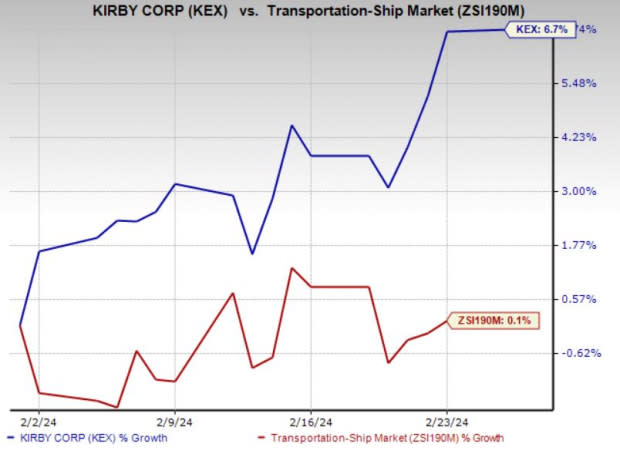

Kirby (KEX) Share Price Increases 6.7% Since Q4 Earnings Beat

Kirby Corporation (KEX) shares gained 6.7% since its fourth-quarter 2023 earnings release earlier this month.

Image Source: Zacks Investment Research

Quarterly earnings per share (EPS) of $1.04 surpassed the Zacks Consensus Estimate by a penny and improved year over year. Total revenues of $799.2 million surpassed the Zacks Consensus Estimate of $781 million and improved 9% year over year.

Total costs and expenses (on a reported basis) grew 5% year over year to $706.35million.

Kirby Corporation Price, Consensus and EPS Surprise

Kirby Corporation price-consensus-eps-surprise-chart | Kirby Corporation Quote

Segmental Performance

The company operates via two segments, namely, marine transportation and distribution and services.

Revenues in the marine transportation unit improved 7% year over year to $452.59 million. Operating margin for the fourth quarter of 2023 improved to 15.1% from 11.1% in the year-ago reported quarter.

Revenues in the inland market increased 11% compared with the fourth quarter of 2022, primarily due to higher pricing and barge utilization. Operating margins improved year over year to the high-teens. The inland market represented 82% of segment revenues in the fourth quarter of 2023.

Inland market revenues (which accounted for 82% of the segmental top line) climbed 11% year over year, primarily due to higher pricing and barge utilization. Inland’s operating margin improved year over year to the high-teens. Average fourth-quarter barge utilization was in the low 90% range due to solid customer demand and the re-opening of the Illinois River locks.

Coastal market revenues (which contributed 18% to the segmental top line) decreased 7% year over year. The coastal business witnessed a positive operating margin in the low-single digits during the reported quarter. Barge utilization was in the low to mid-90% range.

In the distribution and services segment, revenues for the fourth quarter improved 12.7% to $346.58 million. Overall, oil and gas represented 43% of segmental revenues. Operating margin for the fourth quarter of 2023 improved to 8.3% from 5.5% in the year-ago reported quarter.

In the commercial and industrial sub-group, revenues and operating income improved owing to higher business levels in marine repair, on-highway and power generation. Thermo King also contributed favorably with sequential and year-over-year growth due to increased sales despite headwinds from supply-chain constraints. Overall, commercial and industrial revenues grew 24% year over year and accounted for almost 64% of distribution and services segment revenues. Operating margins were in the mid to high-single digits.

In the oil and gas sub-group, revenues decreased 3% year over year and accounted for almost 36% of segment revenues. Operating income surged 289%, with operating margins in the low double digits.

Balance Sheet Highlights & Cash Flow

As of Dec 31, 2023, Kirby had cash and cash equivalents of $32.57 million compared with $42.1 million at the end of the prior quarter. Total debt was $1,016.59 million at the fourth-quarter end compared with $1,067.9 million at the end of the third quarter.

Kirby repurchased 673,279 shares at an average price of $77.08 for $51.9 million in the fourth quarter of 2023.

In 2023, Kirby generated $540.2 million of cash from operating activities compared with $294.1 million in 2022. Capital expenditures were $401.7 million. Free cash flow was $138.5 million.

2024 Outlook

Kirby expects earnings growth in the range of 30%-40% in 2024.

Under the Marine Transportation segment, for 2024, inland revenues are anticipated to increase in the mid to high single-digit range on a full-year basis. Operating margins are likely to improve during the year, with the first quarter being the lowest and averaging around 20% for the entire year. Coastal revenues for the whole year are anticipated to increase in the high single to low double digits range on a year-over-year basis. Coastal operating margins are anticipated to be in the mid to high single-digit range on a full-year basis.

For 2024, distribution and services segment revenues are anticipated to be flat to slightly down on a full-year basis, with operating margins in the mid to high-single digits but slightly lower year over year due to mix.

Net cash flow provided by operating activities is anticipated to be in the $600-$700 million band. Our estimate is pegged at $616.6 million.

Capital expenditures are expected to be between $290 and $330 million. Our estimate is pegged at $311.4 million.

Currently, Kirby carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT fourth-quarter 2023 EPS of $1.47 missed the Zacks Consensus Estimate of $1.74 and declined 23.4% year over year.

JBHT’s total operating revenues of $3,303.70million surpassed the Zacks Consensus Estimate of $3,236.2 million but fell 9.5% year over year. Total operating revenues, excluding fuel surcharge revenue, fell 6% year over year.

Delta Air Lines DAL reported fourth-quarter 2023 EPS (excluding $1.88 from non-recurring items) of $1.28, which comfortably beat the Zacks Consensus Estimate of $1.17. Earnings, however, declined 13.51% on a year-over-year basis due to high labor costs.

Revenues of $14,223 million surpassed the Zacks Consensus Estimate of $14,069.5 million and increased 5.87% on a year-over-year basis, driven by strong holiday-air-travel demand. Adjusted operating revenues (excluding third-party refinery sales) came in at $13,661 million, up 11% year over year.

United Airlines Holdings, Inc. UAL reported fourth-quarter 2023 earnings per share (excluding 19 cents from non-recurring items) of $2.00, which outpaced the Zacks Consensus Estimate of $1.61 but declined 18.7% year over year.

Operating revenues of $13,626 million beat the Zacks Consensus Estimate of $13,546.8 million. The top line increased 9.9% year over year due to upbeat air-travel demand. This was driven by a 10.9% rise in passenger revenues (accounting for 91.1% of the top line) to $12,421 million. Almost 41,779 passengers traveled on UAL flights in the fourth quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report