Koppers Holdings Inc. Reports Record Sales and Operating Profit for 2023

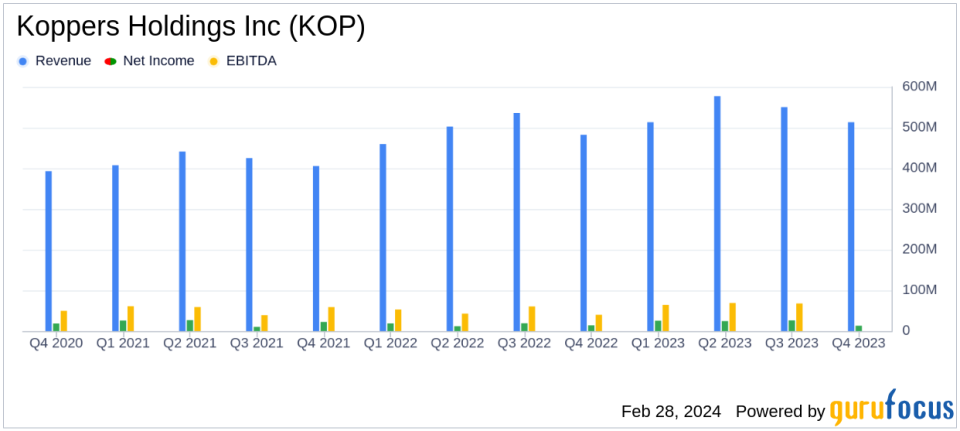

Record Annual Sales: $2.15 billion, up 8.8% from $1.98 billion in the prior year.

Record Operating Profit: $195.2 million, a 25% increase over the previous record.

Net Income: $89.2 million for the year, up from $63.4 million in the prior year.

Adjusted EBITDA: $256.4 million for 2023, compared to $228.1 million in the prior year.

Diluted EPS: $4.14, compared to $2.98 per share in the prior year.

Capital Expenditures: $120.5 million for the year, up from $105.3 million in the prior year.

2024 Outlook: Sales projected at approximately $2.25 billion with adjusted EBITDA around $275 million.

On February 28, 2024, Koppers Holdings Inc (NYSE:KOP) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, a global provider of treated wood products, wood treatment chemicals, and carbon compounds, reported record sales and operating profit for the year, despite facing challenges in the market.

Company Overview

Koppers operates through three primary business segments: Railroad and Utility Products and Services (RUPS), Performance Chemicals (PC), and Carbon Materials and Chemicals (CMC). The company's diverse product portfolio includes treated and untreated wood products, wood preservation chemicals, and carbon compounds. Koppers has a significant presence in the United States, which contributes to over half of its revenue.

Financial Highlights and Challenges

The company's RUPS segment achieved record fourth-quarter sales and adjusted EBITDA, driven by pricing increases and higher volumes for crossties. The PC segment also saw a return to historical profitability levels, thanks to global pricing initiatives and higher volumes. However, the CMC segment experienced a decline in sales and profitability due to lower market prices and weaker demand for most products.

CEO Leroy Ball highlighted the company's resilience, stating,

We finished the year on a strong note near the top end of our adjusted EBITDA range of guidance. Our diversified portfolio drove the strong performance, as our PC and RUPS business segments picked up a struggling CMC segment that continues to work through the trough of its business cycle."

Financial Performance Analysis

Koppers' record sales of $2.15 billion for the year represent an 8.8% increase over the previous year. The RUPS segment's sales rose by 13.9%, while the PC segment's sales grew by 15.8%. However, the CMC segment's sales fell by 4.5%. The company's net income attributable to Koppers was $89.2 million, up from $63.4 million in the prior year, and diluted EPS increased to $4.14 from $2.98 per share. Operating cash flows reached a record $146.1 million, compared to $102.3 million in the prior year.

Looking ahead to 2024, Koppers anticipates sales of approximately $2.25 billion and adjusted EBITDA of around $275 million. The company expects to continue its growth trajectory, driven by pricing benefits, contributions from new facilities, and cost efficiencies.

For more detailed information on Koppers' financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Investors can also join Koppers' management for a conference call to discuss the company's results, with presentation materials available on the Koppers website in the Investor Relations section.

For further insights and analysis on Koppers Holdings Inc (NYSE:KOP) and other investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Koppers Holdings Inc for further details.

This article first appeared on GuruFocus.