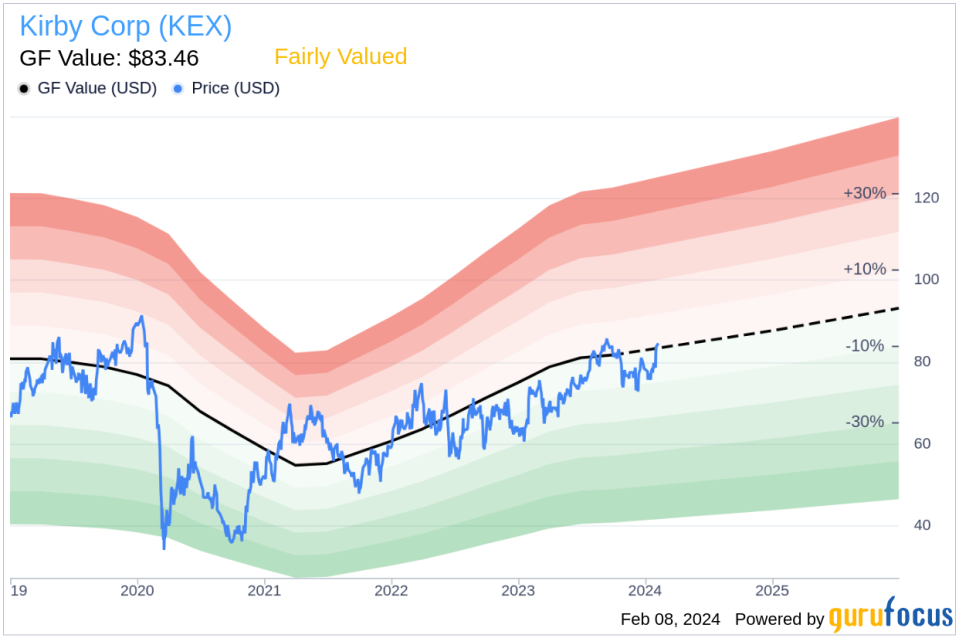

Kirby Corp's stock is currently assessed as Fairly Valued with a price-to-GF-Value ratio of 1.01, based on a GF Value of $83.46. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the buying and selling activities of the company's insiders over time, which can be an indicator of the company's internal perspective on its stock's value and prospects.

The GF Value image above illustrates the relationship between the company's current stock price and its GF Value, offering investors a quick reference to determine if the stock is trading at a premium or discount relative to its intrinsic value as estimated by GuruFocus.

Investors and stakeholders in Kirby Corp may consider the insider's recent transaction as part of their analysis when making investment decisions, alongside the company's valuation metrics and overall market performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.