Koppers (KOP) Earnings Top Estimates in Q3, Revenues Lag

Koppers Holdings Inc. KOP logged profits (attributable to the company) of $26.3 million or $1.22 per share for the third quarter of 2023, up from a profit of $19.1 million or 91 cents per share a year ago.

Barring one-time items, adjusted earnings were $1.32 per share for the quarter, up from $1.19 per share a year ago. It topped the Zacks Consensus Estimate of $1.27.

Koppers recorded revenues of $550.4 million for the quarter, up around 3% year over year. The top line missed the Zacks Consensus Estimate of $555.5 million. Revenues were driven by record sales from the Railroad and Utility Products and Services (“RUPS”) and Performance Chemicals (“PC”) segments on higher pricing and volumes. The Carbon Materials and Chemicals (“CMC”) segment saw lower sales on reduced prices and volumes.

Koppers Holdings Inc. Price, Consensus and EPS Surprise

Koppers Holdings Inc. price-consensus-eps-surprise-chart | Koppers Holdings Inc. Quote

Segment Highlights

Sales from the RUPS segment climbed around 13% year over year to $234 million in the reported quarter. It was above the consensus estimate of $233 million. Sales were driven by higher prices in several markets and increased volumes for crossties.

The PC segment recorded sales of $179.4 million in the quarter, up around 17% year over year. It beat the consensus estimate of $173 million. Sales were driven by price increases and higher volumes globally.

Sales from the CMC division fell around 22% year over year to $137 million. It was below the consensus estimate of $153 million. The downside was due to weaker market demand and lower sales prices across most products.

Financials

Koppers ended the quarter with cash and cash equivalents of $53.5 million, up around 11% on a sequential comparison basis. Long-term debt was $859.8 million, down around 5% sequentially.

Outlook

Koppers noted that it remains focused on expanding and optimizing its business and making progress toward its long-term financial goals.

The company anticipated sales for 2023 to be roughly $2.1 billion. It also expects adjusted EBITDA to be in the range of $253-$257 million for the year. Koppers sees adjusted earnings per share for 2023 to be $4.35-$4.55.

The company also expects capital expenditures of roughly $110-$120 million for this year.

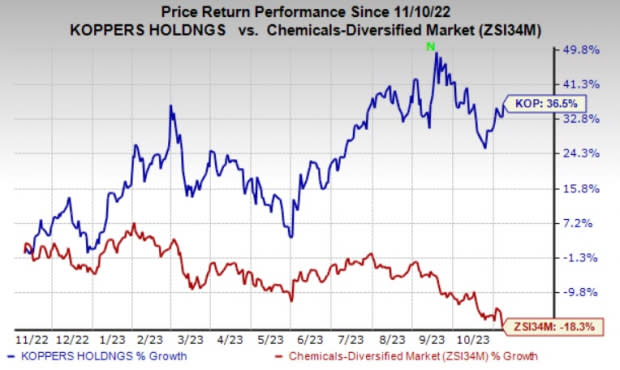

Price Performance

Koppers’ shares are up 36.5% over a year compared with 18.3% decline recorded by the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

KOP currently has a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include Carpenter Technology Corporation CRS, WestRock Company WRK and The Andersons Inc. ANDE.

The consensus estimate for Carpenter Technology’s current fiscal year earnings is pegged at $3.57, indicating year-over-year growth of 213.2%. CRS beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have surged 62% in the past year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for WestRock’s current fiscal year has been revised upward by 5.2%. WRK, carrying a Zacks Rank #2 (Buy), beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have gained 3% in the past year. The company’s shares have gained 2% in the past year.

Andersons currently carries a Zacks Rank #2. The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE shares have rallied around 25% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report