Kronos Worldwide Inc Reports Mixed Results for Q4 and Full Year 2023

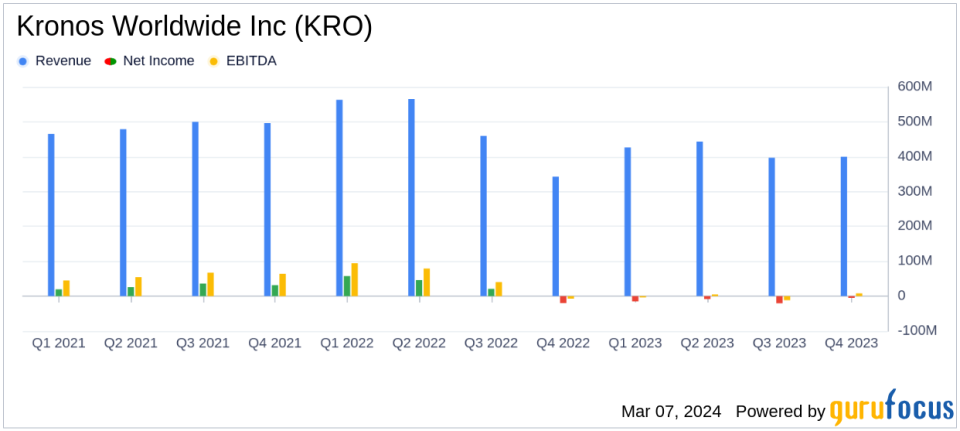

Net Loss: Q4 net loss improved to $5.3 million compared to $19.9 million in Q4 2022.

Full Year Performance: Full year net loss of $49.1 million, down from net income of $104.5 million in 2022.

Net Sales: Q4 net sales increased by 17% year-over-year, while full year sales dropped by 14%.

TiO2 Segment: Q4 segment loss reduced to $1.3 million; full year segment loss was $39.8 million.

EBITDA: Q4 EBITDA turned positive at $6.9 million; full year EBITDA was negative at $(7.2) million.

Production Volumes: Q4 production volumes up by 15% year-over-year; full year down by 19%.

On March 6, 2024, Kronos Worldwide Inc (NYSE:KRO) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading manufacturer and seller of titanium dioxide pigments, faced a challenging year with a net loss of $49.1 million for the full year, a stark contrast to the net income of $104.5 million in the previous year. However, the fourth quarter showed signs of improvement with a reduced net loss of $5.3 million compared to the fourth quarter of 2022.

Kronos Worldwide Inc is known for its titanium dioxide pigments, which are used in a variety of products, including coatings for automobiles and aircraft, as well as in commercial and residential interiors and exteriors. The company also supplies titanium dioxide for plastics used in packaging materials, housewares, and toys. With the majority of its revenue stemming from the United States, Kronos Worldwide's performance is a significant indicator of the health of the chemicals industry.

The narrowed net loss in Q4 2023 was primarily due to higher income from operations, which benefited from increased sales volumes and lower production costs, despite lower average selling prices for titanium dioxide (TiO2). The full year results were negatively impacted by lower sales volumes, reduced production volumes, and lower TiO2 selling prices. Production curtailments were implemented in response to declining demand, and while these actions helped maintain liquidity and reduce finished goods inventory levels, they also led to significant unabsorbed fixed production costs.

Despite the challenges, Kronos Worldwide managed to increase net sales in Q4 2023 by 17% year-over-year, thanks to higher sales volumes in Europe and North America. However, full year net sales saw a 14% decrease due to lower sales volumes across all major markets and a decline in average TiO2 selling prices. The company's strategic cost reduction initiatives and adjustments to production volumes were crucial in navigating the tough market conditions.

Financial Highlights and Challenges

The company's financial achievements in the fourth quarter, including the increase in net sales and the reduction in net loss, are important as they indicate a potential turnaround in Kronos Worldwide's performance. However, the full year results reflect the ongoing challenges in the chemicals industry, particularly in the TiO2 segment, which saw a segment loss of $39.8 million in 2023 compared to a segment profit of $175.9 million in the previous year.

Key financial metrics from the income statement show that the gross margin for the full year decreased significantly from $391.1 million in 2022 to $164.9 million in 2023. Selling, general, and administrative expenses were slightly reduced, and the company also reported an insurance settlement gain and restructuring costs that impacted the income from operations.

"The full year of 2023 includes an insurance settlement gain related to a 2020 business interruption insurance claim of $2.5 million, a fixed asset impairment related to the write-off of certain costs resulting from a capital project termination of $3.8 million, and restructuring costs related to workforce reductions of $5.8 million."

These financial details are crucial for investors as they provide insight into the company's operational efficiency and its ability to manage costs in a challenging environment.

Analysis and Outlook

The company's performance in 2023 was a tale of two halves, with the fourth quarter showing signs of recovery while the full year reflected the broader challenges faced by the industry. The ability of Kronos Worldwide to adapt to market conditions, manage its cost structure, and maintain liquidity will be key factors in its future performance. Investors will be closely monitoring the company's strategic initiatives and market demand for TiO2 as indicators of its potential for recovery and growth.

For a more detailed analysis of Kronos Worldwide Inc's financial performance and to stay updated on the latest financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Kronos Worldwide Inc for further details.

This article first appeared on GuruFocus.