Knight-Swift (KNX) Q4 Earnings Lag Estimates, Revenue Beat

Knight-Swift Transportation Holdings Inc. (KNX)fourth-quarter 2023 earnings of 9 cents per share missed the Zacks Consensus Estimate of 47 cents and declined 91% year over year. Total revenues of $1,931.9 million outperformed the Zacks Consensus Estimate of $1,922 million and improved 0.5% year over year.

Total operating expenses (on a reported basis) increased 24.2% year over year to $1.91 billion.

Knight-Swift’s adjusted operating income fell 78.6% year over year.

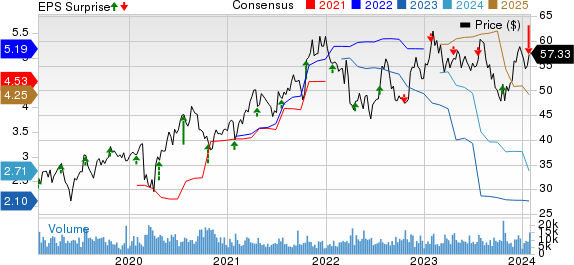

Knight-Swift Transportation Holdings Inc. Price, Consensus and EPS Surprise

Knight-Swift Transportation Holdings Inc. price-consensus-eps-surprise-chart | Knight-Swift Transportation Holdings Inc. Quote

Segmental Results

Revenues (excluding fuel surcharge and inter-segment transactions) from Truckload totaled $1,155.72 million, up 25.5% year over year. Adjusted segmental operating income plunged 56.2% to $69.94 million. Adjusted operating ratio (operating expenses as a percentage of revenues) grew 1120 basis points (bps) to 93.9%.

The Less-Than-Truckload segment generated revenues (excluding fuel surcharges) worth $232.08 million in the fourth quarter, up 13.8% year over year. Adjusted segmental operating income grew 14% to $33.7 million. Adjusted operating ratio remained flat at 85.5%.

Revenues from Logistics (excluding inter-segment transactions) amounted to $164.54 million, down 5% year over year. Adjusted operating income decreased 51.9% to $11.27 million. The adjusted operating ratio rose 670 bps to 93.1%.

Intermodal revenues (excluding inter-segment transactions) totaled $94.43 million, down 16.4% year over year. The operating ratio (on a reported basis) soared to 104.7% from 94.7% in the year-ago quarter.

Liquidity

Knight-Swift exited the fourth quarter with cash and cash equivalents of $168.55 million compared with $193.37 million at the prior-quarter end. Long-term debt (excluding current maturities) was $1.22 billion compared with $1.26 billion at the end of prior quarter.

Guidance

Knight-Swift expects first-quarter 2024 adjusted earnings per share (EPS) in the range of 37-41 cents and second-quarter 2024 EPS in the range of 53-57 cents.

KNX expects net cash capital expenditures for 2024 in the $625-$675 million band. The tax rate is expected to be around 25-26% for 2024.

Currently, KNX carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

J.B. Hunt Transport Services, Inc.’s JBHT fourth-quarter 2023 EPS of $1.47 missed the Zacks Consensus Estimate of $1.74 and declined 23.4% year over year.

JBHT’s total operating revenues of $3,303.70 million surpassed the Zacks Consensus Estimate of $3,236.2 million but fell 9.5% year over year. Total operating revenues, excluding fuel surcharge revenue, fell 6% year over year.

Delta Air Lines DAL has reported fourth-quarter 2023 EPS (excluding $1.88 from non-recurring items) of $1.28, which comfortably beat the Zacks Consensus Estimate of $1.17. Earnings, however, declined 13.51% on a year-over-year basis due to high labor costs.

Revenues of $14,223 million surpassed the Zacks Consensus Estimate of $14,069.5 million and increased 5.87% on a year-over-year basis, driven by strong holiday-air-travel demand. Adjusted operating revenues (excluding third-party refinery sales) came in at $13,661 million, up 11% year over year.

United Airlines Holdings, Inc. (UAL) reported fourth-quarter 2023 EPS (excluding 19 cents from non-recurring items) of $2.00, which outpaced the Zacks Consensus Estimate of $1.61 but declined 18.7% year over year.

Operating revenues of $13,626 million beat the Zacks Consensus Estimate of $13,546.8 million. The top line increased 9.9% year over year due to upbeat air-travel demand. This was driven by a 10.9% rise in passenger revenues (accounting for 91.1% of the top line) to $12,421 million. Almost 41,779 passengers traveled on UAL flights in the fourth quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Knight-Swift Transportation Holdings Inc. (KNX) : Free Stock Analysis Report