Kodiak (KOD) Q2 Earnings Miss, New Lead Candidate in Focus

Shares of Kodiak Sciences KOD fell about 10% on Tuesday, after the company reported its second-quarter 2023 earnings results on Monday, after market close.

Kodiak Sciences reported a second-quarter 2023 loss per share of $1.53, wider than the Zacks Consensus Estimate of a loss of $1.23. The company had incurred a loss of $1.74 per share in the year-ago quarter.

Currently, the company does not have any approved products in its portfolio. As a result, it is yet to generate revenues.

Quarter in Detail

Research and development expenses were approximately $67 million in the reported quarter, down about 9% year over year. The decrease was due to the maturation of the company’s tarcocimab clinical program and the timing of manufacturing activities.

General and administrative expenses were $17.9 million, marginally down on a year-over-year basis, primarily due to lower non-cash stock-based compensation expenses.

As of Jun 30, 2023, Kodiak Sciences had cash, cash equivalents and marketable securities worth $378.7 million compared with $421.2 million as of Mar 31, 2023.

Year to date, shares of KOD have nose-dived 62.2% compared with the industry’s 12.5% fall.

Image Source: Zacks Investment Research

Business Updates

During the second quarter, KOD reported that it failed to meet the primary endpoint in two late-stage studies evaluating tarcocimab for patients with diabetic macular edema (DME). The results from these studies led Kodiak Sciences to discontinue any further development of tarcocimab as the previously anticipated biologics license application was primarily intended to be based on positive results from the DME studies.

The GLEAM and GLIMMER phase III studies could not meet the primary efficacy endpoints of showing non-inferior visual acuity gains for tarcocimab dosed every eight to 24 weeks after three monthly loading doses compared with aflibercept given every eight weeks after five monthly loading doses. Additionally, an unexpected increase in cataracts was observed over time in the tarcocimab arms of both studies.

In the earnings press release, management stated that despite the business decision to wind down ongoing studies of tarcocimab, it will still be evaluating a variety of future options for the tarcocimab program. This is primarily due to two successful studies - the BEACON study in patients with retinal vein occlusion and the DAYLIGHT study in patients with wet age-related macular degeneration.

Following the discontinuation of the tarcocimab program, KOD now has a new lead candidate, KSI-501, a dual inhibitor antibody biopolymer conjugate targeting both VEGF and IL-6, in phase I clinical study for patients with DME. Kodiak Sciences reported completing the enrollment of patients in the early-stage study, across all dose levels of KSI-501, during the second quarter.

Kodiak Sciences expects to develop KSI-501 both as its unconjugated protein and bioconjugate form.

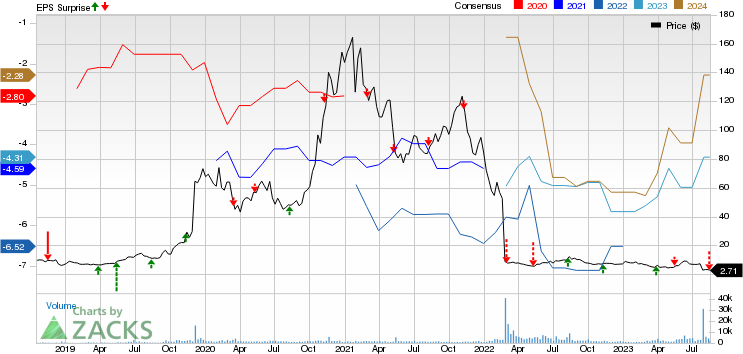

Kodiak Sciences Inc. Price, Consensus and EPS Surprise

Kodiak Sciences Inc. price-consensus-eps-surprise-chart | Kodiak Sciences Inc. Quote

Zacks Rank and Stocks to Consider

Kodiak Sciences currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall medical sector are J&J JNJ, JAZZ Pharmaceuticals JAZZ and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for J&J’s 2023 earnings per share has increased from $10.67 to $10.75. During the same period, the estimate for JNJ’s 2024 earnings per share has increased from $11.01 to $11.29. Year to date, shares of JNJ have lost 2.1%.

JNJ beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 5.58%.

In the past 90 days, the Zacks Consensus Estimate for JAZZ Pharmaceuticals has gone up from earnings of $17.48 per share to $17.78 for 2023. The bottom-line estimate has also moved up from $19.45 to $19.87 for 2024 during the same time frame. Shares of the company have lost 12.1% year to date.

JAZZ’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average negative surprise of 27.59%.

In the past 90 days, the Zacks Consensus Estimate for Corcept has gone up from earnings of 66 cents per share to 75 cents for 2023. The bottom-line estimate has also improved from 64 cents to 81 cents for 2024 during the same time frame. Shares of the company have rallied 52.4% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

Kodiak Sciences Inc. (KOD) : Free Stock Analysis Report