Kohl's Corp's Dividend Analysis

Assessing the Dividend Prospects of Kohl's Corp

Kohl's Corp (NYSE:KSS) recently announced a dividend of $0.5 per share, payable on 2024-04-03, with the ex-dividend date set for 2024-03-19. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Kohl's Corp's dividend performance and assess its sustainability.

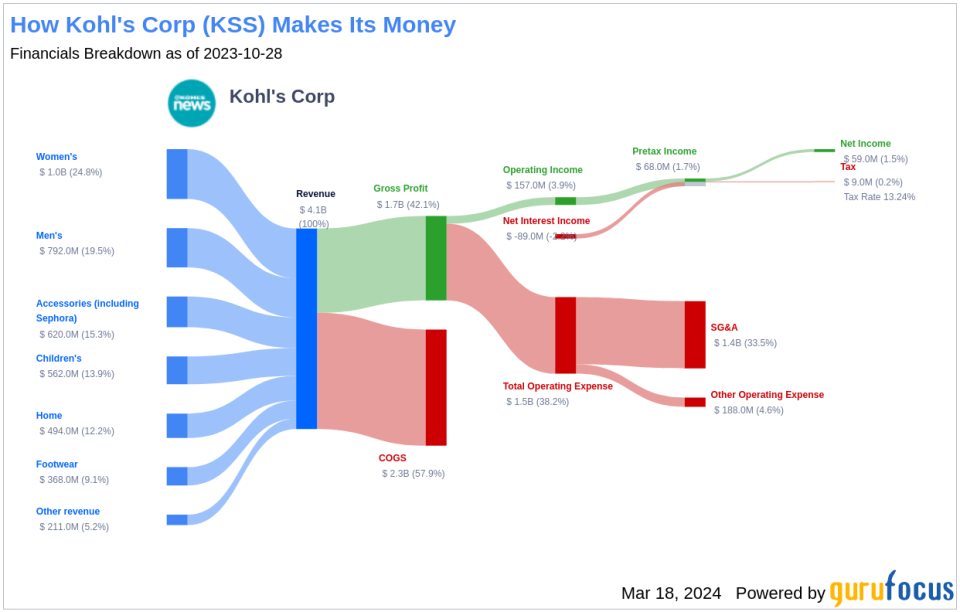

Understanding Kohl's Corp's Business Model

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Kohl's operates approximately 1,170 department stores across 49 states, offering moderately priced private-label and national brand clothing, shoes, accessories, cosmetics, and home furnishings. With a significant presence in strip centers, Kohl's also boasts a substantial digital sales business. Women's apparel, which accounts for 27% of its 2022 sales, is a major category for the retailer. Established in 1962 and headquartered in Menomonee Falls, Wisconsin, Kohl's has grown into a prominent player in the retail sector.

Tracing Kohl's Corp's Dividend History

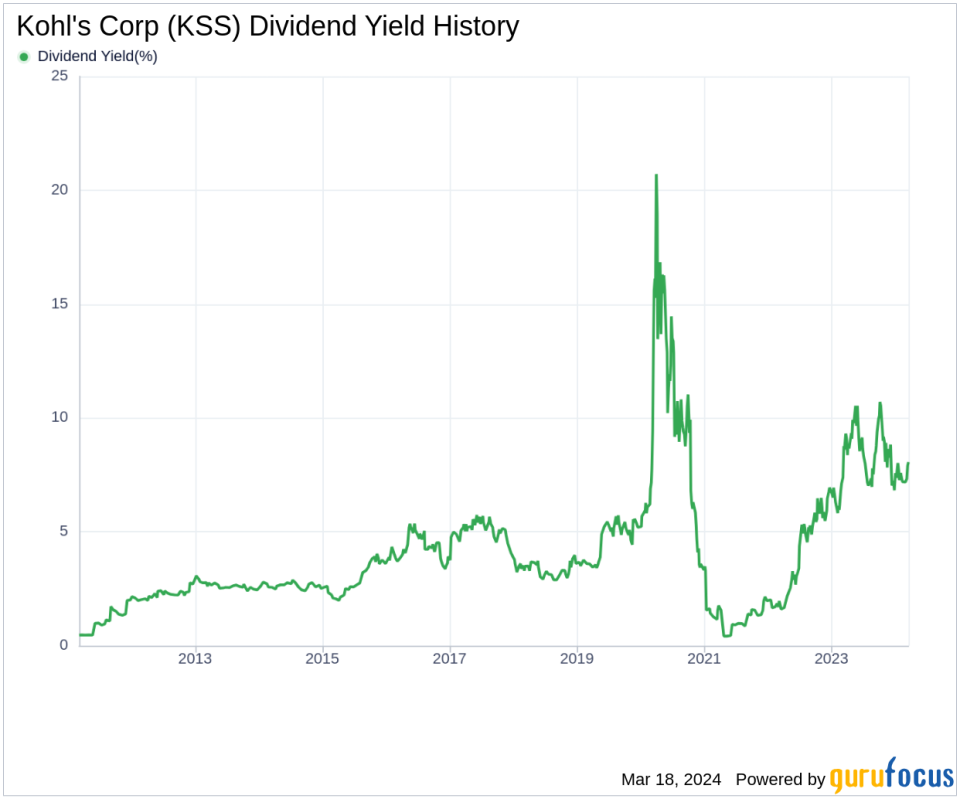

Kohl's Corp has upheld a steady dividend payment tradition since 2011, with dividends being distributed on a quarterly basis. Below is a chart illustrating the annual Dividends Per Share to track historical trends.

Breaking Down Kohl's Corp's Dividend Yield and Growth

Kohl's Corp currently has a 12-month trailing dividend yield of 8.06% and a 12-month forward dividend yield of 8.06%, indicating an expectation of consistent dividend payments over the next 12 months. Over the past three years, Kohl's Corp's annual dividend growth rate was -9.30%, decreasing to -12.00% per year over a five-year span. The decade-long annual dividends per share growth rate is -0.50%. Considering Kohl's Corp's dividend yield and five-year growth rate, the 5-year yield on cost is approximately 4.25%.

Evaluating Dividend Sustainability: Payout Ratio and Profitability

To evaluate dividend sustainability, it is crucial to consider the dividend payout ratio. A lower ratio implies the company retains more earnings for future growth and downturns. As of 2023-10-31, Kohl's Corp's dividend payout ratio stands at 0.00. The company's profitability rank is 6 out of 10 as of 2023-10-31, indicating fair profitability with net profit reported in 8 of the past 10 years.

Growth Metrics: The Future Outlook

Kohl's Corp's growth rank of 6 out of 10 suggests a fair growth outlook. The company's revenue per share and 3-year revenue growth rate indicate a strong revenue model, with revenue increasing by approximately 6.10% per year, outperforming 54.1% of global competitors. Additionally, the 3-year EPS growth rate shows earnings growth of approximately 50.10% per year, surpassing about 85.63% of global competitors.

Concluding Insights on Kohl's Corp's Dividend Strength

Considering Kohl's Corp's consistent dividend payments, the recent dividend announcement is a continuation of its commitment to shareholder returns. Despite a negative growth rate in recent years, the company's strong profitability and fair growth metrics may provide the foundation for future dividend stability. Investors should weigh these factors when evaluating Kohl's as a potential investment for dividend income. For those seeking high-dividend yield stocks, GuruFocus Premium users can utilize the High Dividend Yield Screener for further research and investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.