Kohl's (KSS) Strategic Partnership Aids Growth, High Costs Stay

Kohl’s Corporation KSS is on track with prudent partnerships to fuel growth. The specialty department stores retailer is benefiting from strength in omni-channel capabilities. Focus on strategic efforts like enhancing customer experience is yielding. However, Kohl’s is not immune to an inflationary landscape.

Let’s delve deeper.

Strength in Partnership

The Zacks Rank #3 (Hold) company’s solid partnership with Sephora to create a new era of elevated Beauty at Kohl's is noteworthy and generating impressive results. In its last earnings call, management highlighted that Sephora Kohl's continues to exceed its expectations, fueling a total beauty sales rise of approximately 90%. The company opened nearly 200 Sephora shops during the second quarter of fiscal 2023. Sephora will be featured in over 900 stores by the end of 2023. The company will expand the small format Sephora shops over the next couple of years.

Image Source: Zacks Investment Research

Omni-Channel Capabilities Drive Growth

Kohl’s is focused on growing its store portfolio besides accelerating digital business growth. Management is on track to open seven new stores, including one relocation, during 2023. Given the need of the hour, the company has also been speeding up its digital marketing and enhancing its website to cater to customers’ needs.

The company’s solid endeavors to boost mobile traffic have augmented the adoption of the Kohl app, making it a vital constituent of online sales. Kohl’s has been expanding its e-commerce fulfillment centers and strengthening in-store pickups to improve online offerings.

Growth Efforts on Track

Kohl’s is progressing toward its 2023 key priorities, including improving customer experience, simplifying value strategies, undertaking disciplined inventory and expenses management and solidifying the balance sheet. Management is focused on driving growth in gifting, Sephora, impulse, home decor and longer-term new stores to enhance customer experience. The company has various opportunities to drive its core apparel and footwear offerings.

KSS is committed to driving growth with its loyalty programs, including Kohl's Cash, Kohl's Rewards and private-label credit cards. In the second quarter of fiscal 2023, management launched a co-brand credit card with Capital One to a few customers. Kohl's is on track with managing costs, focusing on lowering the marketing spend ratio and bringing more extraordinary technology into its operations to enhance productivity.

Cost Woes

In the fiscal second quarter, Kohl's gross margin contracted 61 basis points (bps) year over year to 39%. The downside can be attributed to product cost inflation and increased shrinkage. The company’s SG&A expenses escalated by 1.6% to $1,304 million. The rise in such costs was mainly due to wage pressure, increased store expenses on Sephora openings and store experience investments. Management expects fiscal third-quarter SG&A expenses to increase nearly 3% year over year due to additional store-related investments and 45 Sephora small shop openings. Nevertheless, focus on growth initiatives is likely to offer respite.

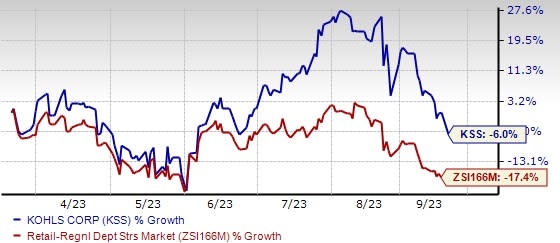

KSS’s stock has decreased 6% in the past six months compared with the industry’s decline of 17.4%.

Some Solid Picks

Here, we have highlighted three top-ranked stocks.

Dillard's, Inc. DDS, a department store retailer, currently sports a Zacks Rank #1 (Strong Buy). DDS has a trailing four-quarter negative earnings surprise of 77.1% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dillard's third-quarter EPS has increased from $7.00 to $7.04 in the past 30 days.

Ross Stores ROST, an off-price retailer, currently carries a Zacks Rank #2 (Buy). ROST has a trailing four-quarter earnings surprise of 11.4% on average.

The Zacks Consensus Estimate for Ross Stores’ current financial-year EPS suggests growth of 19.4% from the year-ago reported figure.

Build-A-Bear Workshop, Inc. BBW has a trailing four-quarter earnings surprise of 21.6%, on average. BBW, a multi-channel retailer of plush animals and related products, currently holds a Zacks Rank #2.

The Zacks Consensus Estimate for Build-A-Bear Workshop’s current financial-year EPS suggests growth of 15.9% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kohl's Corporation (KSS) : Free Stock Analysis Report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report