KONE Oyj's Dividend Analysis

Understanding the Dividend Prospects of KONE Oyj

KONE Oyj (KNYJY) recently announced a dividend of $0.94 per share, payable on 2024-03-26, with the ex-dividend date set for 2024-03-01. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into KONE Oyj's dividend performance and assess its sustainability.

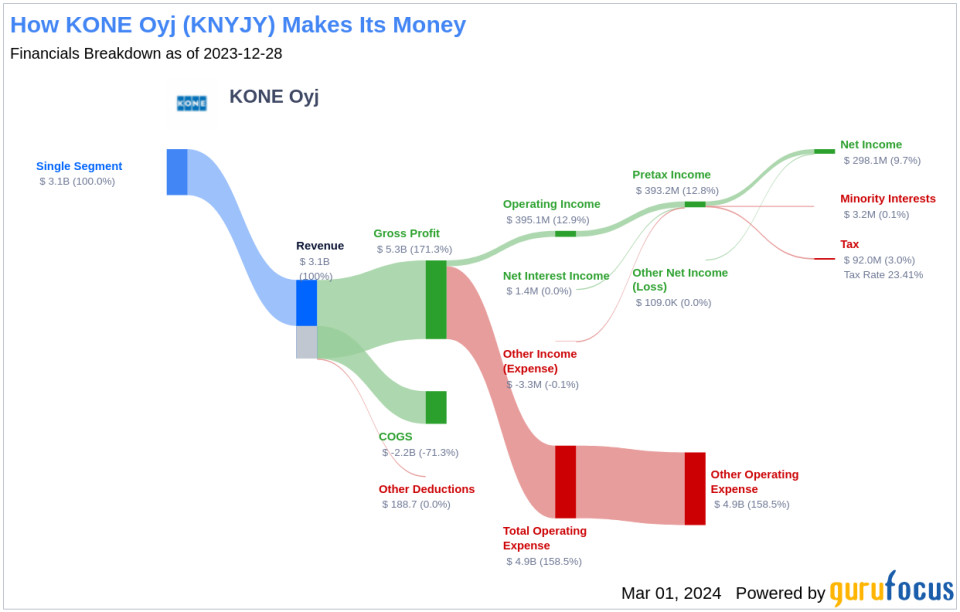

What Does KONE Oyj Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

KONE Oyj is a global leader in the elevator and escalator industry, boasting a significant market presence since its inception in 1918. The company's revenue streams are diversified across new equipment sales, modernization of existing installations, and servicing contracts. The latter, characterized by annual renewals and incremental price increases, is the primary profit generator for KONE Oyj, setting it on par with industry giants such as Otis, Schindler, and TK Elevator. Elevators, being more prevalent than escalators worldwide, form the core of KONE Oyj's business operations.

A Glimpse at KONE Oyj's Dividend History

KONE Oyj has established a reliable track record of dividend payments since 2018, with distributions occurring annually. The following chart illustrates the company's historical Dividends Per Share to provide investors with a perspective on its dividend trends.

