What You Need to Know Ahead of PPL Q2 Earnings

PPL Corporation PPL is scheduled to release second-quarter 2023 results on Aug 4, before market open. The company delivered an earnings surprise of 9.1% in the last reported quarter.

Let’s discuss the factors that are likely to be reflected in the upcoming quarterly results.

Factors to Consider

PPL’s second-quarter earnings are likely to have benefited from ongoing capital investments to further strengthen infrastructure. The bottom line is also expected to have gained from operation and maintenance savings through the company’s centralization efforts and asset optimization. Our model predicts other operation and maintenance expenses of $502.5 million for the quarter, down 10.3% year over year.

The company’s quarterly results are likely to have been impacted by unfavorable weather conditions in some of its service territories that might have led to lower electricity demand. Higher interest expenses are expected to have offset some positives.

Q2 Expectations

The Zacks Consensus Estimate for earnings is pegged at 32 cents per share, indicating a year-over-year increase of 6.7%. The consensus mark for revenues is pinned at $1.72 billion, implying a year-over-year improvement of 1.7%.

The Zacks Consensus Estimate for total electricity delivered in Pennsylvania is pegged at 8,511 gigawatt-hour (GWh), down 0.9% from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for total electricity delivered in Kentucky is pegged at 6,096 GWh, down 14.7% year over year. Both the figures reflect the impact of unfavorable weather conditions in the aforementioned regions during the second quarter, reducing demand for electricity.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for PPL this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here as you will see below.

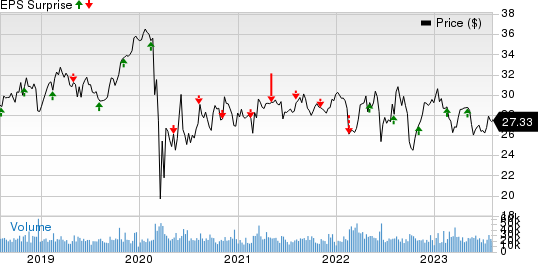

PPL Corporation Price and EPS Surprise

PPL Corporation price-eps-surprise | PPL Corporation Quote

Earnings ESP: The company’s Earnings ESP is 0.00%.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Currently, PPL carries a Zacks Rank #3. You can see the complete list of today's Zacks #1 Rank stocks here.

Another Release

WEC Energy Group WEC reported second-quarter 2023 earnings of 92 cents per share, which beat the Zacks Consensus Estimate of 85 cents by 8.24%.

WEC’s long-term (three to five years) earnings growth rate is 5.76%. It delivered an average earnings surprise of 7% in the last four quarters.

Stocks to Consider

Investors may consider the following players from the same sector as these have the right combination of elements to post an earnings beat this reporting cycle.

TransAlta TAC is likely to come up with an earnings beat when it reports second-quarter results on Aug 4, before market open. It has an Earnings ESP of +440.01% and a Zacks Rank #3 at present.

The Zacks Consensus Estimate for earnings is pegged at 3 cents per share, indicating a year-over-year increase of 112.5%. The consensus mark for 2023 earnings is pinned at $1.03 per share, implying a year-over-year improvement of 1,475%.

ALLETE ALE is likely to report an earnings beat when it announces second-quarter results on Aug 8, before market open. It has an Earnings ESP of +2.56% and a Zacks Rank #3 at present.

ALE’s long-term earnings growth rate is 8.1%. The Zacks Consensus Estimate for earnings is pegged at 78 cents per share, indicating a year-over-year increase of 16.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report