Korn Ferry (KFY) Posts Mixed Q3 FY'24 Results Amid Economic Headwinds

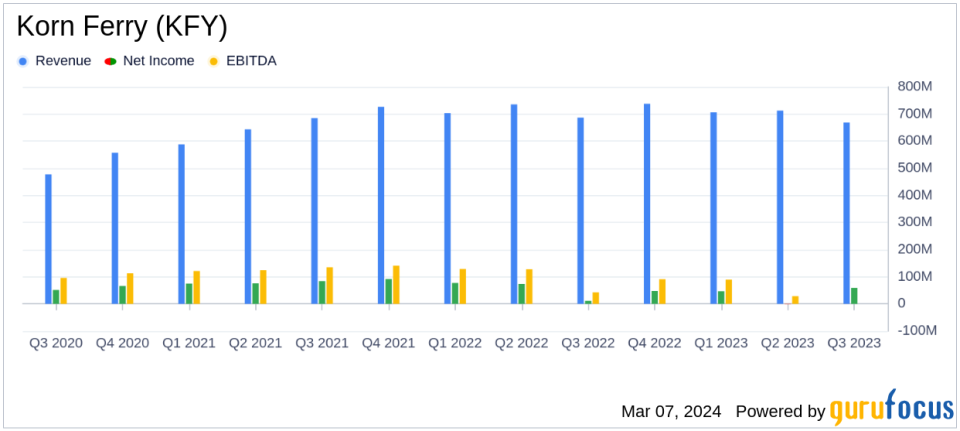

Fee Revenue: Reported a slight year-over-year decrease of 2% to $668.7 million.

Net Income: Increased to $59.1 million compared to $11.2 million in Q3 FY'23.

Diluted EPS: Rose to $1.13, with adjusted diluted EPS at $1.07.

Operating Margin: Improved significantly to 7.5%, a 570bps increase from the previous year.

Adjusted EBITDA Margin: Grew to 15.2%, up 110bps year-over-year.

Share Repurchase: The company bought back 382,500 shares for $21.0 million.

Dividend: Declared a quarterly dividend of $0.33 per share, payable on April 15, 2024.

On March 6, 2024, Korn Ferry (NYSE:KFY), a global organizational consulting firm, released its 8-K filing, announcing its financial results for the third quarter of fiscal year 2024. The company, known for its expertise in helping clients synchronize strategy and talent to drive superior performance, reported a slight decline in fee revenue, which came in at $668.7 million, a 2% decrease compared to the same quarter last year. This dip was attributed to a decrease in demand for permanent placement talent acquisition offerings amidst a challenging global economic environment.

Despite the revenue decline, Korn Ferry's net income saw a substantial increase to $59.1 million, up from $11.2 million in the third quarter of the previous fiscal year. This was reflected in the earnings per share (EPS), with diluted EPS rising to $1.13 and adjusted diluted EPS at $1.07. The company's operating income also saw a notable improvement, reaching $49.9 million with an operating margin of 7.5%, a significant increase from the 1.8% margin in the year-ago quarter. Adjusted EBITDA stood at $101.7 million, with the margin expanding to 15.2%, up from 14.1% in the prior year.

CEO Gary D. Burnison expressed satisfaction with the quarter's results, highlighting the resilience of Korn Ferry's non-search offerings, which provided a buffer against the more cyclically sensitive recruiting offerings. The company's Consulting and Digital segments showed robust performance, with Consulting fee revenue growing by 3% and Digital fee revenue by 6% year-over-year. The average bill rate for Consulting increased to $438 per hour, and Digital's Subscription & License fee revenue climbed by 11%, approximating $33.0 million for the quarter.

The company also continued its shareholder-friendly activities, repurchasing 382,500 shares for $21.0 million and declaring a quarterly dividend of $0.33 per share. Looking ahead, Korn Ferry provided guidance for the fourth quarter of fiscal year 2024, expecting fee revenue to be between $675 million and $695 million, with diluted earnings per share ranging from $1.06 to $1.14. On an adjusted basis, diluted earnings per share is anticipated to be between $1.09 and $1.17.

Korn Ferry's performance in the third quarter demonstrates the company's ability to navigate economic headwinds while continuing to deliver value to shareholders. The improvements in operating and adjusted EBITDA margins reflect the firm's operational efficiency and the strategic success of its diversified offerings. As Korn Ferry moves forward, investors will be watching closely to see how the company continues to adapt to the evolving economic landscape and maintain its growth trajectory.

For a more detailed breakdown of Korn Ferry's financials and to stay updated on the latest investment insights, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Korn Ferry for further details.

This article first appeared on GuruFocus.