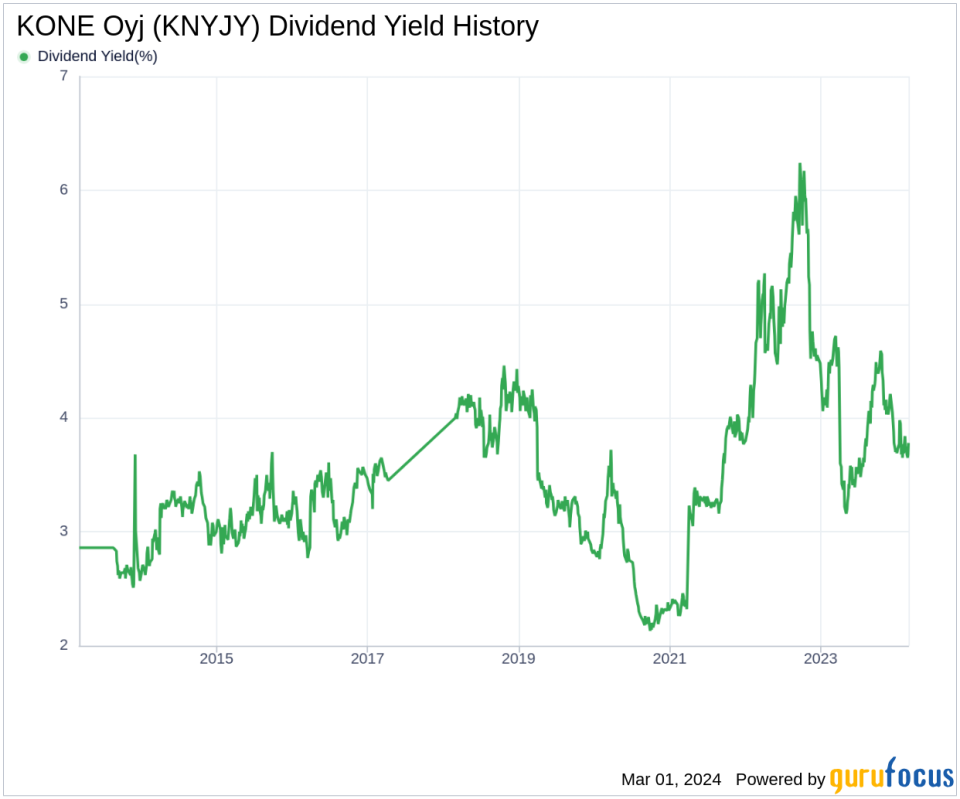

Breaking Down KONE Oyj's Dividend Yield and Growth

KONE Oyj currently exhibits a 12-month trailing dividend yield of 3.80% and a 12-month forward dividend yield of 3.86%, indicating an anticipated uptick in dividend distributions in the forthcoming year.

Reviewing the past three years, KONE Oyj's annual dividend growth rate has been steady at 1.00%, which expands to 1.40% when assessed over a five-year period. The long-term view over the past decade reveals an annual dividends per share growth rate of 6.90%.

Considering KONE Oyj's dividend yield and five-year growth rate, the 5-year yield on cost for KONE Oyj stock is approximately 4.07% as of today.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio of KONE Oyj, currently at 0.97 as of 2023-12-31, raises concerns about the long-term sustainability of its dividend payments. A high payout ratio can indicate that the company may not be retaining sufficient earnings to support future growth or weather economic downturns.

However, KONE Oyj's profitability rank stands at a robust 8 out of 10, reflecting strong earnings capacity relative to its peers. The company has consistently reported positive net income for the past decade, underscoring its solid profitability.

Growth Metrics: The Future Outlook

KONE Oyj's growth rank of 8 out of 10 signals a favorable growth trajectory when compared to industry competitors.

Assessing the company's revenue per share and 3-year revenue growth rate, KONE Oyj has demonstrated a solid 3.30% average annual increase in revenue, although it lags behind approximately 63.03% of global competitors.

The 3-year EPS growth rate is a concern, with an average annual decrease of 0.40%, underperforming 65.66% of global competitors. Furthermore, the company's 5-year EBITDA growth rate of 0.20% also falls short when compared to 68.13% of its global peers.

Conclusion: Evaluating KONE Oyj's Dividend Outlook

In conclusion, KONE Oyj's dividend payments, while consistent, present a mixed picture with a healthy yield and a modest growth rate. The payout ratio, however, suggests potential challenges in maintaining future dividend sustainability without earnings retention for growth. In contrast, the company's strong profitability rank indicates a capacity for generating earnings. Nevertheless, growth metrics reveal areas where KONE Oyj underperforms, which could impact dividend sustainability over the long term. Investors should weigh these factors when considering KONE Oyj's dividends and overall investment potential.

For those seeking high-dividend yield opportunities, GuruFocus Premium users can utilize the High Dividend Yield Screener to discover stocks that meet their investment criteria.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.