Koppers (KOP) Scales 52-Week High: What's Driving the Stock?

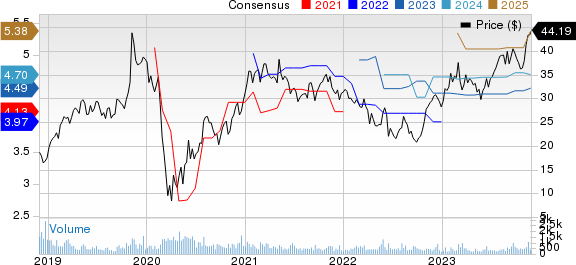

Koppers Holdings Inc.’s KOP shares touched a fresh 52-week high of $44.59 on Nov 27 before closing at $44.19.

In the past year, the stock has gained 51.4% compared with the industry’s 12.4% fall in the same period.

Image Source: Zacks Investment Research

What’s Driving Koppers?

In the third quarter, Koppers’ earnings soared 34% from the previous year’s levels to $1.22 per share. Quarterly revenues demonstrated 3% year-over-year growth.

The Railroad and Utility Products and Services (RUPS) business contributed to the strong performance, posting a remarkable 13% increase in sales to $234 million. The upside was driven by pricing increases and higher volumes for crossties. This achievement can be attributed to record sales and profitability in the domestic utility pole business.

The Performance Chemicals (PC) segment also contributed significantly to Koppers’ performance, recording sales of $179.4 million in the quarter — a substantial 17% year-over-year increase. This segment's results were fueled by renegotiated customer contracts that allowed for necessary price adjustments to address higher raw material and operating costs experienced in the prior year.

Koppers provided a strong outlook for 2023, forecasting sales of approximately $2.1 billion. The company also projects adjusted EBITDA to be in the range of $253-$257 million for the year. Koppers envisions adjusted earnings per share for 2023 to be $4.35-$4.55, reflecting confidence in sustained profitability and growth.

In the third quarter, Koppers exceeded expectations by reporting adjusted earnings of $1.32 per share, which surpassed the Zacks Consensus Estimate of $1.27. It delivered positive earnings surprises in each of the last four consecutive quarters, with the average beat being 22.3%. The consensus estimate for the current-year earnings has been revised upward by 1% in the past 60 days. The Zacks Consensus Estimate for 2023 earnings stands at $4.49 per share, indicating growth of 8.5% from the previous year's reported figure.

Koppers Holdings Inc. Price and Consensus

Koppers Holdings Inc. price-consensus-chart | Koppers Holdings Inc. Quote

Zacks Rank & Other Key Picks

Koppers currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Axalta Coating Systems Ltd. AXTA, sporting a Zacks Rank #1 (Strong Buy), and The Andersons Inc. ANDE and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for AXTA’s current year earnings is pegged at $1.58, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.67%. The company’s shares have rallied 20% in the past year.

The Zacks Consensus Estimate for ANDE’s current-year earnings has been revised upward by 5.1% in the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 32.8% on average. ANDE’s shares have rallied around 33.9% in a year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents, indicating year-over-year growth of 89.3%. AGI beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have increased 48.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report