Kroger's Fiscal 2023 Earnings: Mixed Results Amid Pharmacy Sales Impact

Identical Sales: 0.1% growth in Q4 2023 and 2.3% in fiscal 2023, excluding the impact of the terminated Express Scripts agreement.

Earnings Per Share (EPS): Q4 adjusted EPS at $1.34, up from $0.99 in Q4 2022; Fiscal 2023 adjusted EPS at $4.76, up from $4.23 in 2022.

Operating Profit: Q4 operating profit increased to $1,194 million; Fiscal 2023 operating profit was $3.1 billion.

Gross Margin Rate: FIFO gross margin rate up 18 basis points in fiscal 2023, excluding fuel and the 53rd week.

Debt to EBITDA Ratio: Net total debt to adjusted EBITDA ratio at 1.33, an improvement from 1.56 a year ago.

2024 Guidance: Kroger projects continued growth with a focus on customer value and seamless shopping experience.

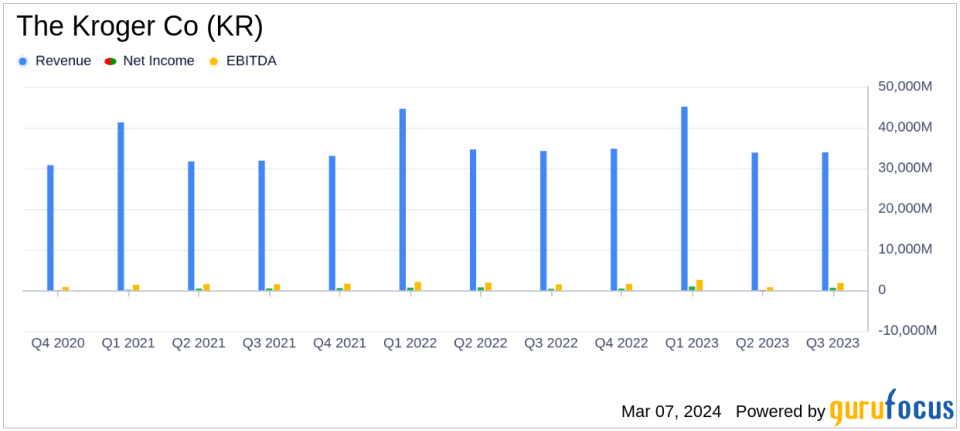

The Kroger Co (NYSE:KR) released its 8-K filing on March 7, 2024, detailing its fourth quarter and full-year 2023 financial results and providing guidance for 2024. The company, a leading U.S. grocer with a vast network of supermarkets and jewelry stores, has been navigating a challenging retail landscape, marked by the termination of its agreement with Express Scripts and a proposed $25 billion merger with Albertsons.

Fiscal 2023 Performance

Kroger reported a mixed performance for the fourth quarter and the full fiscal year of 2023. Identical sales, excluding fuel, saw a marginal increase of 0.1% for the quarter and 2.3% for the year, which would have been higher if not for the reduction in pharmacy sales due to the end of the Express Scripts agreement. This agreement had a slightly positive net effect on operating profit, despite negatively impacting the Operating, General & Administrative (OG&A) Rate.

The company's adjusted earnings per share (EPS) for the fourth quarter was $1.34, up from $0.99 in the same period last year, reflecting a strong performance. For the full year, adjusted EPS was $4.76, an increase from $4.23 in 2022. The FIFO gross margin rate, excluding fuel and the 53rd week, improved by 18 basis points over the fiscal year, driven by strong private-label performance and sourcing benefits, among other factors.

Financial Highlights and Challenges

Kroger's financial achievements in 2023 include a robust operating profit of $1,194 million for the fourth quarter and $3.1 billion for the year. The company also managed to improve its net total debt to adjusted EBITDA ratio to 1.33, signaling a stronger balance sheet. However, the termination of the Express Scripts agreement and the ongoing investments in associate wages and strategic growth initiatives have put pressure on the OG&A rate, which increased by 21 basis points for the fiscal year.

Despite these challenges, Kroger's capital allocation strategy remains focused on generating strong free cash flow, maintaining its investment-grade debt rating, and continuing to pay and potentially increase its quarterly dividend, subject to board approval. The share repurchase program has been paused to prioritize de-leveraging following the proposed merger with Albertsons.

Looking Ahead: 2024 Guidance

For 2024, Kroger anticipates revenue growth by delivering value to customers and enhancing its seamless shopping experience. The company plans to balance investments in the business with productivity and cost savings initiatives. Interim CFO Todd Foley expressed confidence in the company's ability to deliver on its 2024 guidance and maintain a strong track record of generating attractive and sustainable returns for shareholders.

The company's guidance for 2024 includes expectations of continued net earnings growth and strong free cash flow, despite the absence of a full reconciliation of GAAP and non-GAAP measures due to the unpredictability of certain adjustment items.

Value investors and potential GuruFocus.com members interested in the retail defensive industry may find Kroger's performance indicative of its resilience and strategic adaptability in a dynamic market environment.

For a more detailed analysis of The Kroger Co (NYSE:KR)'s financials and future outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from The Kroger Co for further details.

This article first appeared on GuruFocus.