What You Need to Know About Medtronic's Earnings

- By Soid Ahmad

Medical device manufacturer Medtronic PLC (MDT) reported first-quarter 2019 results on Tuesday morning, beating consensus estimates.

Revenue increased 7% organically to reach $7.38 billion, ahead of analysts' consensus of $7.25 billion. The medical devices company reported non-GAAP earnings of $1.17 per share, beating estimates by 6 cents.

Warning! GuruFocus has detected 8 Warning Signs with MDT. Click here to check it out.

The intrinsic value of MDT

For full fiscal 2019, Medtronic is guiding for year-over-year revenue growth of 4.75% as opposed to the previous guidance of 4.25% growth. Regardless, the company is maintaining its midpoint earnings per share guidance of $5.12, exactly in-line with the Street's consensus.

The market reacted positively to the company's performance as the stock was up 4% in premarket trading.

What does Medtronic do?

Medtronic is primarily involved in the development and provision of device-based medical therapies for cardiac and vascular, respiratory and renal and diabetic patients. The company also provides implants for brain therapy and pain management. It generates most of its revenue from medical devices and implants provided to remedy cardiovascular problems.

What drove the top line?

Medtronic witnessed mid-single-digit growth in all its reportable segments except the diabetes business during the quarter. The diabetes segment managed to grow 26% year over year. The largest reportable segment, cardiac and vascular group, posted revenue growth of 5.5%. While revenue from cardiac rhythm and heart failure implants was flat, coronary and structural heart medical devices recorded mid-single-digit growth.

Medtronic's hybrid insulin pump, MiniMed 670G, is also gaining traction as it was responsible for high double-digit growth in diabetes group revenue during the quarter. The continuous glucose monitoring market also contributed. From a geographical perspective, the company witnessed its highest growth in emerging markets with revenue increasing 11.2% year over year.

What's the outlook?

The long-term growth outlook is pretty much tilted toward mid-single-digit growth. Analysts are expecting 7% per-year growth in earnings over the next five years. Most of the industry reports also agree with analyst forecasts.

The global medical devices market is set to expand 4.5% per year between 2018 and 2023, driven by an aging population, increasing medical expenditures and technological advances. High growth, however, is expected to come from emerging technologies like continuous glucose monitoring and smart devices. The global CGM market is expected to grow at a rate of 13.7% per year to cross $4 billion by 2024.

As Medtronic holds the largest market share in the medical devices industry, it's safe to assume the company will replicate industry growth going forward.

Is the growth reasonably priced?

For a company with mid-single-digit growth prospects, high multiples are not usually justified. Medtronic appears slightly cheap on a relative basis. The stock is trading at a forward price-earnings ratio of around 16, which is below the relative value of the S&P 500. Regardless, the stock is trading at a high multiple based on GAAP earnings.

Projections | 2019 | 2020 | 2021 | 2022 | 2023 | Perpetuity | ||

Notes | Dollars in million | |||||||

Net Income | 6912.00 | 7479.00 | 7852.95 | 8245.60 | 8657.88 | 9090.77 | ||

Cost of capital | r*capital invested | 3601.50 | 3637.16 | 3702.04 | 3778.94 | 3867.80 | 3968.61 | |

Dividends | 2700.00 | 2835.00 | 2976.75 | 3125.59 | 3281.87 | 3445.96 | ||

Economic Value Added | 3310.50 | 3841.84 | 4150.91 | 4466.65 | 4790.08 | 5122.16 | ||

Discount factor | 1.00 | 0.93 | 0.87 | 0.80 | 0.75 | 11.52 | ||

Discounted EVA | 3310.50 | 3573.80 | 3591.91 | 3595.48 | 3586.81 | 59007.33 | ||

Market value added | 76666 | |||||||

Invested Capital | 50720 | |||||||

Value of the equity | 127386 | |||||||

Perpetual Growth in Residual Earnings | 2.5% | Price Target | $94.4 | |||||

The economic value added valuation reveals Medtronic is priced for perfection. Assuming consensus earnings for 2018 and 2019 and earnings growth of 5% per year between 2020 and 2024, the price target comes slightly ahead of Tuesday's trading price.

Although there's no harm in owning a stock with more than a 2% dividend yield at a reasonable price, there are certain caveats as far as Medtronic is concerned. First, the company has goodwill of more than $39 billion, making up 77% of the total shareholders' equity.

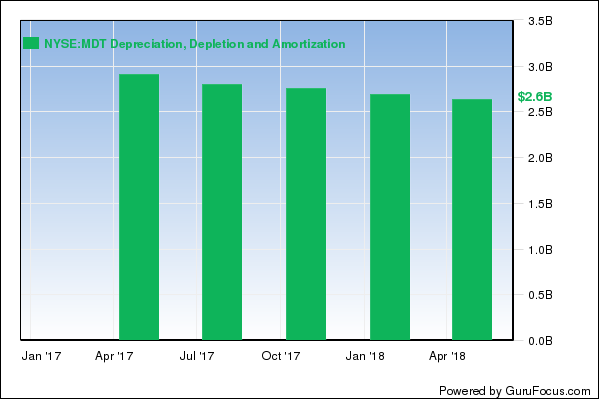

Further, Medtronic had $21.7 billion in intangible assets as of the end of June. Intangible expenses for fiscal 2018 amounted to more than $1.5 billion.

As non-GAAP earnings exclude the impact of amortization, earnings are prone to overstatement. The bottom line is that valuation is based on non-GAAP earnings, which might not be reflective of the company's true economic value. On the basis of GAAP earnings, the stock is clearly overvalued.

Final thoughts

Although Medtronic posted decent top-line growth during the quarter, the stock is priced for perfection based on non-GAAP numbers. The company should be avoided as its balance sheet assets are concentrated in goodwill and intangibles, while Wall Street valuations are based on non-GAAP earnings.

Disclosure: I have no positions in any stocks mentioned and no plans to initiate any positions within the next 72 hours.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 8 Warning Signs with MDT. Click here to check it out.

The intrinsic value of MDT