Kohl's (KSS) Stock Down Despite Q3 Earnings Beat: Here's Why

Shares of Kohl's Corporation KSS were down more than 4% in the pre-market trading session on Nov 21 as the company posted third-quarter fiscal 2023 results, wherein the top and bottom lines declined year over year. However, earnings beat the Zacks Consensus Estimate.

Results reflect the strength of the company’s expense and gross margin management, together with the progress of its strategic plans. Solid growth in Sephora and newness in gifting and home aided the performance. Kohl’s also lowered its inventory during the quarter.

Management raised the lower end of its bottom-line guidance for fiscal 2023 despite pulling down the lower end of its net sales growth guidance.

Quarter in Detail

Kohl's posted earnings of 53 cents per share compared with 82 cents reported in the year-ago period. The bottom line came much ahead of the Zacks Consensus Estimate of 34 cents.

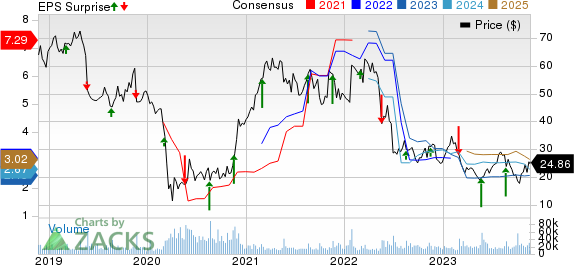

Kohl's Corporation Price, Consensus and EPS Surprise

Kohl's Corporation price-consensus-eps-surprise-chart | Kohl's Corporation Quote

Total revenues came in at $4,054 million, down from the prior-year quarter’s level of $4,277 million. Net sales declined 5.2% year over year to $3,843 million. The Zacks Consensus Estimate for the top line was pegged at $4,103 million.

Comparable sales decreased 5.5%. We had expected a comparable sales decline of 5%.

Kohl's gross margin expanded 158 basis points (bps) to 38.9% in the reported quarter. We had expected the gross margin to expand 50 bps to 37.8% in the quarter under review.

SG&A expenses escalated by 1.9% to $1,360 million. As a percentage of total revenues, SG&A expenses rose 235 bps to 33.5%. Our model suggested an SG&A expense increase of 3.1%, with the rate expanding 260 bps to 33.8%.

The company posted an operating income of $157 million, down from $200 million in the year-ago period. The operating income margin shriveled 82 bps to 3.9%.

Other Financial Details

Kohl’s ended the quarter with cash and cash equivalents of $190 million, long-term debt of $1,638 million and shareholders’ equity of $3,751 million. The company generated operating cash flow of $379 million in the first nine months of fiscal 2023.

Management expects capital expenditures toward the lower end of the $600-$650 million band for the full year 2023 (including the expansion of its Sephora collaboration and store refresh actions).

On Nov 7, 2023, Kohl’s declared a quarterly cash dividend of 50 cents per share, payable on Dec 20, 2023, to shareholders of record as of Dec 6.

Guidance

Kohl’s expects net sales to decline 2.8-4% in fiscal 2023, which includes the impact of a 53rd week (of nearly 1%). Earlier, management projected a net sales decline of 2-4%.

The operating margin is still likely to be about 4%.

Earnings per share (EPS), excluding non-recurring charges, are envisioned in the band of $2.30-$2.70 compared with the $2.10-$2.70 band projected earlier. The company delivered an adjusted loss of 15 cents in fiscal 2022.

Shares of this Zacks Rank #3 (Hold) company have rallied 32.9% in the past six months compared with the industry’s growth of 14%.

Some Solid Picks

Here, we have highlighted three better-ranked stocks.

The off-price retailer, The TJX Companies TJX, holds a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

The Zacks Consensus Estimate for The TJX Companies’ current financial-year EPS suggests growth of 19.6% from the year-ago reported figure. TJX has a trailing four-quarter earnings surprise of 6.6%, on average.

Abercrombie & Fitch ANF, a specialty retailer, currently has a Zacks Rank #2.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 10.3% from the year-ago reported numbers. ANF has a trailing four-quarter earnings surprise of 724.8%, on average.

American Eagle AEO, a specialty retailer of casual apparel, accessories and footwear for men and women, currently carries a Zacks Rank of 2. AEO has a trailing four-quarter earnings surprise of 43.2%, on average.

The Zacks Consensus Estimate for American Eagle’s current financial year’s sales and earnings per share suggests an increase of 2.4% and 37.1%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Kohl's Corporation (KSS) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report