Kite Realty Group Trust (KRG) Reports Solid Earnings Growth and Robust Leasing Activity in Q4 ...

Net Income: KRG reported a net income of $47.5 million for the year 2023, a significant improvement from a net loss of $12.6 million in 2022.

FFO Per Share: NAREIT FFO per diluted share increased by 4.6% year-over-year to $2.03.

Leasing Activity: Approximately 4.9 million square feet were leased in 2023, with new and renewal leases executed at 14.3% comparable blended cash leasing spreads.

Same Property NOI: Increased by 4.8% on a year-over-year basis.

ABR Growth: Average base rent (ABR) per square foot rose to $20.70, marking a 3.4% increase year-over-year.

2024 Guidance: KRG anticipates net income per diluted share of $0.29 to $0.35 and NAREIT FFO of $2.00 to $2.06 per diluted share.

On February 13, 2024, Kite Realty Group Trust (NYSE:KRG), a leading owner and operator of open-air, grocery-anchored shopping centers and mixed-use assets, released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company's portfolio, primarily located in high-growth Sun Belt and select strategic gateway markets, comprises 180 U.S. open-air shopping centers and mixed-use assets, totaling approximately 28.1 million square feet of gross leasable space.

Financial and Operational Highlights

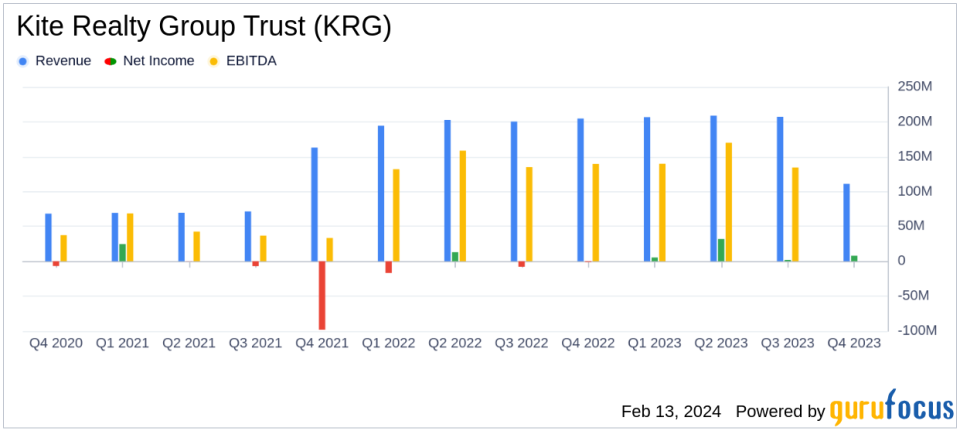

KRG's financial results for the fourth quarter and full year 2023 reflect a substantial turnaround from the previous year. The company reported a net income attributable to common shareholders of $8.0 million, or $0.04 per diluted share, for Q4 2023, compared to a net loss of $1.1 million, or $0.01 per diluted share, for Q4 2022. For the full year, net income reached $47.5 million, or $0.22 per diluted share, a significant improvement from a net loss of $12.6 million, or $0.06 per diluted share, in 2022.

John A. Kite, Chairman and CEO, commented on the company's performance, stating:

"The KRG team capped off a remarkably productive year with over 380,000 square feet of new leasing volume in the fourth quarter the highest quarterly new leasing activity in our Companys history. Our dedicated team enables us to consistently deliver outstanding results and long-term value to all stakeholders. Over the course of 2024, we will continue to operate from a position of strength with a best-in-class operating platform and balance sheet."

The company's leasing activity was robust, with approximately 4.9 million square feet leased in 2023, achieving a 14.3% comparable blended cash leasing spread. This leasing performance contributed to a 4.8% increase in Same Property Net Operating Income (NOI) year-over-year. Additionally, KRG increased its ABR per square foot to $20.70 and maintained a strong retail portfolio leased percentage of 93.9% as of December 31, 2023.

Balance Sheet and Dividend Declaration

KRG's balance sheet remains solid, with net debt to Adjusted EBITDA at 5.1x as of December 31, 2023. The company also issued $350 million of 5.50% senior unsecured notes due March 2034, which will be used to satisfy all 2024 debt maturities. Reflecting confidence in its financial position, KRG's Board of Trustees declared a first quarter 2024 dividend of $0.25 per common share, representing a 4.2% year-over-year increase.

2024 Outlook

Looking ahead, KRG provided an initial outlook for 2024, expecting to generate net income attributable to common shareholders of $0.29 to $0.35 per diluted share and NAREIT FFO of $2.00 to $2.06 per diluted share. The company anticipates a Same Property NOI range of 1.0% to 2.0% and a full-year bad debt assumption of 0.75% to 1.25% of total revenues.

Value investors and potential GuruFocus.com members may find Kite Realty Group Trust's solid performance and positive outlook appealing, as the company continues to demonstrate its ability to navigate the retail real estate market effectively. KRG's strategic focus on high-growth markets and commitment to maintaining a strong balance sheet position it well for continued success in 2024.

For a more detailed analysis of Kite Realty Group Trust's financial results and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Kite Realty Group Trust for further details.

This article first appeared on GuruFocus.