Kraft Heinz Co (KHC) Posts Mixed Results Amid Market Headwinds

Net Sales: Full year net sales slightly up by 0.6%, with organic net sales growing 3.4%.

Gross Profit Margin: Increased to 33.5% for the full year, reflecting a 280 basis point improvement.

Net Income: Full year net income rose by 20.2%, with diluted EPS up 20.9%.

Q4 Performance: Q4 net sales declined by 7.1%, with organic net sales down 0.7%.

Share Repurchase: Announced a $3.0 billion share repurchase program.

2024 Outlook: Expects organic net sales growth of 0 to 2% and adjusted EPS growth of 1 to 3%.

On February 14, 2024, The Kraft Heinz Co (NASDAQ:KHC) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, known for its extensive portfolio of food and beverage products, including Kraft, Heinz, Oscar Mayer, Velveeta, and Philadelphia, operates primarily in North America but also has a significant presence in Europe and emerging markets.

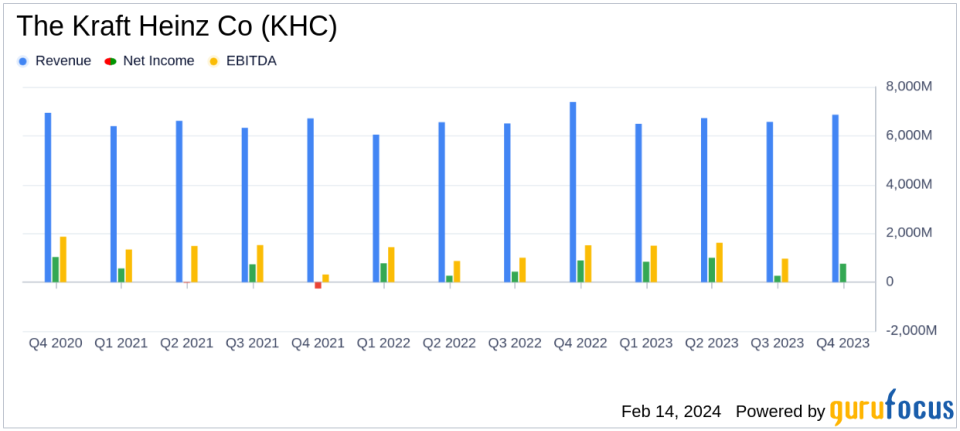

In 2023, Kraft Heinz saw a modest increase in net sales of 0.6%, with organic net sales growing by 3.4%, despite a negative impact from a 53rd week in the previous year. The company's gross profit margin improved significantly, reaching 33.5% for the full year, up from the previous year. Net income for the year increased by 20.2%, with diluted earnings per share (EPS) rising to $2.31, a 20.9% increase. This growth was attributed to higher Adjusted EBITDA, lower non-cash impairment losses, and lower tax expenses.

However, the fourth quarter presented challenges, with net sales declining by 7.1% and organic net sales decreasing by 0.7%. The company faced headwinds driven by ongoing consumer pressure, which CEO Carlos Abrams-Rivera expects to dissipate as the reduction in SNAP benefits is lapped. Despite these challenges, Kraft Heinz remains focused on executing its strategy and investing in its brands and people for continued growth.

Financially, the company ended the year on target with a Net Leverage ratio of approximately 3.0x and announced a $3.0 billion share repurchase program, signaling confidence in its future performance.

For the upcoming fiscal year 2024, Kraft Heinz anticipates organic net sales growth between 0 to 2 percent and an adjusted EPS growth of 1 to 3 percent, projecting a continued trajectory of growth.

Income Statement and Balance Sheet Highlights

The income statement for the full year showed a gross profit of $8.926 billion, a 9.9% increase from the previous year. Operating income also saw a significant rise of 25.8%. The balance sheet reflected the company's efforts to strengthen its financial position, ending the year with a Net Leverage ratio in line with its target.

Cash flow from operations was notably strong, increasing by 61.0% to $4.0 billion, driven by lower cash outflows for inventories and tax payments, higher Adjusted EBITDA, and lower interest payments due to debt reduction. Free Cash Flow for the year was $3.0 billion, up 90.7% from the prior year.

The company's capital return strategy included paying $1.965 billion in cash dividends and repurchasing $455 million of common stock, demonstrating its commitment to returning value to shareholders.

Looking Ahead

As Kraft Heinz looks to 2024, the company is poised to continue its growth trajectory, with a focus on strategic execution and investments in its brand portfolio. The company's outlook reflects a cautious optimism, with expected growth in both organic net sales and adjusted EPS. However, the company remains mindful of potential industry headwinds and consumer pressures that could impact performance.

Value investors and potential GuruFocus.com members may find Kraft Heinz's commitment to efficiency, digital advancements, and shareholder returns, coupled with its strategic growth initiatives, an attractive proposition for long-term investment consideration.

For a more detailed analysis and up-to-date information on The Kraft Heinz Co (NASDAQ:KHC) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from The Kraft Heinz Co for further details.

This article first appeared on GuruFocus.