Kodiak (KOD) Down as Late-Stage DME Studies Fail

Kodiak Sciences’ KOD shares were down almost 45.9% on Jul 24, as it failed to meet the primary endpoint in two late-stage studies evaluating tarcocimab for patients with diabetic macular edema (DME). The results from these studies led Kodiak to discontinue any further development of tarcocimab.

The developmental candidate, tarcocimab is a novel antibody biopolymer conjugate being developed for treating various eye diseases. It is being developed in multiple late-stage studies, namely GLEAM, GLIMMER, GLOW, DAYLIGHT and BEACON.

The GLEAM and GLIMMER phase III studies evaluated tarcocimab for six-month durability in patients with DME. The study aimed to evaluate the durability, efficacy and safety of tarcocimab compared with Eylea (aflibercept) in improving visual clarity.

Although the data showed that many patients on tarcocimab achieved longer treatment intervals, the studies could not meet the primary efficacy endpoints of showing non-inferior visual acuity gains for tarcocimab dosed every 8-24 weeks after three monthly loading doses compared with aflibercept given every eight weeks after five monthly loading doses.

Additionally, an unexpected increase in cataracts was observed over time in the tarcocimab arms of both studies.

However, the phase III DAYLIGHT study, evaluating tarcocimab in patients with wet age-related macular degeneration (AMD), met its primary endpoint of non-inferior visual acuity gains. It was a randomized, double-masked, active comparator-controlled study that compared the efficacy and safety of a high-intensity dosing regimen of tarcocimab tedromer with aflibercept.

The data showed that tarcocimab was well tolerated in wet AMD patients and a low rate of intraocular inflammation was observed among them.

Kodiak had $379 million in cash and cash equivalents as of Jun 30, 2023. Management plans to reassess its near-term strategy.

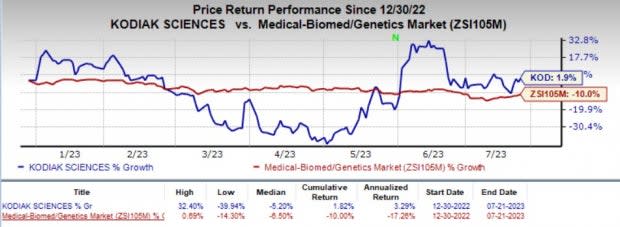

Kodiak's shares have rallied 1.9% year to date against the industry’s decline of 10%.

Image Source: Zacks Investment Research

Based on the abovementioned results, the company plans to present data from the DAYLIGHT study and additional insights from the tarcocimab development program at a future medical meeting.

This would include data from the BEACON study, which met its primary endpoint in 2022, for patients with retinal vein occlusion and the GLOW study in non-proliferative diabetic retinopathy patients. The GLOW study result is expected in September.

Looking ahead, Kodiak is determined to continue to develop transformative therapies for prevalent diseases. It is developing KSI-501, a dual inhibitor antibody biopolymer conjugate targeting both VEGF and IL-6, in phase I clinical study for patients with DME.

The phase I study is an open-label, multiple ascending dose study. The primary objectives of the study are to evaluate ocular and systemic safety, and to establish the maximum tolerated dose. The early-stage study enrolled its first patient in April 2023.

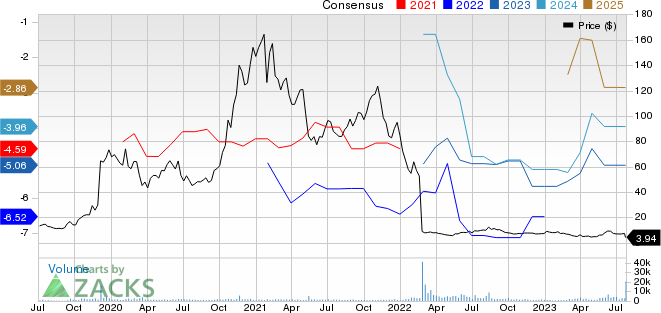

Kodiak Sciences Inc. Price and Consensus

Kodiak Sciences Inc. price-consensus-chart | Kodiak Sciences Inc. Quote

Zacks Rank and Stocks to Consider

Kodiak currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same industry are ADC Therapeutics ADCT, Acadia Pharmaceuticals ACAD and Akoya Biosciences AKYA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for ADC Therapeutics has widened from a loss of $2.58 per share to a loss of $2.61 for 2023. The consensus estimate has narrowed from a loss of $2.72 per share to a loss of $2.45 for 2024 during the same time frame. Shares of the company have lost 63% year to date.

ADCT’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 10.70%.

In the past 90 days, the Zacks Consensus Estimate for Acadia Pharmaceuticals has narrowed from a loss of 58 cents per share to a loss of 31 cents for 2023. Shares of the company have rallied 93.5% year to date.

ACAD’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 2.75%.

In the past 90 days, the Zacks Consensus Estimate for Akoya Biosciences has narrowed from a loss of $1.80 per share to a loss of $1.71 for 2023. The consensus estimate for Akoya Biosciences has narrowed from a loss of $1.57 per share to a loss of $1.33 for 2024 during the same time frame. Shares of the company have lost 25.5% year to date.

AKYA’s earnings missed estimates in each of the trailing four quarters, delivering an average negative surprise of 21.05%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Kodiak Sciences Inc. (KOD) : Free Stock Analysis Report

Akoya Biosciences, Inc. (AKYA) : Free Stock Analysis Report