Kohl's Corp (KSS) Posts Mixed Fiscal 2023 Results Amid Strategic Shifts

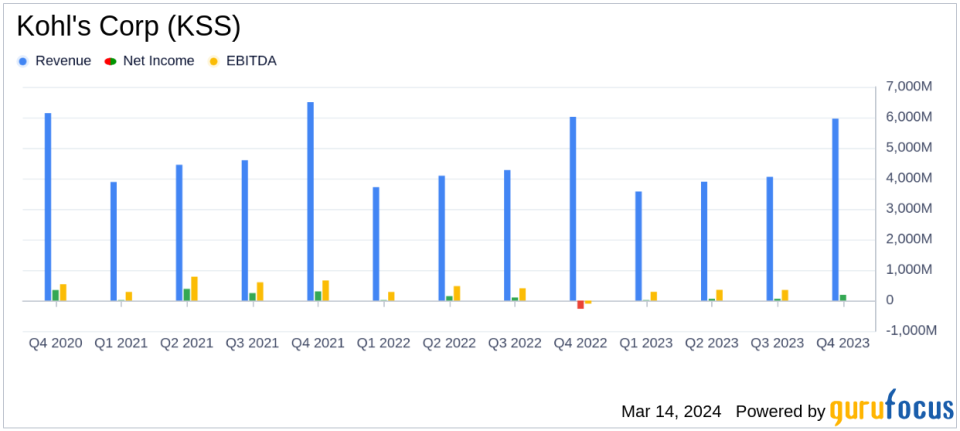

Net Sales: Declined slightly to $16.586 billion from $17.161 billion in the previous year.

Gross Margin: Improved to 36.7% from 33.2% year-over-year.

Net Income: Reported at $317 million, recovering from a loss of $19 million last year.

Inventory Levels: Reduced by 10% at year-end, reflecting new inventory management processes.

Capital Expenditures: Decreased to $577 million from $826 million in the prior year.

Dividends and Share Repurchases: Paid $220 million in dividends; no share repurchases reported.

On March 12, 2024, Kohl's Corp (NYSE:KSS) released its 8-K filing, detailing the financial results for the fourth quarter and full fiscal year 2023. Kohl's, a leading omnichannel retailer with over 1,100 stores, reported a year of strategic shifts aimed at enhancing the store experience and managing inventory more effectively.

Financial Performance and Strategic Initiatives

CEO Tom Kingsbury highlighted the company's focus on improving the store experience, expanding partnerships, and investing in underpenetrated categories. The company's comparable sales performance was the best since 2010, driven by initiatives such as the expansion of Sephora at Kohl's, which continued to drive significant beauty sales growth. Inventory was managed down by 10% at the year's end, reflecting the implementation of new inventory management processes.

"Looking ahead, we are incredibly focused on delivering comparable sales growth in 2024. Our strategic initiatives are positioned to build momentum and contribute more meaningfully," said Kingsbury.

Despite these strategic efforts, net sales saw a slight decline to $16.586 billion from $17.161 billion in the previous year. However, the gross margin rate improved to 36.7% from 33.2%, indicating a more profitable sales mix or improved cost management. Net income showed a significant recovery, reporting at $317 million compared to a loss of $19 million in the prior year.

Financial Health and Capital Allocation

Kohl's balance sheet reflects a stable financial position with total assets at $14.009 billion, slightly down from $14.345 billion the previous year. The company reduced its merchandise inventories and maintained a disciplined approach to capital expenditures, which decreased to $577 million from $826 million in the prior year. This conservative approach to spending is crucial in the retail sector, where managing cash flow and maintaining financial flexibility are key to navigating cyclical trends.

The company also reported a net cash provided by operating activities of $1.168 billion, a significant improvement from $282 million in the previous year. This increase in cash flow is a positive sign for investors, indicating that the company's operational efficiency and cost-control measures are yielding results.

Despite the challenges faced in the retail industry, Kohl's has not lost sight of returning value to shareholders, paying out $220 million in dividends. However, unlike the previous year, the company did not engage in share repurchases, choosing instead to focus on strengthening its financial position.

Outlook and Future Growth

For the full year 2024, Kohl's anticipates the potential impact from credit card late fee regulatory changes in the second half of the year. The company's guidance includes this consideration, although specific figures were not disclosed in the filing.

Kohl's is poised to capitalize on strategic initiatives such as the partnership with Babies "R" Us, aiming to expand its presence in the baby gear category. This move represents a strategic effort to tap into new market segments and drive future growth.

In conclusion, Kohl's Corp (NYSE:KSS) has navigated a year of transition with a focus on strategic initiatives that are beginning to show results. While net sales have declined slightly, improvements in gross margin and net income, along with effective inventory management, position the company for a potentially stronger performance in the coming year. Investors and stakeholders will be watching closely to see how the company's strategic initiatives continue to unfold in the competitive retail landscape.

Explore the complete 8-K earnings release (here) from Kohl's Corp for further details.

This article first appeared on GuruFocus.